According to recent reports, credit card spending in India has been on the rise, with spending at an all-time high of Rs 1.37 trillion in March. For the fiscal year 2022-2023, spending topped Rs 14 trillion, up 47.27% from the previous year.

Now, this sounds bullish, but dig deeper and you’ll see some astonishing facts! 63% of the total spending was done online. Clearly, it is now easy to click “buy” on a smartphone, and this could mean impulsive spending is on the rise!

While credit cards are on the rise, sadly, most people don’t have a great credit score (we’ll delve into this further). In fact, only 3 out of 10 individuals have a score over 800. That means a lot of people are at risk of defaulting – and that’s not good news for anyone.

So, why should you care about credit scores? Well, for starters, having a good score can make your financial life a lot easier. Let’s start with some basics first, shall we?

Credit Cards: An Overview

What are credit cards, and how do they work?

Essentially, a credit card is a pre-approved line of credit that allows you to make purchases up to a certain limit. You can use your credit card to pay for everything from online shopping to restaurant bills, and you’ll be expected to pay back what you’ve borrowed each month, plus any interest charges.

Credit cards have become more than just a payment method, it’s now a status symbol. People often have more than one card in their wallet, but why?

If you’re new to the world of credit cards, all the terms and jargon can be overwhelming, and you may wonder if it’s even worth having one. After all, you can do everything with a debit card, right?

Credit cards vs. debit cards

Why do people prefer credit cards more than debit cards?

Are you team credit or team debit? While they may seem similar, credit cards and debit cards are actually quite different. When you use a credit card, you’re borrowing money from the credit card company that you’ll need to pay back later, possibly with interest. With a debit card, you’re spending your own money that’s already in your bank account.

According to a recent report, credit card users spent about five times more than debit card users in 2022. That’s a big difference! On average, credit card users spent ₹6,000 compared to ₹2,500 spent by debit card users.

The Reserve Bank of India has also allowed linking RuPay credit cards on the UPI network, which could lead to even more credit card transactions in 2023.

Advantages of Credit Cards

Credit cards can be your best friend if used wisely. Here are some of the benefits that credit cards offer:

- Buy Now Pay Later: Credit cards let you buy things you can’t afford right now and pay for them later. It’s like having a mini loan in your wallet.

- Safety: Credit cards come with a layer of protection against fraud and theft. If someone steals your credit card, you won’t be responsible for the charges as long as you report it in time.

- Reward Points: Many credit cards offer reward points that can be redeemed for cash back, discounts, or free travel. The more you spend, the more points you earn.

- Manage Separate Accounts for different purposes: You can have separate credit cards for business expenses, travel, and personal purchases.

- Manage good credit history: Using a credit card responsibly can help you build a good credit history and improve your credit score.

Disadvantages of credit cards

The Not-So-Sweet Side of Credit Cards: Watch out for these pitfalls before you swipe your card!

- Overspending: It’s easy to overspend when you’re using a credit card, leading to high debt and interest charges

- High-Interest Rate: Credit cards often come with high-interest rates, making it difficult to pay off the balance.

- Hidden charges of credit cards: Many credit cards come with hidden fees like annual fees, balance transfer fees, and foreign transaction fees

- Debt trap: Paying only the minimum balance on your credit card can result in a never-ending cycle of debt. To avoid this, one must pay the full amount due each month.

Let’s talk about the love-hate relationship between credit cards and credit scores: The numbers game.

You may also like: How much is the Rupee worth across the globe?

Credit scores: The Key to unlocking better financial opportunities

Credit scores are a critical aspect of personal finance that affect a wide range of financial opportunities, including loan approvals, interest rates, and insurance premiums.

In simple terms, a credit score is a three-digit number that measures your creditworthiness, which means how likely you are to pay back the money you borrow.

But how do credit scores work, and why do they matter?

How do credit scores work?

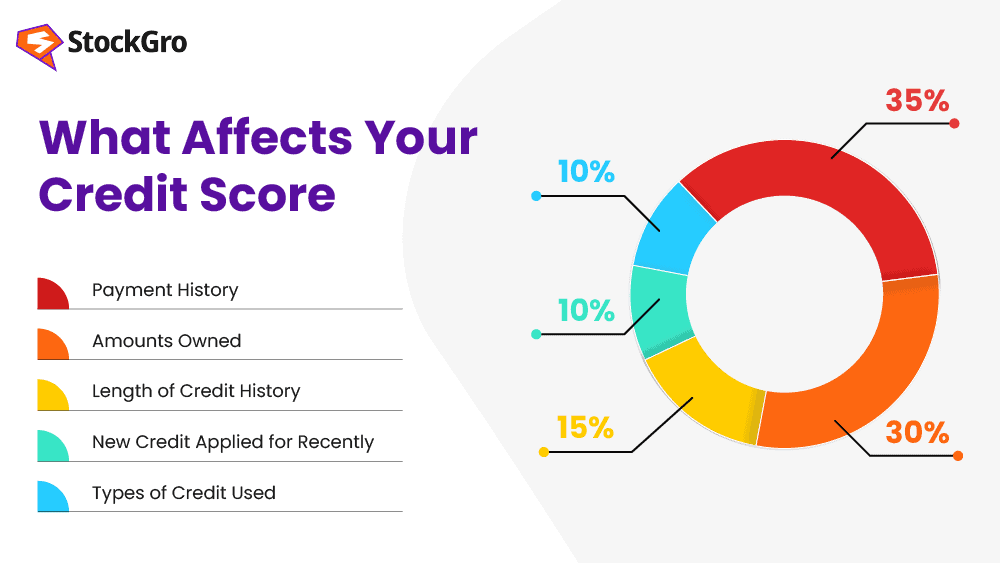

When calculating credit scores, a bunch of factors come into play. These include payment history, credit utilisation, how long you’ve had credit, the types of credit you’ve used, and the number of new credit inquiries.

Each factor is assigned a specific weight, and your score is calculated based on the combination of these factors.

Credit scores typically range from 300 to 850, with higher scores indicating better creditworthiness.

Why do credit scores matter?

Your credit score is like a report card for how responsible you are with money. The higher your score, the better you are at managing your finances. Only 3 in 10 people have a credit score over 800, which means most of us have some work to do.

It’s important to keep your credit score high because it affects your ability to get loans, mortgages, and other financial products. Plus, the more responsible we are with our money, the less likely we are to default on our debts, which is good news for everyone.

A good credit score can help you get approved for loans and credit cards and can also help you get better interest rates. A bad credit score, on the other hand, can make it difficult to get loans or credit cards and can result in higher interest rates and fees.

Credit card companies earn revenue in two ways. Firstly, they charge merchants, eateries, and other sellers of goods and services a fee when you use your credit card to buy something.

Secondly, they generate profits by imposing interest and fees on your outstanding balance. Here is how credit card interest works—and how you can pay less of it.

You may also like: Pump-and-dump: Why is it illegal in the stock market?

How does credit card interest work?

When you use a credit card, you have the option to pay off your balance in full each month or to make a partial payment and carry the remaining balance over to the next month. If you choose to carry a balance, that’s when the interest kicks in.

Think of it like borrowing money from a friend. If you pay them back in full and on time, they won’t charge you any extra. But if you only pay back a little bit, they might start charging you interest on the remaining amount.

There are a few scenarios where credit card interest rates come into play.

- First, if you don’t make any payment by the due date, you’ll be charged a late fee and interest.

- Second, if you only pay the minimum amount due, you’ll be charged interest on the remaining balance from the day you made the purchase until you pay it off in full.

- And finally, if you use your credit card to withdraw cash, you’ll be charged interest from the day you took out the cash until you pay it back in full.

Final thoughts

Credit cards can be a game-changer in personal finance, allowing you to spend money without having to spend actual money at that moment. This solves many liquidity issues and creates track records for creditworthiness.

That being said, like everything else in life, there is a dark side to credit cards that can leave your wallet in a pinch.

If you’re good at managing your credit cards, though, you can avoid falling into this trap.