In the pulsating heart of the global economy, the information technology industry of India is a force to be reckoned with. Poised to hit a staggering $350 billion mark by 2026 and contribute a significant 10% towards the country’s GDP, it’s a sector that’s not just surviving, but thriving.

Within this dynamic environment, one name that consistently stands out is Tech Mahindra. A titan in the industry, Tech Mahindra has carved a niche for itself with its innovative solutions and global presence.

In a surprising turn of events, the share price of Tech Mahindra experienced a sudden surge, causing a stir in the financial world. Despite a weaker-than-expected performance in the Tech Mahindra Q4 results 2024, the company’s share price skyrocketed by an impressive 10%.

This unexpected turn of events has piqued the interest of investors and market watchers alike, leading to a flurry of discussions and analyses. Secure your straps, because we’re about to go on an exciting ride on the financial roller coaster that is Tech Mahindra’s share price.

Tech Mahindra share news: The unexpected surge

In the world of stock markets, surprises are not uncommon. Yet, the recent surge in Tech Mahindra’s share rate was a development that caught many off guard.

Tech Mahindra, ranked as the fifth largest IT firm in India by market value, witnessed an impressive 10% rise in its share price, hitting an upper limit at ₹1,309.30 per share as of April 26, 2024. This upbeat market reaction highlights the faith in the company’s forward-looking strategies.

Talking about the Tech Mahindra share price history, it has given a 56.61% return over the past 5 years.

Source: Google Finance

Tech Mahindra Q4 results

The spike came as a surprise, mainly due to the company’s Q4 results indicating a 41% drop in net profit YoY, amounting to ₹661 crore. Furthermore, the quarter’s revenue also saw a 6.2% YoY decrease, settling at ₹12,871.30 crore.

Ordinarily, such financial outcomes wouldn’t trigger a favourable market response. Yet, the market reaction was predominantly optimistic.

Here are some of the key Tech Mahindra financials based on Tech Mahindra financial statements:

| Q4FY24(₹ million) | FY24(₹ million) | |

| Revenue | 128,713 | 519,955 |

| Gross profit | 34,772 | 128,808 |

| EBITDA | 14,078 | 49,645 |

| Profit before tax | 9,591 | 32,244 |

| Profit after tax | 6,610 | 23,578 |

| EPS (₹) | 7.5 | 26.7 |

Tech Mahindra share price targets

Financial analysts have offered varied perspectives on Tech Mahindra’s share price targets.

| Research firms | Recommendation | Target price |

| CLSA | Buy | ₹1,589 |

| Nomura | Buy | ₹1,460 |

| Citi | Sell | ₹1,095 |

| Morgan Stanley | Underweight | ₹1,190 |

| JPMorgan | Underweight | ₹1,100 |

| Jefferies | Underperform | ₹1,065 |

| Macquarie | Underperform | ₹930 |

| HSBC | Neutral – Hold | ₹1,300 |

These diverse opinions reflect the complex dynamics and varying expectations surrounding Tech Mahindra’s financial performance and stock valuation.

The FY27 vision

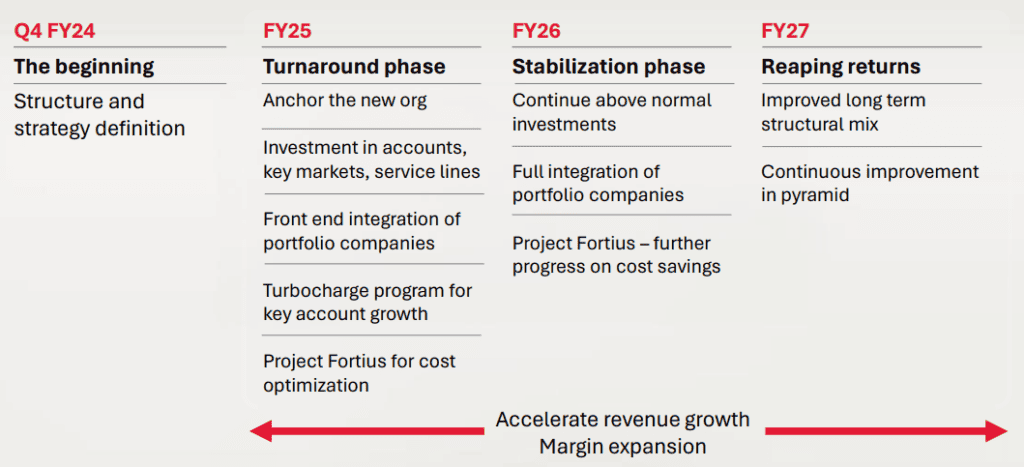

Tech Mahindra’s FY27 vision is a strategic roadmap designed to steer the company towards profitable growth and industry dominance by the fiscal year 2027. This vision is multi-dimensional, encompassing the expansion of major accounts, capitalising on the benefits of acquisitions, and enhancing cost structures.

The company’s strategy to realise this vision involves a series of phased initiatives over the upcoming years. It begins with a turnaround phase, moves towards stabilisation, and ultimately reaches a phase where the returns are harvested.

A crucial element of this vision is the TechM flywheel, which emphasises a balanced industry mix and gives priority to services with high growth potential. The company is determined to accelerate its key account growth program and keep a strong focus on securing large deals. Operational excellence is also a key focus, with an emphasis on services that yield high margins and excellence in delivery.

This is the three-year roadmap proposed by the company:

Source: Tech Mahindra Investors Presentation

Tech Mahindra’s dedication to Environmental, Social, and Governance (ESG) leadership is clear in its ambitious goals. These include achieving carbon neutrality by 2030 and net-zero emissions by 2035. The company also plans to raise its use of renewable energy to 50% by FY26 and enforce a zero-waste-to-landfill policy at all its owned locations.

These are all the parameters representing the company’s commitment to ESG leadership:

| Parameters | Target FY26 |

| Climate Resilience | Carbon Neutral by 2030 | Net Zero by 2035 |

| Renewable Energy | 50% by FY26 & 90% by FY30 |

| Zero Waste to Landfill | All owned locations |

| Afforestation | 150,000 trees |

| Water withdrawal intensity | Reduction by 20% |

| Supply Chain assessment | Audit 200 suppliers |

| Diversity | 38% women associates |

| Human Rights assessments | All owned locations |

Bottomline

The recent rise in Tech Mahindra’s share price, despite disappointing Q4 results, highlights the volatile nature of the stock market and the intricate blend of elements that sway investor sentiment.

Despite the financial hurdles underscored in the quarterly report, the market maintained a positive outlook, uplifted by the company’s strategic blueprint and the future growth potential laid out in its FY27 Vision.

Tech Mahindra’s ability to withstand adversity, along with its progressive strategies and dedication to ESG values, reinforces its position as a key contender in the global IT sector. The company is well-equipped to adapt to the ever-changing industry landscape and deliver value to its stakeholders in the forthcoming years.