In the electrifying world of technology and innovation, there’s a silent yet powerful force that keeps our lives connected and illuminated – the electrical wire and cable industry. This industry, often overlooked, is the lifeline of our modern civilisation, powering homes, offices, and cities, and enabling the digital revolution.

This sector is anticipated to expand from a substantial $228.42 billion in 2024 to an impressive $298.53 billion by 2029, with a compound annual growth rate (CAGR) of 5.5% globally. In the heart of this industry, two titans stand tall – KEI Industries and Polycab. Each with their unique strengths and strategies, they have carved out a niche for themselves in the market, illuminating millions of lives across the globe.

Through this exploration, the article strives to enhance understanding and comparison of KEI Industries vs Polycab along with their significant roles in shaping the future of the electrical wire and cable market.

Company profiles

KEI Industries Ltd

KEI Industries Limited, a distinguished entity in the wire and cable manufacturing sector, boasts a rich legacy of over 55 years. The firm has carved a niche for itself as one of the leading organised players in the Indian market, offering a diverse array of products that serve a broad spectrum of industry needs.

The company is engaged in the production and marketing of Extra-High Voltage (EHV), Medium Voltage (MV), and Low Voltage (LV) power cables. It serves both retail and institutional markets and additionally offers Engineering, Procurement, and Construction (EPC) services.

KEI stands out as one of the rare Indian manufacturers with the ability to produce extra high voltage (EHV) cables exceeding 220kV, thus placing itself in an elite group of global manufacturers capable of producing EHV 400kV cables.

The share of KEI Industries in the Indian cables & wires segment is noteworthy. KEI Industries maintains its stature as the runner-up in the industry, commanding an impressive share of about 13% in the organised cables & wires sector and nearly 9% in the total market.

KEI Industries news about share price

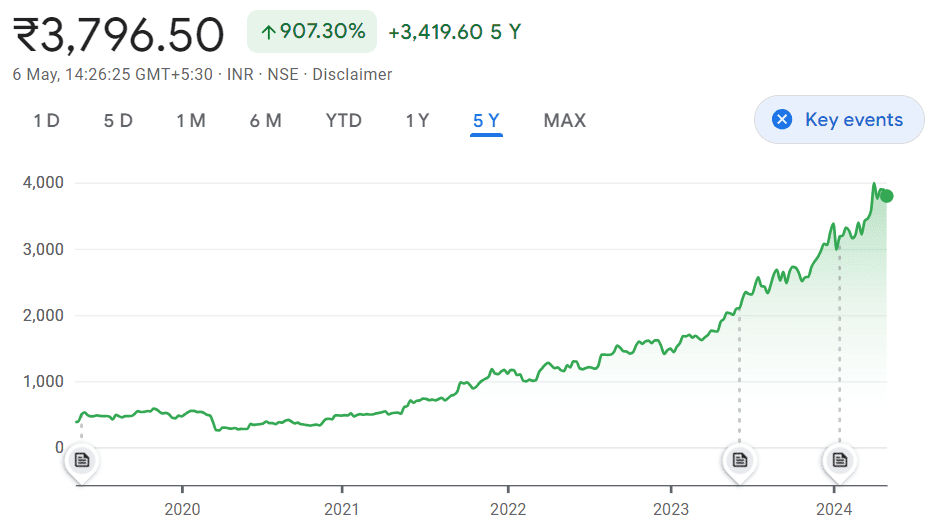

As of May 6, 2024, the KEI Industries share price is ₹3,796.50. Looking at the KEI Industries share price history, the return given by the stock for the past 5 years is 907.30%.

Source: Google Finance

Polycab India Ltd

Polycab is a distinguished entity in the electrical sector, celebrated for its vast experience of more than four decades. The company has earned a reputation as a reliable producer and distributor of wires, cables, and fast-moving electrical goods (FMEG), all under the respected ‘POLYCAB’ brand.

Their product assortment is varied, covering a broad spectrum of products from power cables and control cables to electric fans, LED lights, and solar products. The company boasts a robust nationwide presence with over 4300 distributors, more than 205,000 retail outlets, 23 warehouses and depots, 4 regional offices, 9 local offices, and 17 experience centres.

The share of Polycab India in the cables & wires sector is significant. Polycab dominates the market, holding a substantial ~26% share in the organised sector and an ~18% share in the overall market

Polycab news about share price

Polycab share news: As of May 6, 2024, the Polycab share price is ₹5,901.00. Looking at the Polycab share price history, the return given by the stock for the past 5 years is 800.71%.

Source: Google Finance

The Polycab share price target set by the analysts in Prabhudas Lilladher is ₹6,021. They raised the ratings from ‘accumulate’ to ‘buy’.

Financial profiles

Let’s compare the key financial metrics for both companies.

| KEI Industries results(as of Dec 2023) | Polycab India results(as of Dec 2023) | |

| Revenue (₹ crores) | 2,059 | 4,340 |

| Operating profit (₹ crores) | 215 | 570 |

| Profit before tax (₹ crores) | 202 | 546 |

| Net profit (₹ crores) | 151 | 417 |

| EPS (₹) | 16.70 | 27.49 |

| Market cap (₹ crores) | 34,289 | 88,489 |

| Price to earning | 59.0 | 53.2 |

| Debt to equity | 0.05 | 0.03 |

| ROCE | 27.2 % | 27.0 % |

Source: Screener

Reasons for growth

KEI Industries Ltd

- Diversified business model: The company boasts a diverse portfolio of products and services, serving a multitude of sectors and regions resulting in significant portions of the KEI Industries turnover. This not only amplifies their business prospects but also helps in reducing potential risks.

- Strategic investments: Active allotment of resources is being made to enhance manufacturing capacity, which includes the establishment of a new facility in Gujarat. This expansion is backed by an investment of approximately ₹1,000 Crore over the forthcoming three to four years.

- Strong financial position: The company has demonstrated steady expansion with a compound annual growth rate (CAGR) of 15% over the past 15 years. This growth is supported by a net debt-free position and positive cash flows, which facilitate investments funded internally.

Polycab India Ltd

- Diverse product range: The company produces a broad range of wires and cables tailored to diverse industries, which plays a significant role in its strong growth trajectory.

- Strategic initiatives: The execution of Project LEAP, along with other strategic initiatives, has been crucial in steering the company’s transformation and promoting its sustainability objectives.

- International expansion: The substantial expansion in the company’s international operations, which includes exports to more than 70 countries, has been a key factor propelling its growth.

- Innovation and R&D: The company’s growth path has been bolstered by persistent product development and innovation, especially in the Fast-Moving Electrical Goods (FMEG) segment.

Company strategies

KEI Industries Ltd

- Capacity expansion: The company is actively investing in both brownfield and greenfield capital expenditures at several sites, including Chinchpada, Pathredi, and Sanand. These investments aim to boost the production capabilities for House Wire, LT power cables, and EHV cables.

- Growth projections: KEI Industries is targeting a growth rate of 16% to 17% for the current and following fiscal year, a goal that is facilitated by their ongoing capacity expansions.

- Export market development: KEI Industries intends to leverage its increased production capabilities to tap into new export markets for EHV cables, given that the current production is predominantly dedicated to fulfilling existing demand.

- Industry outlook: The company foresees sustained demand from both public and private sector capital expenditures, and predicts robust growth in the Wire and Cable division in the upcoming years. They also identify potential opportunities in infrastructure projects such as highways, metros, railways, and the power sector, along with the construction and manufacturing industries.

Polycab India Ltd

- Capex plans: The company intends to allocate ₹800 – ₹900 Crores for investments in the ongoing fiscal year and anticipates a capital expenditure of ₹600 – ₹700 Crores for FY25.

- FMEG business: The company is currently reorganising its B2C operations with the goal of achieving stability and resuming growth within the next four quarters.

- Exports: The company is making strides to revitalise and enhance its export operations, specifically targeting the US and Europe, despite recent obstacles of transitioning the distribution model.

- Product focus: The company is focusing on switches and switchgears in the FMEG sector, with strategies in place to broaden its product range and distribution network.

Bottomline

The electrical wire and cable industry, while often underappreciated, serves as the backbone of our technologically advanced society. The analysis of KEI Industries and Polycab brings to light two industry powerhouses with unique strategies and market positions.

KEI Industries, with its diversified product portfolio and strategic investments, stands out as a key player in the Indian market, boasting a significant market share and steady financial performance. On the other hand, Polycab’s extensive product range, international expansion, and focus on innovation position it as a dominant force in the industry, commanding a substantial share of both the organised and overall market.

The journey of KEI Industries and Polycab symbolises resilience, innovation, and adaptability – qualities that define success in the electrifying world of technology and innovation.