According to a study by Mordor Intelligence, the worldwide market for HR professional services is set to experience a compound annual growth rate (CAGR) of over 7% in the upcoming period.

Amid the dynamic landscape of human resource services, Team Lease Services Ltd. has emerged as a significant player. Founded with the mission to empower India’s workforce, Team Lease has been a pioneer in the country’s staffing and human capital sector for more than two decades.

This article will provide an in-depth analysis of Team Lease’s financial performance, with a particular emphasis on their most recent Q4 results. Let’s get ready to delve into the financial intricacies of this HR giant.

About Team Lease Services Ltd

TeamLease Services, one of India’s premier human resource companies, has been providing various solutions to more than 3800 employers, addressing their hiring, productivity, and scalability challenges. With a remarkable track record of hiring over 22 lakh individuals in the past 23 years, TeamLease is recognised as one of India’s fastest-growing employers.

The company stands out for its innovative initiatives such as operating India’s first Vocational University and the country’s fastest-growing Public-Private Partnership (PPP) Degree Apprenticeship Program. Catering to a diverse clientele, TeamLease offers solutions across the three E’s of employment – Employment (with over 2.74 lakh employees), Employability (benefitting over 5.6 lakh students), and Ease-of-doing Business (serving over 1000 employers).

The company’s services span across various domains including General Staffing, IT Staffing, Telecom Staffing, Hiring, Compliance and Payroll Services, Degree Apprenticeship (DA), Learning Services, and Skill University.

As a leading Human Capital Management company, TeamLease has demonstrated robust growth with an 18% YoY increase in revenue. It serves over 3800 clients across various business spectrums, with over 1000 digital engagements. The company boasts of a significant presence with over 7500 locations across 28 states in India.

Founded in 2001 and going public in 2016, TeamLease has grown exponentially over the past 23 years. It has made a net addition of 43k staffing on a full-year basis and continues to be one of the largest private sector employers with approximately 3.2 lakh associates/trainees. Furthermore, through its Skill University and EdTech, it has impacted over 5.6 lakh students, underscoring its commitment to enhancing skill development and employability.

The market capitalisation of Team Lease Services Ltd is ₹5,089.36 crore, as of May 25, 2024. The company holds a significant position in the organised staffing industry, boasting a market share of over 6%.

Team Lease Services Ltd’s quarterly performance

Here are some of the principal financial indicators of Team Lease Services Q4 results performance in comparison to the preceding quarter:

| Q4 FY24(₹ crores) | Q3 FY24(₹ crores) | Change(%) | |

| Revenue | 2,432 | 2,445 | -0.53% |

| Operating profit | 37 | 36 | 2.78% |

| Profit before tax | 30 | 33 | -9.09% |

| Net profit | 28 | 31 | -9.68% |

| EPS | 16.39 | 18.49 | -11.36% |

The Selling, General & Administrative (SG&A) expenses saw a quarter-on-quarter decrease of 1.21% but experienced a year-on-year growth of 19.28%. The operating income, on the other hand, dropped by 11.23% compared to the previous quarter but showed a year-on-year increase of 24.25%.

In terms of revenue, the company’s specialised IT staffing business saw a growth of 4.7%, which is a slowdown compared to the 12.3% increase witnessed in the preceding quarter.

Also read: Nykaa, the cosmetic brand, has announced its Q4 results: Know more here!

Team Lease Services Ltd’s annual performance

Here are the principal financial metrics of the company, in comparison with the figures from the previous year:

| FY2024(₹ crores) | FY2023(₹ crores) | Change(%) | |

| Revenue | 9,322 | 7,870 | 18.45% |

| Operating profit | 131 | 122 | 7.38% |

| Profit before tax | 118 | 115 | 2.61% |

| Net profit | 113 | 112 | 0.89% |

| EPS | 66.88 | 65.12 | 2.70% |

Also read: Jubilant FoodWorks: What does the company’s Q4 result look like?

Market reaction to Team Lease Services Ltd’s results

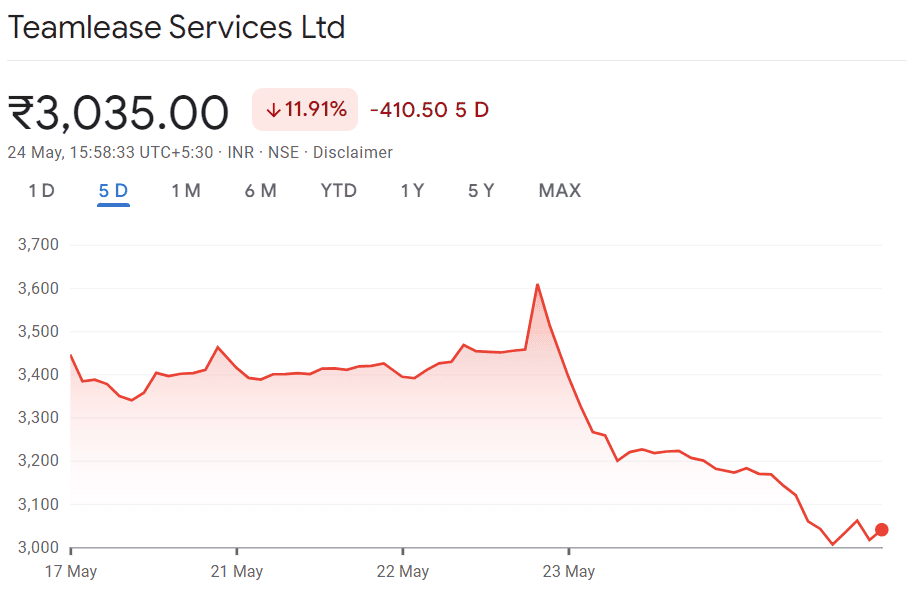

On May 22, 2023, Team Lease Services Ltd released its quarter four results. On that day Team Lease Services share price hit a 52-week high of ₹3,700.00. The stock started to trade with a downtrend since then, hitting a 52-week low of ₹2,990.20 on May 24, 2023.

This downtrend can be clearly seen in the Team Lease Services Limited share price history of the last 5 days:

As of May 25, 2024, the sentiment among analysts regarding the share price target of Team Lease Services Ltd is varied. Looking at the breakdown of the 10 analysts tracking the stock:

- 4 analysts have expressed a strong buy recommendation,

- 2 analysts have issued a buy recommendation,

- 1 analyst has suggested a hold stance,

- 1 analyst has recommended selling the stock, and

- 2 analysts have given a strong sell recommendation.

This diverse range of opinions reflects the mixed sentiment towards the company’s stock.

Also read: Torrent pharma shares soar over 8% after impressive Q4 results

Peer analysis

Let’s compare the key financial ratios of Team Lease Services Ltd with that of its competitors:

| Company | CMP (₹) | Market cap(₹ crores) | P/E | Earnings Yield (%) |

| Team Lease Services | 3,035 | 5,054 | 46.4 | 2.63 |

| Jyoti CNC Automation | 885 | 20,127 | 133 | 1.37 |

| Inox India | 1,264 | 11,475 | 58.5 | 2.30 |

| Quess Corp | 614 | 9,113 | 30.4 | 4.67 |

Key Performance Highlights revealed

- Group Level Performance: The company expanded its workforce by approximately 10,000 during the quarter. Despite a 1% quarter-on-quarter decline in revenue, the EBITDA saw a growth of 2%.

- General Staffing: The company added a net of around 44,000 to its headcount in FY24, bringing the total billable headcount to approximately 2.67 lakhs. The staffing revenue remained steady quarter-on-quarter, primarily due to festive billings in Q3FY24.

- Degree Apprenticeship (DA): The company experienced positive growth in trainee headcount for the current quarter, even after accounting for NEEM loss. This growth was driven by the National Apprenticeship Promotion Scheme (NAPS) and the Work Integrated Learning Program (WILP).

- Specialised Staffing: The ongoing challenges in the IT industry continue to affect the company’s growth and profitability.

- HR Services: The company saw a 36% growth in revenue for the quarter and a 41% increase in EBITDA, largely due to the seasonal nature of the Edtech business.

- New Logos and Cash Flow: The company added 110 new logos during the quarter and generated free cash of ₹265 crore.

Bottomline

Despite encountering some challenges in recent quarters, Team Lease Services Ltd. continues to maintain its strong position in the human resource services sector in India.

The Q4 FY2024 results present a varied picture. There was a minor decrease in revenue compared to the previous quarter, while the operating profit saw an uptick. On a yearly basis, the company demonstrated notable growth, with both revenue and operating profit witnessing an increase. However, the growth in net profit and Earnings Per Share (EPS) was relatively modest.

The company’s dedication to workforce expansion, client acquisition, and significant free cash flow generation are encouraging signs of its operational robustness and market standing.