In the intricate world of finance, where numbers narrate stories, a remarkable event has unfolded. Thermax Limited, a prominent player in the industrial sector, has seen its share price surge by an extraordinary 14% in a single trading session on May 15, 2024.

Thermax, a company with a diverse portfolio spanning energy, environment, and water solutions, among others, has been a stalwart in the Indian industrial landscape. This jump in its stock price isn’t just a figure; it marks an important step in the company’s path.

This article will analyse this financial event, exploring the factors that contributed to this surge and the potential implications it has for the future.

About Thermax Limited

Thermax Limited provides solutions for the energy, environmental, and chemical sectors. The company’s range of offerings encompasses boilers and heaters, absorption chillers/heat pumps, power plants, and solar equipment. It also includes air pollution control systems, water and waste recycling plants, ion exchange resins, performance chemicals, and associated services.

Thermax is a prominent player in the energy and environment sectors, with a substantial global footprint. The company employs approximately 4,127 individuals worldwide, demonstrating its significant human resource strength.

With installations across over 90 countries, Thermax has established a broad international reach, showcasing its ability to operate on a global scale.

Financially, Thermax stands strong with a revenue of $1 billion, indicating its robust economic standing and competitive position in the market. The company’s industrial capacity is further highlighted by its 14 manufacturing locations, which include 10 in India and 4 abroad. This not only reflects Thermax’s manufacturing prowess but also its strategic international presence.

Moreover, Thermax’s commitment to customer service is evident from its sales and service network which spans more than 30 countries. This extensive network ensures that Thermax maintains a close relationship with its customers, providing them with the necessary support and services.

Thermax emerges as a well-established entity with a significant international presence, financial strength, and a comprehensive operational network, positioning it as a key player in its industry.

Order book status

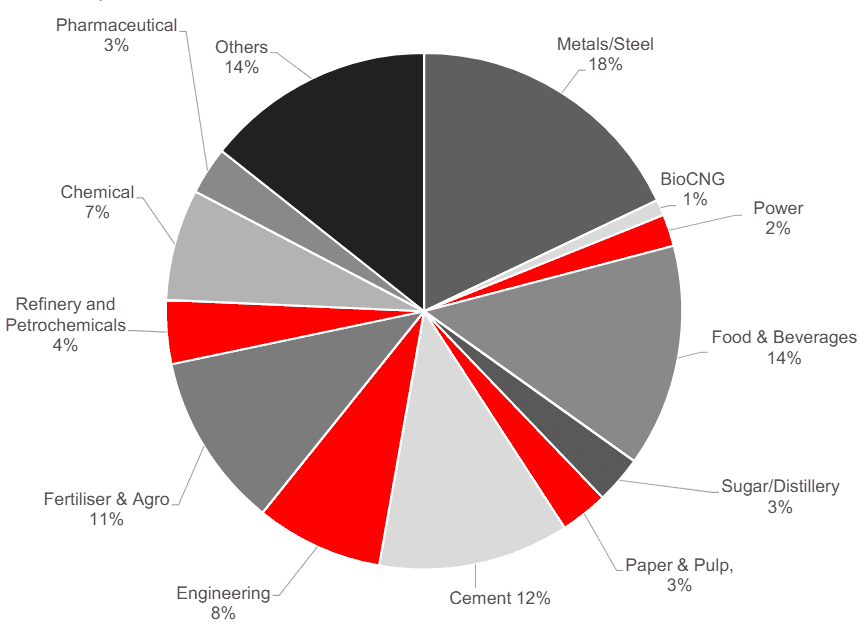

The company is building on stable base orders and has seen an inflow of enquiries from the retail, chemical, and F&B industries. There is an upward trend in enquiry inflow from the textile segment, and competitive wins have been noted across the distillery segment.

This chart provides insight into Thermax’s market focus and performance in these sectors for the quarter.

Source: Thermax Limited: Investor Presentation Q4 FY23-24

Thermax Limited quarterly performance

Here are a few crucial financial indicators of Thermax’s Q4FY24 results, compared with the same quarter from the preceding year:

| Q4 FY2024(₹ crores) | Q4 FY2023(₹ crores) | Change (%) | |

| Revenue | 2,764 | 2,311 | 19.60 |

| Operating profit | 273 | 200 | 36.50 |

| Profit before tax | 251 | 214 | 17.29 |

| Net profit | 188 | 156 | 20.51 |

| EPS | 15.97 | 13.09 | 22.00 |

Source: Screener

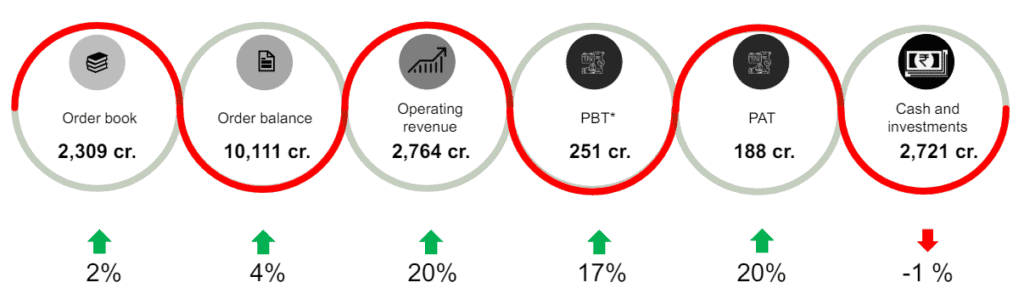

Let’s have a look at the snapshot of a few quarterly metrics revealed in the Q4 results:

Source: Thermax Limited: Investor Presentation Q4 FY23-24

Also read: Piramal Enterprises Q4 results: Key takeaways

Thermax Limited annual performance

Here are the essential financial metrics of the company when contrasted with the previous year:

| FY2024(₹ crores) | FY2023(₹ crores) | Change(%) | |

| Revenue | 9,323 | 8,090 | 15.24 |

| Operating profit | 797 | 601 | 32.61 |

| Profit before tax | 869 | 603 | 44.11 |

| Net profit | 643 | 451 | 42.57 |

| EPS | 54.15 | 37.79 | 43.29 |

Source: Screener

Market reaction

Shares of Thermax Ltd have been attracting significant buying interest in recent days, driven by the positive Q4 results announced on May 10, 2024. On Wednesday, May 15, the Thermax share price soared, hitting an unprecedented peak of ₹5,382.40 during the morning trading session on the Bombay Stock Exchange. This was a 14% jump from the previous close of ₹4,695.55.

Looking at the Thermax share price history, the stock has been on the uptrend since the Q4 FY 2024 earnings release, as can be seen from this chart:

Source: Google Finance

Must read: Tata Motors Q4 results 2024: A comprehensive analysis

Thermax share price targets:

Post the March quarter result, Thermax Limited has been the subject of varied perspectives among experts and brokerage firms.

HDFC Securities, a well-known brokerage firm, has retained a ‘buy’ recommendation on the stock, with a target price set at ₹4,686. They are of the opinion that Thermax is poised to reap benefits from investments in clean energy, sustainability, decarbonisation, and the stabilisation of the international market.

HDFC Securities sees potential in Thermax’s new product range and initiatives aimed at cleaner air and water. They have revised their estimates upwards, taking into account improved growth and margins for Thermax.

In contrast, Nirmal Bang has an ‘accumulate’ stance on the stock with a target price of ₹4,400. The firm foresees a future improvement in margins, with a focus on commissioning challenging projects such as rice straw plants and ethanol-related initiatives.

On a different note, Kotak Institutional Equities has downgraded the stock from an ‘add’ to a ‘reduce’, but intriguingly, they have increased the fair value from ₹3,550 to ₹4,350. The firm observed that while Thermax’s Q4FY24 results were strong in terms of profitability, they were weak in terms of order inflows.

While there are mixed views on Thermax’s stock, the overall sentiment leans towards a positive outlook, with all firms acknowledging the company’s potential in some form.

Future outlook

Thermax is strategically positioned for substantial expansion, driven by the momentum in the energy sector, market confidence, and emerging technologies. The shift towards the production of green hydrogen has cast a spotlight on the need for electrolyzer production.

Thermax is tapping into this opportunity by considering collaborations to create and distribute electrolyzers, with expectations of considerable revenue generation starting within the next two to three years.

By the year 2030, Thermax envisions a major upswing in its operations. It is set to contribute significantly to India’s industrial revival, with a commitment to sustainable energy practices and the pursuit of cutting-edge solutions to meet forthcoming demands.

The company has plans to deploy 1 gigawatt (GW) of hybrid renewable energy solutions within the next three years. Additionally, Thermax is seeking strategic alliances in various sectors, including its industrial product division.

Also read: The renewable energy industry in India: A game-changer for the environment

Bottomline

The recent surge in Thermax Limited’s share price, marked by a 14% increase in a single trading session, is a testament to the company’s robust financial performance and strategic positioning in the industrial sector.

With a strong foothold in energy, environment, and water solutions, Thermax has demonstrated significant growth and resilience. Thermax Limited’s recent financial achievements and strategic initiatives highlight its strong market position and growth potential.