Shares of several Tata Group companies have caught investors’ eyes lately. Among these, the company behind Zudio stores stands out. In a single year, the share price has jumped by 240%. This dramatic increase has not gone unnoticed.

What’s pushing this momentum? Is this a reliable trend for the future, or are other factors at play? In the following sections, we’ll check into the forces driving this surge and touch on potential implications for investors.

Tata Group share price performance

Several entities within the Tata Group portfolio have recently experienced notable stock value growth. For instance, Trent, Voltas and Tata Investment Corporation have seen their prices more than double from their 52-week lows. This shift underscores the conglomerate’s strategic strength across various sectors.

Beyond these, other members of the Tata Group companies list, such as Tata Power, Tata Motors & The Indian Hotels Company, have also posted significant gains, with increases ranging from 50-100% over the past year. These movements suggest a broader trend.

Collectively, the Tata Group’s market cap stands at ₹34.8 lakh crore. Each segment plays a vital role in shaping the conglomerate’s substantial influence in the Indian economy. Amid this overall rise, Trent Ltd. has particularly stood out with its striking 250% growth over the past year.

About Trent Ltd.

Part of the Tata umbrella, Trent Ltd. has emerged as a significant player in India’s consumer space since. The logo operates through various formats, each catering to distinct customer segments.

Westside, one of its flagship chains, occupies large retail spaces of 20-30K square feet. This chain offers a diverse range of products—apparel, footwear, cosmetics, and home decor—all aimed at delivering modern styles that remain accessible to a broad audience.

Tata’s Zudio store focuses on the budget-conscious segment, offering trendy fashion at affordable prices. These outlets are more compact, typically spanning 7-10K square feet, but have quickly gained popularity, reflecting a strong demand for value-driven shopping. It operates via omnichannel, integrating both physical stores and the Zudio online stores to reach a wider audience.

Trent’s reach extends beyond fashion into the food and grocery sector through its Star outlets. Here, shoppers find a curated selection of fresh produce, daily essentials, and exclusive private labels. The emphasis on quality combined with competitive pricing has enabled Star to carve out a distinct position.

Further diversifying, Trent has teamed up with international giants like Zara, Massimo Dutti, etc., introducing global fashion trends to the Indian consumer. This strategic alliance strengthens the company’s presence in the high-end segment.

As of June-2024, the company oversees more than 890 locations, a substantial increase from 681 the previous fiscal year ending in March. This expansion highlights Trent’s strategic growth.

Also read: A guide to investing in the Indian retail sector: Trends and opportunities

Trent’s stock performance

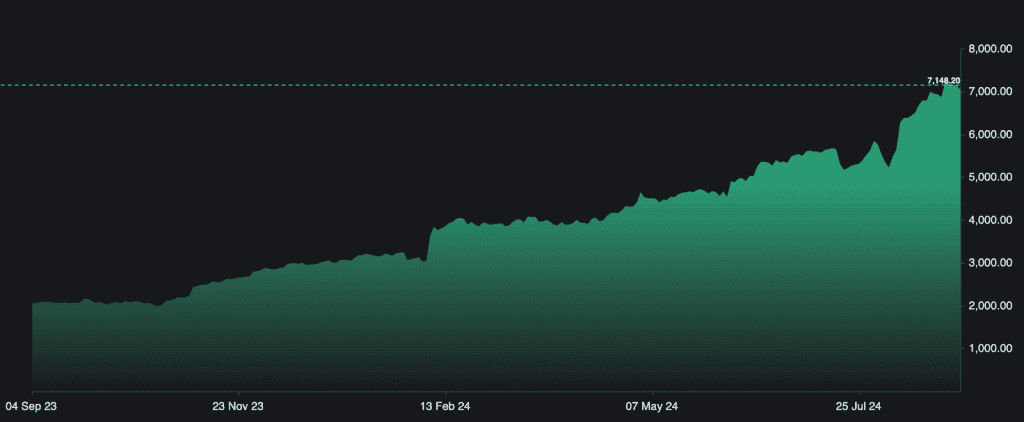

Trent has seen a 241.37% increase in share price over the past year as of September 3rd 2024.

Source: Cogencis iInvest

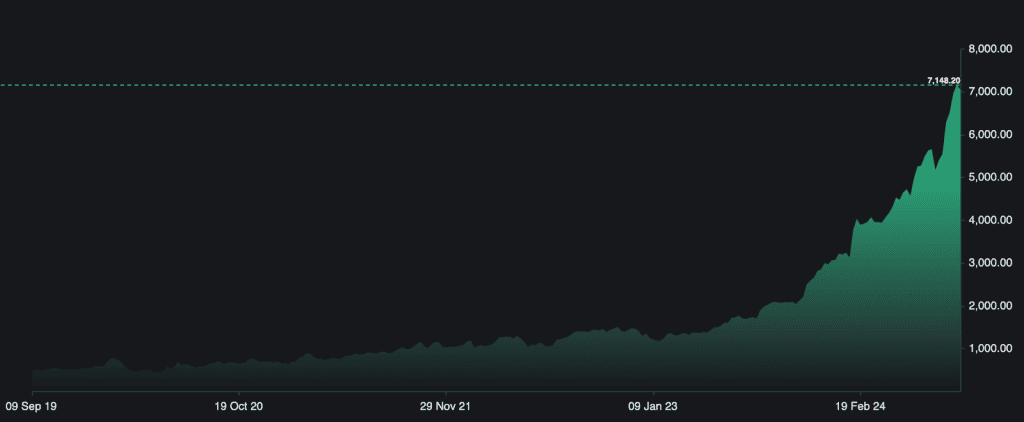

Over five years, Trent’s value has soared 1,400.86%. And, 6,009.3% over 10 years, which means a decade ago, an investment of ₹2 lakh in Trent would have grown into over ₹1 crore today.

Source: Cogencis iInvest

In the past year, Trent’s stock reached a 52-week high of ₹7,325 on 28 August 2024, after hitting a low of ₹1,945 on 26 October 2023.

The leap from October 2023 to August 2024 reflects strong investor confidence, particularly due to the Zudio brand’s aggressive growth. Soon, Trent is expected to enter the Nifty50, marking its place among India’s leading companies and attracting broader attention.

Q1FY25 financial performance

The impressive rise in Trent’s stock is a reflection of its solid Q1FY25 financial results. During this quarter, the company saw a 55% jump in consolidated revenues and a 136% surge in profit before tax (PBT) compared to the same period last year. These numbers clearly demonstrate Trent’s strategic effectiveness.

- Expansion: Trent added 25 new outlets in this period, bringing its total to 823 (228 Westside, 559 Zudio & 36 others) across 178 cities. Notably, 16 of these were Zudio, enhancing the brand’s footprint in the budget fashion market.

- Margins: Operating EBIT margins improved to 10.6%, up from 7.8% a year earlier. This margin expansion highlights Trent’s capacity to increase efficiency while expanding its operations.

- Sales growth: Both Westside and Zudio achieved significant like-for-like (LFL) sales increases, despite challenges such as heatwaves and elections. Emerging categories like beauty, personal care, and footwear now account for more than 20% of standalone revenue, showing successful diversification efforts.

- Digital growth: Westside.com and Tata Neu experienced over 30% growth, underscoring the success of Trent’s omnichannel strategy in reaching a broader audience.

Meanwhile, the Star business (72 stores) registered a 29% rise in revenue, with six new stores added to its network. This segment, driven by proprietary brands, is becoming increasingly vital to Trent’s overall expansion plans.

These strong Q1FY25 results explain the recent upward movement in Trent’s stock and set a positive tone for the remainder of the fiscal year.

| (₹ Crore) | Q1 FY25 | Q1 FY24 | Growth vs Q1 FY24 | CAGR over Q1FY20 |

| Revenues (incl. GST) | 4354 | 2808 | 55% | 38% |

| PBT | 501 | 212 | 136% | 49% |

Source: Trent Ltd. Q1FY25 Press Release

You may also like: The Indian fashion industry: A booming sector with huge potential

Market sentiment

Market sentiment around Trent Ltd. remains largely positive, fuelled by its strong financial results and strategic expansion, particularly through the Zudio brand. The company’s ability to achieve significant growth in a competitive retail environment has caught the attention of investors and market watchers alike.

- Growth and Expansion: The >50% year-on-year revenue increase in 2025 first quarter has been a key driver of this positive outlook. Zudio’s rapid expansion and strong same-store sales growth (SSSG) have played a central role in boosting confidence in Trent’s long-term potential.

- Valuation Concerns: Despite the enthusiasm, there are some reservations about the stock’s current high valuations. The recent surge to record highs has prompted discussions about whether the stock may be overbought, with potential for a near-term pullback.

Overall, while there is caution about the stock’s high price, the general sentiment remains optimistic, particularly about Zudio’s continued growth and its impact on Trent’s future performance.

You may also like: Anil Ambani’s ADAG Stocks Slide After SEBI Ban: Key Details

Bottomline

Trent Ltd.’s stock rise highlights its strong foundation and strategic expansion, particularly through Zudio stores(online & offline). However, with the stock’s current high valuation, it’s important to balance optimism with caution. While the company shows promise, keeping an eye on market dynamics will be crucial for informed investment decisions.