Tatas have a 100% stake in Air India, 83.33% in AirAsia India and 51% in Vistara. Here’s all you need to know about the Tata mega merger.

- Air India is back under the Tata hut after the Tatas bought it back for Rs. 18,000 cr.

- Tata airlines are among the most punctual airlines in the industry

- Launch of Akasa air and the demise of Jet and SpiceJet means a new order is here

The Maharaja is back home and is now piloted by the Tatas after a 68 year long wait. With a host of airlines (Air India, Air Asia, Vistara) under its wing, the Tata Group is number two in coverage, only after Indigo. The industry has seen airlines, once heralded as the best in business, bite the dust. Deccan Airways, Kingfisher, Jet Airways, and Spicejet were among the top airlines at one point. But even with the Indian aviation sector being so taxing, a formidable group like this can (easily?) shun away the pressure.

The competition is cut-throat, with 7-8 airlines running in the country. The Tatas, however, have plans to unscramble the industry by cutting down from three carriers to one. The group aims to bring its associate and affiliate airlines Vistara and Air Asia under the Air India umbrella. The plan is to merge Vistara into Air India and AirAsia India into AI Express. This will ease the operations since these companies have a lot of overlapping routes, both passenger and cargo.

The Tata mega merger comes after a host of mergers already planned by the Tata Group which we discussed here. The first Tata company to go under the knife was Tata Steel. Now it’s the turn of the Maharaja (of the skies).

And biggest airlines across the world have come from mergers: Delta and Northwest Airlines, United and Continental Airlines, Virgin and Alaska and many more. But merger is a word that the Indian aviation industry fears. Kingfisher and Air Deccan merged, Jet Airways merged with Air Sahara and also with Jetlite. None of these was successful. Instead, it led to the death of these airlines—a total catastrophe. But Air India is confident.

Tata mega merger: Maharaja heads home

Air India started operations in 1932 as Tata Air Services (renamed Tata Airlines in 1938 and Air India in 1946) and was founded by JRD Tata. In 1948, the Indian government acquired a 49% stake in the airlines, only to acquire a majority stake in 1953. Eventually, Air India became the national carrier, and Tatas shunned away from the airlines that they founded.

But then Air India became a loss-making airline in the late 2010s, and the government wanted to divest. The Tatas were quick to jump on and emerged as the winning bidder. The base price was set at Rs. 12,906 cr. A consortium led by Ajay Singh bid Rs. 15,100 cr. at the same time, Tata Sons’ SPV Talace bid Rs. 18,000 cr. for the carrier. It made a cash payment of Rs. 2,700 cr. and absorbed the debt of Rs. 15,300 cr.

On an emotional note, Air India, under the leadership of Mr. JRD Tata had, at one time, gained the reputation of being one of the most prestigious airlines in the world. Tatas will have the opportunity of regaining the image and reputation it enjoyed in earlier years. Mr JRD Tata would have been overjoyed if he was in our midst today.

-Ratan Tata

Buying Tata was as much an emotional decision for Tatas as it was a financial decision.

Tatas (through Air India and Vistara) are the only ones operating wide-bodied aircraft in India. SpiceJet has given up on its wide-body aircraft aspirations, while IndiGo is still planning to jump in. With the Tatas offering complimentary means against IndiGo offering meal options, people prefer flying with the Tatas. Air India is also planning to offer premium economy services, which Vistara already does.

And with the Tata revamp comes one of the most significant narrow bodied aircraft orders in the Indian aviation sector. The order is reported to be for 300 aircraft. This could triple to fleet from an existing fleet of 113 in the next 5 years. Not just that, the Tatas are planning to raise $1 billion at a valuation of $5 billion. This could help Air India reach its goal of 30% domestic market share in the next 5 years.

The Vistara kill

Air India and Vistara were labelled the two most punctual airlines recently, but they will soon be merged. The conglomerate is planning to kill the Vistara brand, as part of its Tata mega merger plan.

Vistara is a joint venture between Tatas and SIA, with Tatas having a majority stake in the airlines. The venture started in January 2015 and has become one of the most premium carriers in the economy segment (my personal favourite).

SIA has reaped benefits from Vistara and realises that the cost of scaling up Vistara will be significantly higher as compared to Air India, which already has a significant size.

Vistara Executive

The integration could help consolidate the group, but it will also focus on organic growth to reach the 30% target market share. The merger will help the brand create a niche in the industry. It will also help Vistara access international geographies with premium ground slots and Air India benefits by getting a reputation makeover and becoming a customer-centric carrier. Air India will get a firm footing on the domestic front.

India’s air traffic flows to double in 10 years

Singapore Airlines

With this integration will come an improved customer experience for the Air India flyers to cover up for the lacklustre experience over the years. It’ll also ease the competitive pressure as Air India and Vistara have been competing with each other in many markets even after being owned by the same parent.

Tata Group also owns 83.67% of AirAsia India, which could soon be merged with Air India. AirAsia India was launched in 2014.

The assessment and implementation of the full integration process of AirAsia India and Air India Express, through a possible scheme of merger or otherwise and subject to necessary corporate approvals, is expected to take approximately 12 months, with network and other synergies to be realised progressively during that period

A statement by Air India

It is speculated that post the merger, Tatas could hold 75-80% while SIA could hold a 20-25% share. The merger could be concluded by the end of 2023.

The new order in the aviation sector

With the mother or mergers in the Tata carriers, the launch of Akasa air, and the demise of Spice Jet and Jet airways, a new world order is emerging in the Indian aviation sector.

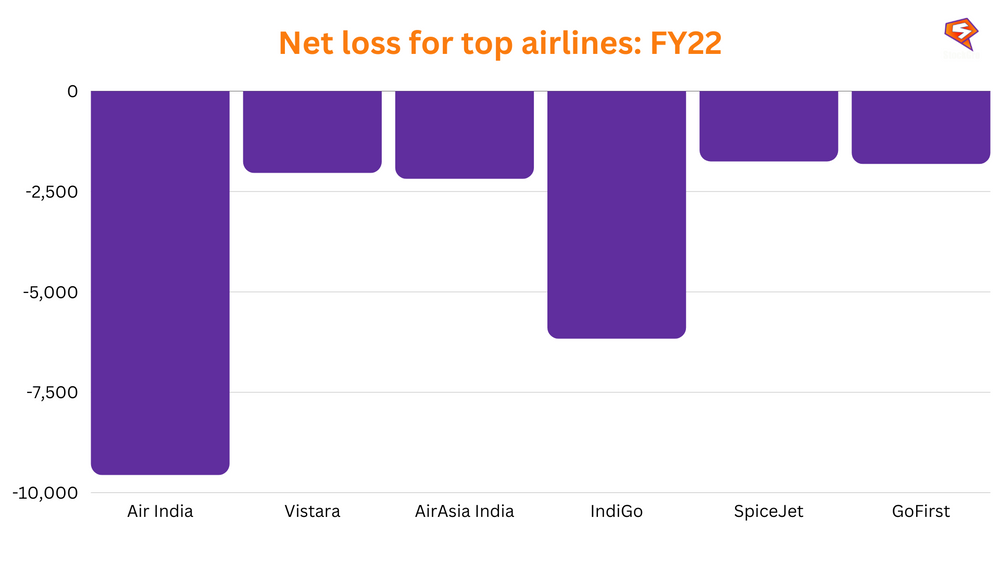

Given that we have so many of them, the Indian carriers are pinned against the wall. Almost all these carriers are running into huge losses, with debt levels shooting through the roof.

During the pandemic, the airlines’ net worth fell and has yet to return to the pre-COVID levels. The airline industry, in total, lost over Rs. 30,000 crores in FY22 alone. This is more than twice the loss pre-pandemic, i.e. in 2020. The losses in FY20 stood at Rs. 13,030 cr. industry wide.

With the emergence of new players, more financial muscle is being added to the industry, but high fuel costs and weak demand mean the long road ahead.

The ones expected to go down first are SpiceJet and Go First. They have been hurt by their management churn, funding, and operational issues. Delayed flights, high turbulence mid-air, and whatnot. These airlines have seen it all in the past few years.

IndiGo holds over 55% market share, while Tata Group has ~26% of the total domestic air traffic. Tata has a low-cost carrier in AirAsia, a full-service carrier in Vistara and both in Air India. The only issue is that the three are all loss-making. Akasa has deep pockets and the right people (?), and the market expects it to be “the ride of Ferrari at the pace of Maruti”, as Crisil puts it.

The market is yet to undergo more turbulence with the Tatas, IndiGo and Akasa at the helm. Where do you see the market going?