India is bullish on its electric vehicle (EV) industry and is exploring greater horizons and numbers consistently. The industry highly aligns with India’s goal to cut nearly one billion tonnes of carbon emission by 2030, due to which the government usually encourages the EV industry. Also, India has a humongous population of 432 million middle class people, as of 2020-21. Usually, middle class people prefer two-wheeler vehicles over others.

The Indian two-wheeler EV market is thus gaining rapid success over the last few years. From 2021 to 2023, the electric two wheeler market grew at a massive 303% CAGR. Moreover, it is expected to reach US$ 113.9 billion by 2029.

Due to the early-stage of this market, there are comparatively few players and Tunwal E-Motors limited is on its way to make its place in the market. The Indian stock market is ready to welcome Tunwal E-Motors IPO and boost its market share in the industry. Read the article to know more about it.

Check out this article: What does the EV boom mean for auto stocks?

About Tunwal E-Motors

The Pune-based company was incorporated in the year 2018, and is operating in the manufacturing of two-wheelers EV segment. This focus has helped the company expand to 19 states in the country. Since its incorporation, it has launched nearly 23 models and has an effective network base of 225 dealers across the country.

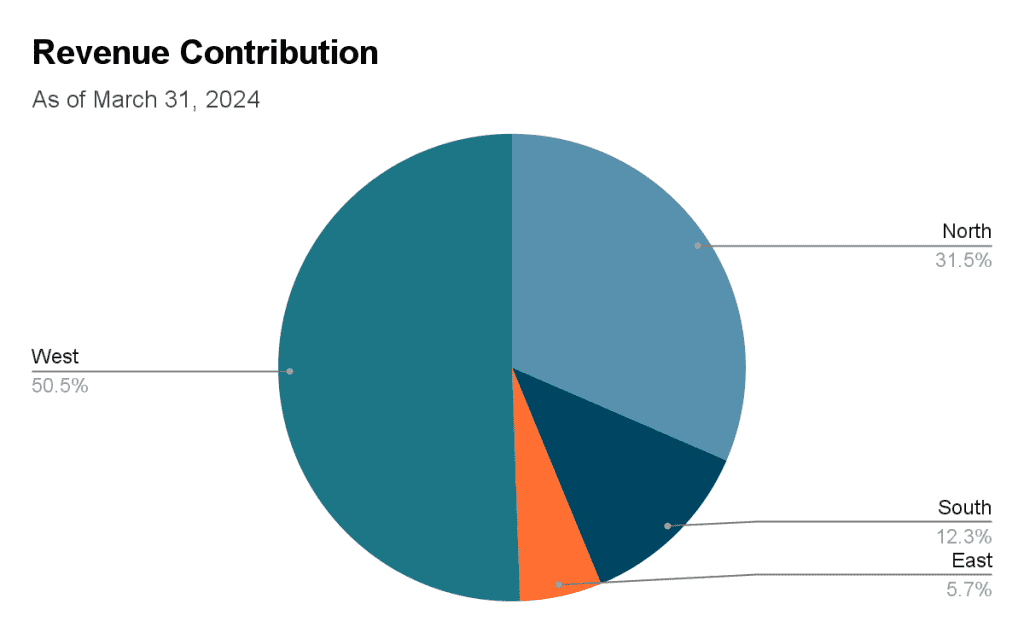

Company’s production plant is situated in Palsana , Rajasthan. The contribution of four regions in the country shows that it earns its highest revenue from the western region.

Source: RHP

The company purchases raw material from India and China. Company sold 20,332 units in FY 2023-24 through its total 256 distributors in the country. Company is expanding its distribution network mainly in the smaller towns or B & C towns of the country, where demand for two-wheelers is growing.

Tunwal electric scooter, E-bikes, and E-mobility named ‘Smiley’ constitute the product mix. The products of Tunwal E-Motors are famous for its affordability and innovation among the customers.

Tunwal E-Motor IPO details

The company launched its IPO to raise funds from the market for the following objectives:

- Working capital funding

- Research & development

- Pursuing inorganic growth

- Corporate purpose

| Total issue size | ₹115.64 crores |

| Price | ₹59/- |

| Lot size | 2000 shares |

| Fresh Issue | ₹81.72 crores |

Source: RHP

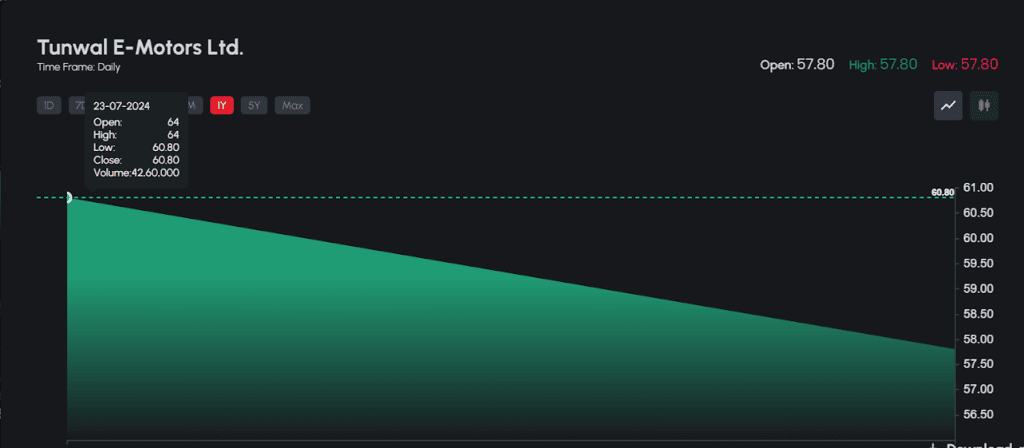

The Tunwal E-Motor IPO date was from July 15, 2024 to July 18, 2024. The company’s shares listed on the exchanges on July 23, 2024. It opened in the market at ₹64/-, up by 8.4% from its issue price.

Source: Cogencis iINVEST

Tunwal E-Motor GMP

The grey market of Tunwal E-motors limited IPO was positive from the start. On the first day, the IPO was subscribed by 2 times, which on day two increased to 3.18 times. Finally, on the third day, the IPO was subscribed 12.31 times.

Know more: Bharti Airtel vs Vodafone Idea: A Deep Dive

Financial Performance

| Particulars | March 2024 | March 2023 | March 2022 |

| Revenue from operations | 10460.07 | 7650.18 | 7545.91 |

| EBITDA Margin(%) | 17.05 | 8.64 | 5.74 |

| PAT Margin(%) | 11.29 | 4.87 | 3.10 |

| Return of Equity (%) | 57.53 | 45.32 | 55.12 |

| ROCE (%) | 59.38 | 31.97 | 27.13 |

Source: RHP

The company financials are super positive about the pace of growth that company is currently delivering. The revenue has increased by 36.7%, while its net profit increased by a massive 217%, from March 2023.

The growing return on capital employed (ROCE) indicates the company’s focus towards expanding the production and aggressive investment in the capital. Similarly, the ROE is also on the upward trend.

SWOT analysis

| Strength | Weakness | Opportunities | Threat |

| Focused product portfolio, constant efforts of innovation leading ROCE at 59%. | Company’s revenue is concentrated nearly 74% just from its top 10 distributors. | Expanding dealer network throughout the country and planning for exports. | Competitive market, few players like Ather, Ola, Hero Electric. |

| Strong financial growth of approx 217% y-o-y, in the net profit. Moreover, other ratios are also well-balanced. | Company is solely dependent on only the market of EV two-wheelers. | Whole sector is in early-stage, which opens immense opportunities for growth. | Company procures raw material from third-party vendors with no general agreement. So, risk of unavailability may lurk over the production process. |

Bottomline

The sales and distribution of the products of Tunwal E-Motors limited is impressive. It has achieved good sales in the short span of 6 years, from its inception in 2018. Tunwal electric vehicles have the classic features of better quality, affordability and varieties to match its ambition to span into B & C cities of the country.

Its financials indicate better prospects for the company, and the recent IPO also provides an opportunity for investors to be a part of the growth of the EV industry in India.

Also read about: India’s first electric vehicle index: What you need to know.