On Saturday, August 10, 2024, the Hindenburg released a research report, and it stunned everyone. Previously, in its report in January 2023, it made some allegations about Adani group companies. Continuing with them, it has accused the SEBI chairperson Madhabi Puri Buch of formerly having some stake in the offshore secret entities of the Adani group.

The allegations in the report were based on a whistleblower document. Moreover, there are some grave allegations regarding the chairperson’s husband, Dhaval Buch. Let’s understand these allegations and their market effect in detail in this article.

What is the Hindenburg report?

Hindenburg Research, led by Nathan Anderson, investigates and reveals hidden financial misconduct. Through meticulous analysis, they try to uncover unethical activities and undisclosed risks, aiming to prevent market calamities. The primary strategy involves short selling. Their reports target firms they believe are overvalued, profiting from predicted stock declines.

Named after the infamous 1937 airship disaster, the Hindenburg Research report aims to spotlight potential market “explosions” before they happen. These findings are shared with a select group of investors, providing them an edge before the broader market reacts.

Previous impact of Hindenburg Research report on Adani

In January 2023, the Hindenburg Research Adani report levelled serious allegations against the Adani conglomerate, accusing it of inflating financial figures and deceiving investors. The fallout was immediate and severe.

Investor confidence collapsed. Stocks across Adani’s companies plummeted, facing a loss of USD 56.4 billion. Gautam Adani, who had recently been the second-richest individual globally, rapidly fell down the wealth rankings.

The turmoil extended beyond stock prices. Adani Enterprises had to abandon a critical public offering, reflecting the deep financial shock. Although the group has since clawed back some losses, the episode left a lasting mark on its credibility, triggering heightened scrutiny from investors and authorities alike.

In the aftermath of the fallout, Adani Group stocks didn’t stay down for long. In May 2023, they surged, for instance, ₹63,418 crore rose in market value in a single session on May 23. Investor sentiment shifted, driven by the Supreme Court panel’s clear chit and fresh capital inflows from GQG Partners.

Must read: How Adani Group stocks rose to Rs. 63,418.85 cr in a single day

Hindenburg research new report

Following the Adani report saga, SEBI sent an apparent show-cause notice to Hindenburg Research on June 27, 2024, about the disclosure of their short positions in the market. However, Hindenburg claims full disclosure in this matter. Moreover, the company alleges SEBI of not paying proper heed to their previous report regarding alleged offset secret shell companies run by companies like Adani.

The Hindenburg news report, dated August 10, 2024, made some serious allegations about the regulatory body and its chairman, according to a whistleblower report, as follows:

- IPE Plus Fund 1

The ‘Global Dynamic Fund Opportunity Fund’ (GDOF) is a Bermuda-based company that invested in IPE Plus Funds 1 (Mauritius-based). It is alleged that different companies of Vinod Adani invested substantial amounts in GDOF. This fund is managed by India Infoline (IIFL), now known as 360 One.

As per Hindenburg, SEBI chairman Madabhi Puri Buch and her husband Dhaval Buch had a stake in this fund.

- Madhabi Puri Buch and Dhaval Buch

The couple invested in GDOF in 2015. They even made a transfer of assets from Madhabi Puri Buch’s name to her husband, Dhaval Buch, before she was appointed a whole time SEBI member. Moreover, during her tenure as a whole time member, she asked for the redemption of units to India Infoline in February 2018, as per the allegation.

- Adani offshore fund

Hindenburg questioned the identity of offshore shareholders of the Adani group. As per the Supreme Court expert committee report, the SEBI recognised such investors but was unable to find their identity.

- Real Estate Investment Trusts (REITs)

The report believes that the appointment of the SEBI chairperson’s husband, Dhaval Buch, as a senior advisor at Blackstone in 2019 was not justified owing to his previous experience. Moreover, the REITs sponsored by Blackstone – Mindspace and Nexus Select Trust were the second and fourth REITs allowed for IPO in India. It was after Dhaval Buch’s appointment.

Moreover, the report alleges that since the appointment of Madhabi Puri Buch as SEBI chairperson, different amendments were implemented and proposed for REIT regulation, which would benefit private equity firms like Blackstone. The report also accused the chairman of promoting REITs without mentioning Blackstone explicitly.

SEBI’s response to recent allegations

The regulator issued a statement dated August 11, 2024, mentioning a response to these allegations by Hindenburg research report. It also alerted investors regarding the probable short positions of Hindenburg Research in the market.

SEBI’s response addresses all the allegations regarding the Adani report investigation, REITs promotion and regulatory framework amendments.

Also, read about: SEBI’s quasi-powers: Keeping India’s securities market ethical

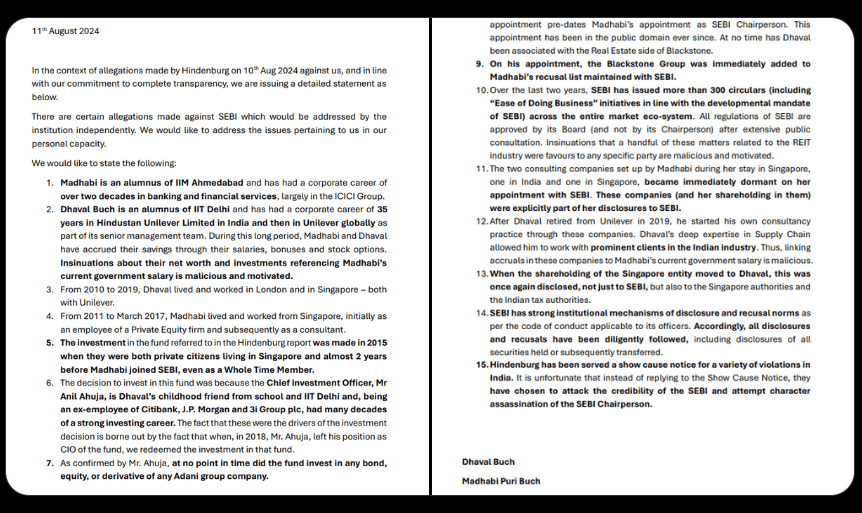

Response by Madhabi Puri Buch

The SEBI chairperson, Madhabi Puri Buch and her husband released a statement replying to these allegations on the platform ‘X’ (Twitter). It explained the investment made in the offshore entity before the appointment as a SEBI working member and its link with the Adani group. It also mentioned that a report by Hindenburg is attacking SEBI’s credibility and there is an attempt at the chairperson’s character assassination.

Source: ANI on X

Market response to the Adani vs Hindenburg report

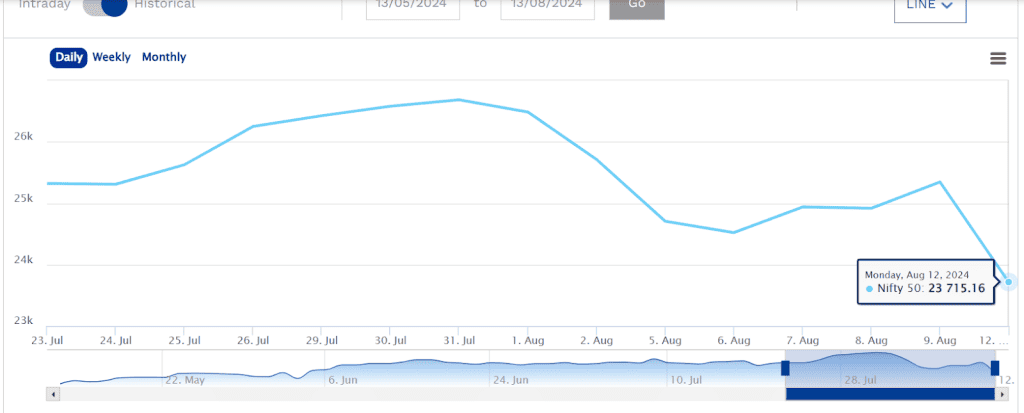

The allegations came on Saturday, and the market was expecting some volatility owing to market situations during the previous episode of the Adani vs Hindenburg Research report. On Monday i.e. August 12, 2024, the NIFTY 50 index closed down by 6.4% owing to this news.

Source: NSE Indices-NIFTY 50

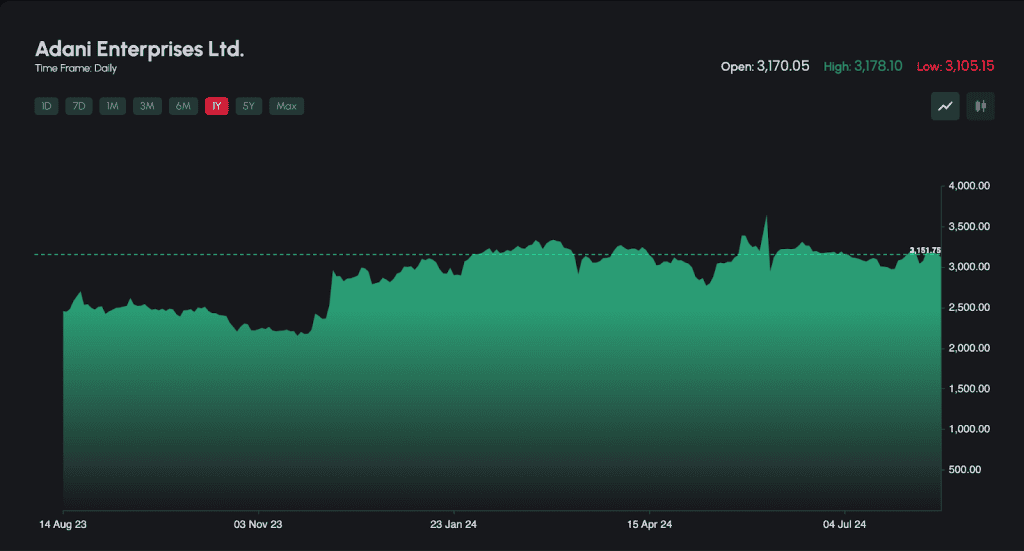

Moreover, the Adani group stocks again experienced a slight shock. It was visible in Adani ports, which dipped by nearly 2%, and Adani Enterprises, which closed 1.1% lower on Monday.

Source: NSE

Bottomline

The Hindenburg Research report made a huge sensation for the first time while making allegations about the Adani group. It also caused some serious monetary damage to Gautam Adani. The recent report criticising the previous stand of SEBI has also some serious allegations.

The chairperson, Madhabi Puri Buch, and her husband, Dhaval Buch, are accused of having shares in the offshore entities allegedly linked to the Adani group. Questions regarding the validity of such claims made by Hindenburg would be understood only after proper investigation.

Check this out! Gautam Adani’s net worth the man and the mogul