The TATA Consultancy Services has been in operation for over 56 years, building partnerships with various national and international brands. The company focuses primarily on IT services, business solutions and consulting services. The company belongs to the largest multinational group in India, the TATA group. The company even generated a consolidated revenue of USD 29 billion in FY 2024. Some other important features of TCS are in the table below.

| Top employer | Selected as the global top employer by the Employers Institute. |

| Delivery model | Location-independent Agile delivery model. It is considered an industry standard. |

| Sustainability | The company is mentioned in sustainability indices like the MSCI Global Sustainability Index. |

| Top IT service provide | Secured the No.1 rank in IT services in Europe. |

The Q3FY25 report of the TATA Consultancy Service is discussed below in detail.

Q2FY25 Review

The Q2FY25 results of TCS were released on 10th October 2024. The prevalent geopolitical conditions and business environment resulted in restrained discretionary spending. These internal and external factors had a significant bearing on the Q2FY25 report. Due to the expenditures in infrastructure, talent and third-party costs, the operating margin for the second quarter of FY25 was 24.1%.

Domestic growth was fueled by the BSNL transaction. It was exceptionally strong and rose 95.2% year over year and 21.3% sequentially.

The highlights of the Q2FY25 earning report are listed below.

- Net profit: TCS reported a net profit of ₹ 11,955 crore. It represents a 5% rise.

- Revenue: Revenue reached ₹ 64,259 crore. It was up 7.6% year-on-year.

Also read: Exploring the potential of a company: Complete analysis of company annual report.

Q3FY25 Analysis

The Q3FY25 earnings report was released on 9th January 2024. Before getting into the revelations of the report, it is important to take a look at the stock price and some key developments for the company.

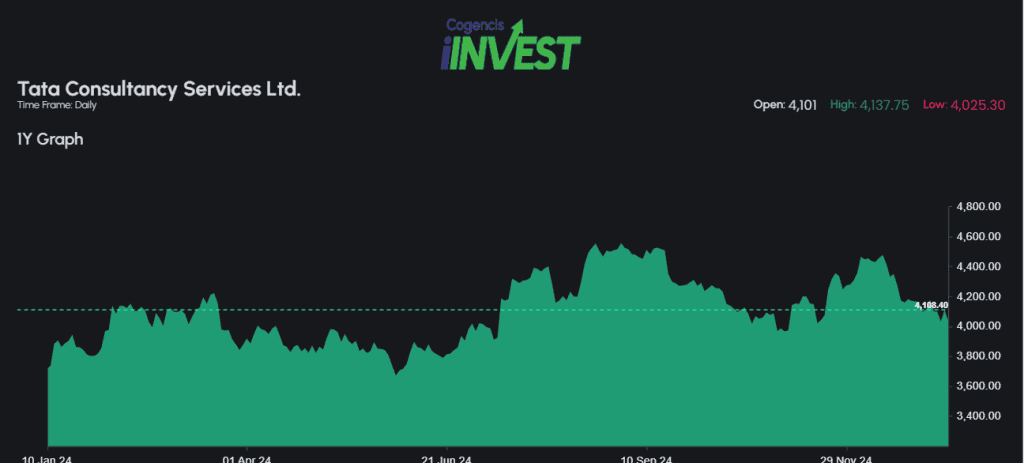

TCS stock price performance

The trading volume of the TCS stock is 23.92 lakhs. The total market capitalisation stood at ₹ 14,63,154.59 crore. The TCS stock closed at 4,044.00 at 3.40 PM. The TCS share price reached its high at ₹4137.75 and low at ₹4,025.30.

Also read: Stock Market Analysis and Its Benefits.

Recent developments

Listed below are different key developments that may impact the earnings report.

- Important deals- the important deals made by TCS are as follows.

- 15-year agreement with Ireland’s Department of Social Protection for an end-to-end digital solution.

- The multi-year agreement with Air France-KLM on a cloud-native.

- An agreement with the Bank of Bhutan.

- A five-year deal renewal with Telenor of Denmark.

- A three-year agreement for software and hardware for SPARSH, the Indian government undertaking.

- GenAI- With more than 600 AI and Gen AI projects under its management, both in development and production, TCS has been aggressively pursuing these initiatives.

- Emerging markets- TCS has made minor changes to its approach to expand its footprint in developing nations. The aim was to achieve sustained growth. The company secured many government projects. For eg. The IRCTC website project and the digital project of India Post.

Report takeaways

The key takeaways from the Q3FY25 earnings report are as follows.

Net profit

As the Indian market grew 70.2% year-on-year, the net profit of the company increased by 12% and reached ₹12,380 crore.

Revenue growth

The IT giant also said that its revenue increased 5.6% to ₹63,973 from the ₹60,583 crore that it recorded in the same quarter of the previous fiscal year.

Operating margin

The operating margin of a business is a percentage that shows how much profit a company makes for every rupee of sales. The operating margin of the company is 24.5%.

Total Contract Value

It is a measure that shows how much money a contract should bring in overall throughout its existence. The TCV of the company is USD 10.2 billion.

Dividend

Additionally, TCS has declared a special dividend of ₹66 per share and an interim dividend of ₹10 per share. On February 3, the investors will receive the third interim dividend and special dividend. The record date is January 17.

Employment

TCS recorded a net decrease of 5,370 staff, reversing two consecutive quarters of employment growth. The attrition rate is 13%. The attrition rate refers to the rate of employees leaving the firm. This quarter, the business promoted more than 25,000 workers, increasing the total number of promotions this fiscal year to over 110,000.

| Particulars | Q3 FY 2024-25 | Q2 FY 2024-25 | Change (%) |

| Revenue | 63,973 | 64,259 | -0.44 |

| Operating Profit | 17,034 | 16,731 | 1.81 |

| Profit After Tax | 12,444 | 11,955 | 4.09 |

Also read: How Quarterly Results Influence Stock Prices?

Conclusion

The TCS share price on 9th January 2025 was stuck at low levels. The TCS stock closed the trading day at 4,044. A detailed analysis of the earnings report can give investors keen insights into the functioning of the company and its prospects. It enables individuals to make prudent financial decisions. Traders might be able to make calculated investment choices for the TCS stock.