The Sensex dipped by 27.43 points (0.03%) to 79,897.34, while the Nifty fell by 8.50 points (0.03%) to 24,316.

Positive global cues led to a good start, but selling pressure erased gains. The Nifty dipped below 24,200 but recovered to close flat.

Impact on the stock market

The market saw mixed reactions across various sectors. While Oil and Gas(up by 1.10%) and Media sectors (up by 1.03%) saw healthy gains, the Realty (down by 1.49%) and Pharma sectors (down by 0.60%) experienced notable declines.

Nifty Bank: Up by 0.16%

PSU Bank and Private Bank Indices: Up by 0.17% and 0.16%, respectively.

Also Read: Marico share price

| Sector/Index | Performance |

| Information Technology | +0.14% |

| Healthcare | -0.65% |

| Oil & Gas | +1.10% |

| Realty | -1.49% |

| PSU Banks | +0.17% |

Top gainers today in share market

| Company | Price | Change (%) |

| ONGC share price | 304.75 | +2.21 |

| BPCL share price | 306.60 | +2.08 |

| Coal India share price | 500.05 | +1.90 |

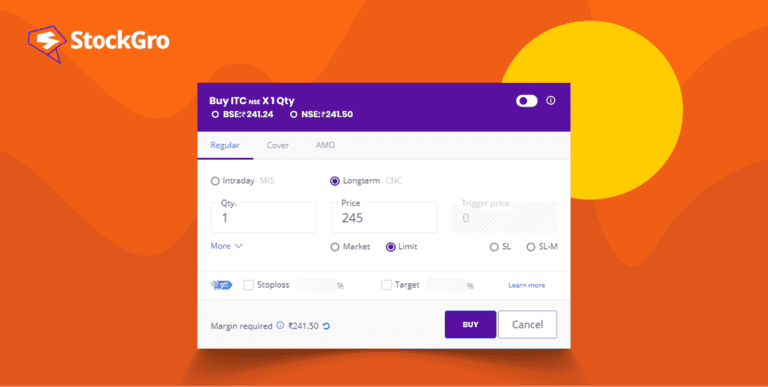

| ITC share price | 458.65 | +1.59 |

| Tata Motors share price | 1,020.80 | +1.52 |

Top losers today in share market

| Company | Price | Change (%) |

| TATA Cons. Prod share price | 1,131.40 | -1.69 |

| Bajaj Finance share price | 6,950.30 | -1.48 |

| M&M share price | 2,698.05 | -1.24 |

| Divis Labs share price | 4,582.50 | -1.17 |

| NTPC share price | 377.10 | -1.13 |

Market aftermath: Impact on stocks

Ahluwalia Contracts rise by 7%

Shares of Ahluwalia Contracts (India) rose by 7% on July 11 after securing an ₹ 893.48 crore order from the Airports Authority of India (AAI) for developing the Lal Bahadur International Airport in Varanasi.

The project includes constructing a new terminal and allied works on an EPC model within 36 months. The stock has gained 77% in the past six months, outperforming the Nifty 50, which rose by 12%.

Also Read: Ahluwalia contracts shares

NELCO shares fell 4%

Shares of NELCO fell 4% to an intraday low of ₹ 865 after reporting a year-on-year decline in Q1 net profit and revenue. NELCO’s net profit for Q1 FY25 dropped 20.4% to ₹ 4.6 crore, and revenue decreased by 6% to ₹ 74.1 crore.

The stock has gained 7% in the past six months, underperforming the Nifty 50, which rose by 12%. On a sequential basis, net profit declined by 25%. NELCO, a subsidiary of Tata Power, offers networking solutions and specialises in VSATs, private hubs, and hybrid networks.

HPL Electric & Power saw a 15% surge

HPL Electric & Power shares surged 15% on July 11 after winning a ₹ 2,000.71 crore order for smart meters. This order exceeds the company’s previous year’s total order book and represents about 64% of its market capitalisation.

The company reported a net profit of ₹ 13.72 crore for Q4 FY25, a 22.3% annual increase, with revenue up 17% to ₹ 424.09 crore. Over the past year, the stock has tripled in value, rising 200%, compared to a 26% increase in the Nifty 50.

Crude Oil price rebound

Crude oil prices rebounded after three days of decline, driven by a decrease in U.S. oil stocks, improved demand prospects, and hopes for rate cuts. The U.S. Energy Information Administration (EIA) reported a 3.4 million barrel decrease in U.S. crude oil inventories.

OPEC+ reaffirmed its global oil demand forecast for the second half of 2024 and 2025, anticipating increased demand due to more air travel and economic recovery.

Crude oil prices are expected to remain volatile, with support at $81.30-$80.90 and resistance at $82.55-$83.10. In INR, support is at ₹6,810-₹6,735 and resistance at ₹6,940-₹7,020.

Conclusion

In today’s market wrap-up on July 11, 2024, Indian indices closed flat due to profit booking.

Stocks like Ahluwalia Contracts and HPL Electric performed well due to significant new orders, whereas NELCO faced declines due to poor quarterly results. Crude oil prices also rebounded.

Stay tuned on StockGro for more updates and insights into market trends.