Titan Company’s Q1FY25 pre-quarter business update was disappointing, impacting its share performance. Want to know more about the details and what’s next? Read our blog for an in-depth analysis.

The Titan’s story

Titan Company Limited, established in 1984, is a product of a unique partnership between the Tata Group & TIDCO meaning Tamil Nadu Industrial Development Corporation. The jewellery sector, led by brands such as Tanishq, Zoya, and Mia, forms the backbone of Titan’s business. Titan, Fastrack, and Sonata dominate the wristwatch segment.

The company’s revenue is heavily skewed towards jewellery, which accounts for 88% of the total. Watches and wearables contribute 8%. Eyecare and emerging businesses make up the remaining 4%.

Speaking of revenue mix, Titan’s global revenue share has risen, jumping from 0.8% in FY19 to 2.2% in FY24. Similarly, the influence of online channels is substantial, now accounting for roughly 20% of sales, highlighting the shift towards digital commerce.

With 3,035 stores in 428 towns, Titan’s retail footprint is expansive. The retail space spans over 4.14 million square feet. Supporting this distribution are ten production and assembly units, ensuring a steady supply chain.

Ownership is well-divided: As of March 2024, Tata Group holds 25.02%, TIDCO 27.88%, and the remainder is owned by institutional investors and the public. This balanced shareholding structure fortifies Titan’s market standing.

Here are some of the strategic moves in the last 5 years:

- They incorporated Hug Innovations to advance in smart wearables. Expanding into new regions,

- Titan set up operations in the Gulf and the United States.

- Acquiring almost 99% of CaratLane reinforced their jewellery segment.

- They also invested in innovative firms like Clean Origin and CueZen.

- On the other hand, they exited partnerships with Favre Leuba and MontBlanc to focus more on core activities.

- Around June 28, the firm entered a joint venture with Rhythm Jewelry in Bangladesh, securing a 74% stake. Rhythm Group holds the remaining 26%. They’ve jointly invested 1 crore BDT, which is about ₹72 lakh. This venture aims to boost jewellery production and retail in Bangladesh, targeting the expanding international market.

Also read: India’s gems and jewellery industry: A treasure trove of opportunities

Titan Earnings overview

In the first quarter of FY25, Titan reported a revenue increase of around 9%. The jewellery business, essential for Titan, saw an 8% rise domestically. This was the first instance in nine quarters where double-digit growth wasn’t achieved, influenced by elevated gold prices and fewer wedding days.

The watches and wearables division had varied outcomes. While analog watches surged by 17%, wearables dropped by 6%. Customers leaned towards premium brands like Titan and Helios. Seventeen new outlets were added, showcasing expansion efforts.

The eyecare sector posted a modest 3% year-on-year increase. Affordable fashion options boosted volumes. ‘Runway,’ a new premium sunglasses brand, opened its first store in Bengaluru. Additionally, Titan Eye+ expanded with three new locations in India during this period.

Emerging businesses like Taneira and CaratLane also showed progress. Taneira’s revenue climbed by 4%, with new stores in Jodhpur and Nashik. CaratLane reported an 18% increase, growing its network to 275 stores nationwide. The fragrances business grew by 13%, whereas fashion accessories declined by 15%.

| Segments | YoY growth% (Q1FY25 vs Q1FY24) | Net store additions – Q1FY25 |

| Jewellery | 9 | 34 |

| Watches & wearables | 15 | 17 |

| Eye care | 3 | 3 |

| Emerging businesses | 4 | 4 |

| TCL (Standalone) | 9 | 58 |

Source: Titan Company Limited Q1FY25 Update

To learn about the last quarter, read more here: Insights and implications from Titan Q4 results

Titan Company market movements

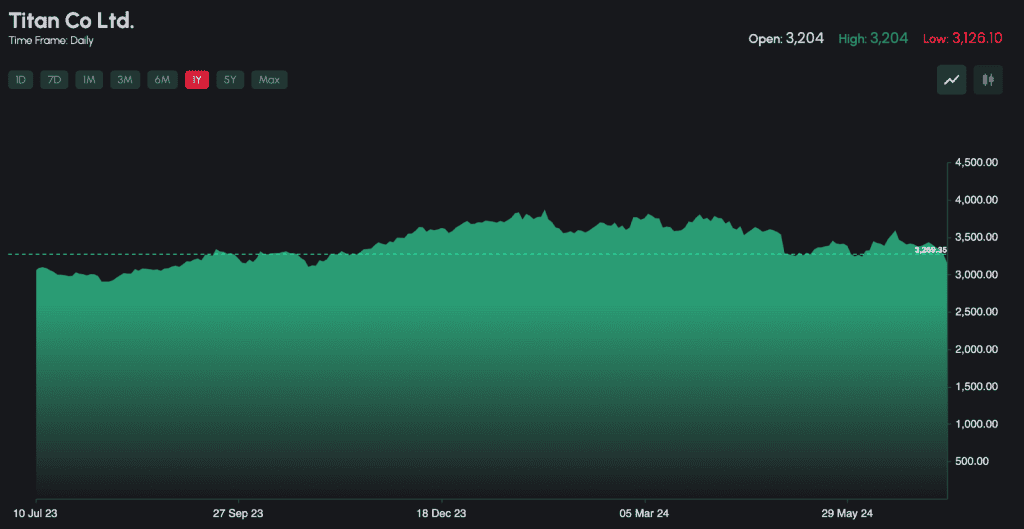

Titan’s share price fell over 2% in early Monday trading on July 8, 2024. The stock dropped to ₹3,156.15 on the Bombay Stock Exchange/ BSE, a decline of 3.46%, marking the fifth consecutive session of losses.

In the past month, the firm’s stock has slided by more than 8%. Over the last three months, it has dropped by 16%. This negative movement has led to a year-to-date reduction of over 14%.

The stock price has varied significantly, with a 52-week high of ₹3,886.95 and a low of ₹2,882.45. This range highlights the investor reaction to Titan’s financial performance.

Here’s the share performance for the last one year:

Source: NSE

Titan share price fall reason

As noted earlier, the main reason for the logo’s share price slide is due to lacklustre performance in its jewellery division. In this year’s first quarter, domestic jewellery revenue grew by only @8%, a steep drop from the 19% increase in the previous quarter. Also, the sharp 20% YoY rise in gold costs has dampened consumer interest, and fewer wedding days this year have compounded the slowdown.

The outfit also lowered its EBIT margin i.e., the earnings before interest and taxes margin forecast for the jewellery business from around 12.5% to approximately 12%. This adjustment underscores the pressures from rising competition and persistently high gold costs, raising doubts about profit margins.

The market is becoming increasingly crowded, with new players like Aditya Birla Group’s Novel Jewels entering the fray. Additionally, the rising popularity of lab-grown diamonds is impacting Tanishq’s studded products, challenging Titan’s dominance in the industry.

Regarding competition, Kalyan Jewellers India Ltd also saw a slowdown in growth. Nevertheless, they recorded around 29% growth in domestic operations for Q1FY25, which is noteworthy.

Other segments of the business showed mixed outcomes. The watches and wearables division expanded, but the eyewear and emerging businesses posted only modest gains. This uneven performance across various sectors adds to the uncertainty about Titan’s overall growth trajectory.

Brokerage firms have responded by revising their ratings and projections for Titan’s stock. JP Morgan downgraded Titan from overweight to neutral, reducing its price target to ₹3,450 from ₹3,850. Similarly, Morgan Stanley and Goldman Sachs have cut their price targets, indicating a more cautious outlook on Titan’s short-term prospects.

You may also like: What led Ahluwalia Contracts stock to soar 18%?

Bottomline

Titan’s share price fall reason is due to several challenges, especially in the jewellery segment. Elevated gold costs and fewer wedding days have impacted revenue, while the competitive market is squeezing margins.

Other divisions, like watches and eyewear, have shown varied outcomes. Though there is ongoing growth in these sectors, the overall results are inconsistent.

Stakeholders should monitor Titan’s strategies and evolving market conditions. The upcoming festive and wedding seasons will be critical for a potential turnaround. The company’s strong brand and growth plans offer promise, but external pressures and market dynamics warrant close attention.