Picture a scorching summer day with no air conditioning. Unimaginable, isn’t it? It’s remarkable how air conditioning and refrigeration have become indispensable in our daily lives.

With a predicted CAGR of 10%, the room air conditioner market in India is expected to reach a staggering $5 billion by FY28.

At the forefront of this industry, two dominant players emerge – Voltas and Blue Star. In addition to revolutionising the comfort experience, these companies have revolutionised the face of the industry as a whole.

So, buckle up and get ready for an insightful ride into the world of Voltas and Blue Star, where innovation meets strategy in the quest for market dominance.

Also read: https://www.stockgro.club/blogs/personal-finance/what-is-cagr-and-how-to-calculate-explained/

Company profiles

Voltas

Founded in 1954, Voltas, a part of the Tata group, is the largest air conditioning company in India. Famous for its high quality and wide selection of products, Voltas provides a range of cooling solutions and home appliances.

Through a successful partnership with Beko of the Arçelik Group, Voltas has broadened its range of products to include the innovative Voltas Beko home appliances, which seamlessly blend style and cutting-edge technology.

Voltas provides a variety of engineering solutions, such as HVAC (Heating, Ventilation, and Air Conditioning) and MEP (Mechanical, Electrical, and Plumbing), in addition to consumer goods. This makes Voltas a trusted partner for businesses and organisations.

Because of its dominant position in the industry and Voltas’ market share of 21.6%, it stands to gain significantly from the sector’s expansion.

Voltas share price

If we check the Voltas share price history, it has provided a return of 116.10% in the past 5 years as of April 11, 2024.

The Voltas share rate remained relatively stable with minor fluctuations, but recently experienced a significant increase, reflecting the robust performance of Voltas shares in the competitive market.

Voltas share news: As of April 11, 2024, the Voltas share price NSE is ₹1,340.80.

Blue star

Blue Star, a prominent player in India’s consumer durables industry, has an impressive annual revenue of more than ₹7977 crores (as of April 11, 2024). Having 30 offices, 7 manufacturing facilities, and over 4000 channel partners, its nationwide presence is strong and well-established. At present, the Blue Star market share is approximately 14%.

Blue Star is renowned for its range of innovative products, including air conditioners, water purifiers, and air coolers. Energy efficiency and environmental responsibility are two of the company’s top priorities. Its exceptional dedication to quality makes it the preferred choice for consumer durables requirements in India.

Blue Star’s share price

If we check the Blue Star share price history, it has provided a return of 314.35% in the past 5 years as of April 11, 2024.

Blue share news: As of April 11, 2024, the Blue Star share price NSE is ₹1,417.20.

Financial profiles

Let’s compare the key financial ratios for both companies.

| Voltas (March 2023) | Blue Star (March 2023) | |

| EPS (Rs.) | 42.47 | 38.06 |

| Net Profit/Share (Rs.) | 42.48 | 38.07 |

| PBIT Margin (%) | 7.36 | 5.33 |

| Net Profit Margin (%) | 18.31 | 4.98 |

| Return on Capital Employed (%) | 8.18 | 28.71 |

| Total Debt/Equity (X) | 0.04 | 0.37 |

| Asset Turnover Ratio (%) | 0.80 | 1.66 |

| Current Ratio (X) | 1.44 | 1.08 |

| Inventory Turnover Ratio (X) | 2.25 | 3.92 |

| Earnings Retention Ratio (%) | 87.05 | 73.74 |

| Earnings Yield | 0.05 | 0.03 |

Also read: https://www.stockgro.club/blogs/stock-market-101/what-is-eps/

These ratios paint a picture of the financial year 2023.

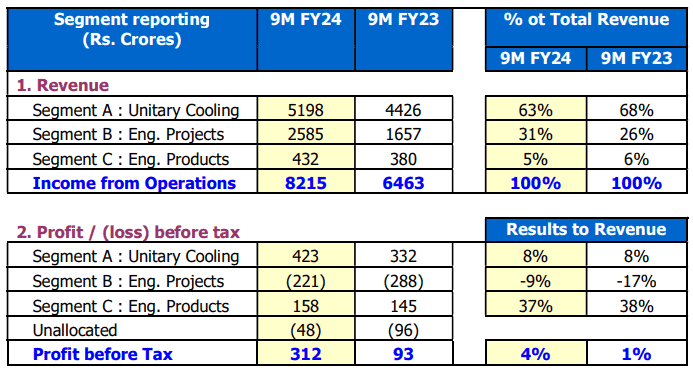

In the third quarter of FY2024, Voltas released the following results.

Additionally, in the third quarter of FY2024, Blue Star released the following results.

Also read: https://www.stockgro.club/blogs/personal-finance/what-is-ebitda/

Reasons for growth

Voltas

- The festive season and weddings increased demand for consumer appliances, leading to volume growth outperforming the industry.

- Collaborations with channel partners and calibrated pricing strategies contributed to sales.

- New product releases and the proliferation of Exclusive Brand Outlets (EBOs) contributed to the increase in sales.

- Stability in commodity prices and operating leverage improved product profitability.

Blue star

- The company saw a significant 25% increase in revenue during Q3 FY24 compared to Q3 FY23. This growth was fueled by high demand for room air conditioners and refrigeration products during the festive season, as well as expansion in the commercial air conditioning business.

- Net profit in Q3 FY24 saw a substantial 72% surge compared to Q3 FY23. This impressive growth can be attributed to effective total cost management strategies, optimisation of the product portfolio, and reaping the benefits of scale.

- The company’s growth plan and profitability improvement programs involve ongoing investments in expanding manufacturing capacity, accelerating R&D, and digitalisation.

Company strategies

Voltas

- Voltas Limited demonstrates resilience amidst global economic challenges, with a focus on adapting to central bank policies and geopolitical events.

- The company aims to maintain its leadership in the unitary cooling products market, emphasising energy-efficient products and market share.

- Voltas is committed to improving project execution, particularly in the electromechanical projects and services segment, despite challenges in overseas collections.

- The company is pursuing growth through product diversification, such as commercial refrigeration and air coolers, and capitalising on festive demand.

Blue star

- Investing in research and development, embracing digitisation, and expanding production capacity.

- A new chairman and two independent directors have been appointed, according to the announcement made by the board.

- Capitalise on the opportunity for growth in international markets, especially those in North America and Europe.

- Emphasise product portfolio optimisation and growth both domestically and internationally.

- Setting a goal to achieve $500 million of business in the international market within three years.

Future outlook

The market outlook for Voltas is positive, with an anticipated surge in demand for air conditioners, commercial refrigerators, air coolers, and home refrigerators in the upcoming summer. With a focus on all channels, the organisation is working hard to expand its reach and capture a larger portion of the market.

The goal of these long-term plans is to strengthen Voltas’ position as market leader by helping the company expand faster than its competitors. This outlook underscores Voltas’s commitment to meeting the evolving needs of its diverse customer base and staying ahead in the competitive landscape.

Blue Star’s future looks promising, backed by the steady execution of a robust order book in its B2B business and the anticipated growth in its products business. The business expects its Room Air Conditioners and Commercial Refrigeration products to have a significant uptick in demand, which will further solidify its position in the industry.

Additionally, Blue Star anticipates a robust performance in the B2B sector, particularly in Tier 3 and 4 cities where market penetration is currently low. This view highlights Blue Star’s dedication to reaching more people and meeting the changing demands of its varied client base.

Bottomline

The success stories of Voltas and Blue Star underscore the importance of agility, innovation, and customer-centricity in navigating the complexities of the consumer durables industry.

As these companies continue to chart their course forward, their commitment to excellence and market leadership will undoubtedly shape the future trajectory of the Indian consumer durables landscape.