Globally recognised as the leading supplier of generic drugs, India has earned a reputation for its cost-effective vaccines and generic medicines. Currently, the Indian Pharmaceutical industry holds the third position in terms of volume in pharmaceutical production, demonstrating a remarkable evolution into a prosperous industry that has been growing at a CAGR of 9.43% over the last nine years.

In this thriving industry, Unichem Laboratories stands out. Unichem, established in 1944, has effectively carved a niche for itself as a noteworthy entity in India’s pharmaceutical industry. Its extensive product range covering various therapeutic areas and its substantial global footprint is a testament to Unichem’s enduring innovation and resilience.

Unichem Laboratories recently announced its Q4 results, sparking a flurry of discussions among investors and market analysts. The results, which showed a YoY increase in net loss, have raised both concerns and curiosity.

The objective of this article is to offer a comprehensive examination of the Unichem Lab Q4 results, dissecting the numbers and interpreting their implications.

About Unichem Laboratories Ltd

Unichem Laboratories, a distinguished entity in the realm of pharmaceuticals, was founded by the late Mr. Amrut Mody. Since its inception in 1944, Unichem has evolved to be one of the most esteemed pharmaceutical companies in India. The company is globally acknowledged and operates as an integrated entity, specialising in the development of intricate active pharmaceutical ingredients (API) and various dosage forms.

Unichem Laboratories is dedicated to enhancing health outcomes through its superior products. By amalgamating strategic research and profound industry knowledge, Unichem aspires to evolve into a global pharmaceutical entity with a growing emphasis on pioneering research and markets in developed countries.

The company prides itself on a wide-ranging and varied product portfolio that covers numerous therapeutic domains. Unichem’s pharmaceutical offerings include anti-infectives, analgesics, cardiology medications, psychiatric drugs, hormone supplements, gastrointestinal medications, diabetes drugs, and nutritional products.

Some of their prominent products encompass alfuzosin hydrochloride, aripiprazole, cetirizine hydrochloride, meloxicam, glipizide, paliperidone, apixaban, apremilast, and solifenacin succinate.

With its business core constituted by formulations, Unichem is backwards integrated into API Manufacturing, which enhances customer value in terms of quality and sustainability. This integration ensures that Unichem maintains high standards of quality and dependability, which are vital in the healthcare industry.

Unichem Laboratories, with its unwavering commitment to innovation and quality, persistently contributes to global healthcare, exemplifying the essence of resilience and innovation in the pharmaceutical industry.

The market capitalisation of Unichem Laboratories Ltd is ₹3,872.32 crore, as of May 27, 2024.

Unichem Laboratories Ltd’s quarterly performance

Here are some of the principal financial indicators of the company’s quarterly performance in comparison to the preceding quarter:

| Q4 FY24(₹ crores) | Q3 FY24(₹ crores) | Change(%) | |

| Revenue | 432 | 434 | -0.46 |

| Operating profit | 25 | 38 | -34.21 |

| Profit before tax | -126 | 84 | -250.00 |

| Net profit | -129 | 84 | -253.57 |

| EPS | -18.37 | 11.93 | -253.98 |

The Selling, General & Administrative (SG&A) expenses of the company witnessed a quarter-on-quarter growth of 1.33% and a year-on-year surge of 12.05%.

Also read: Jubilant FoodWorks: What does the company’s Q4 result look like?

Unichem Laboratories Ltd’s annual performance

Here are the principal financial metrics of the company, in comparison with the figures from the previous year:

| FY2024(₹ crores) | FY2023(₹ crores) | Change(%) | |

| Revenue | 1,705 | 1,343 | 26.95 |

| Operating profit | 100 | -46 | -317.39 |

| Profit before tax | -62 | -176 | -64.77 |

| Net profit | -70 | -202 | -65.35 |

| EPS | -10.01 | -28.72 | -65.15 |

In Q4 FY24, the pharmaceutical company reported a loss before exceptional items and tax amounting to ₹0.25 crore, a significant reduction from the loss of ₹13.61 crore recorded in Q4 FY23.

For the quarter ending in March 2024, the company has set aside a provision for a fine from the European Commission, which is reflected as an exceptional loss of ₹125.62 crore. In contrast, the exceptional loss in Q4 FY23 was ₹33.54 crore, attributed to a one-time discretionary loyalty bonus.

Also read: Nykaa, the cosmetic brand, has announced its Q4 results: Know more here!

Market reaction

On May 22, 2024, Unichem Laboratories Ltd released its quarter 4 results. On that day, the share opened at a trading price of ₹561.70. The Unichem Lab share price hit a 52-week low of ₹526.50.

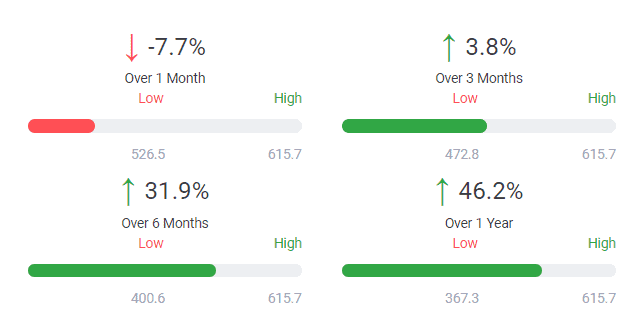

When looking at the Unichem Lab share price history post the event, the share has been trading with a downward trend.

The share price returns of Unichem Laboratories Ltd stock is as follows:

Also read: Grasim Industries’ Q4 result is out, and here is what you should know!

Peer analysis

Let’s compare the key financial ratios of Unichem Laboratories Ltd with that of its competitors:

| Company | CMP (₹) | Market cap(₹ crores) | ROCE (%) | Earnings Yield (%) |

| Unichem Laboratories Ltd | 550 | 3,876 | 0.69 | 0.47 |

| Orchid Pharma Ltd | 1,025 | 5,199 | 9.32 | 2.13 |

| Shilpa Medicare Ltd | 493 | 4,819 | 5.27 | 2.41 |

| Entero Healthcare Solutions Ltd | 1,023 | 4,449 | 4.64 | 0.95 |

| Aarti Drugs Ltd | 483 | 4,453 | 14.8 | 5.37 |

| Advanced Enzyme Technologies Ltd | 374 | 4,179 | 15.0 | 5.04 |

Bottomline

Unichem Laboratories Ltd. is at a pivotal crossroads, characterised by both hurdles and potential prospects. The company’s recent Q4 FY2024 results, which showed a YoY increase in net loss, have sparked considerable concern among investors and market analysts. However, a detailed inspection of the financials unveils a multifaceted scenario.

The market reaction to the Q4 results was immediate and negative, with Unichem Laboratories’ share price hitting a 52-week low and continuing to trade downward. This suggests investor sentiment is currently cautious, reflecting concerns over the company’s ability to manage its financial challenges effectively.