On Monday, April 29, 2024, the shares of BSE Ltd., a prominent stock exchange in India, witnessed a significant decline of 17%. This was a major swing, as it marked the largest single-day drop since BSE’s listing.

Investors quickly responded to the development, causing the trading volume to surge to 10.11 million shares. This event caused a stir in the market, sparking intense discussions and debates among investors, analysts, and market observers.

This article seeks to offer a comprehensive examination of the factors contributing to the decline in BSE’s share price, the potential consequences, and the market’s response to this occurrence.

Background

The Bombay Stock Exchange (BSE) was founded in 1875, marking its distinction as the pioneering stock exchange in Asia. It began as an organisation for brokers and gradually transformed into a fully operational exchange, playing a vital role in facilitating trade and investment activities.

BSE has had a captivating and eventful journey in the history of India’s securities market. In August 1957, BSE was recognised by the Indian government under the Securities Contracts Regulation Act, marking a significant milestone in its history. Since then, BSE has introduced various innovations, such as the country’s first equity index, S&P BSE SENSEX, in 1986.

Before the drop, BSE’s share price was consistently reaching new highs, even in the midst of market volatility. In the past 1 year, the stock has given a return of 428.73%.

Nevertheless, the BSE Ltd share price experienced a significant drop of more than 17% in a single trading session due to a directive from the market regulator, the Securities and Exchange Board of India (SEBI) concerning regulatory fees on options contracts.

The trigger: SEBI’s directive

The Securities and Exchange Board of India (SEBI) has instructed BSE to pay regulatory fees based on the notional value of its options contracts. This represented a notable departure from the previous approach, where BSE used to cover these fees based on the premium value.

SEBI has also directed BSE to make the payment of the differential regulatory fee for previous periods, along with an interest rate of 15% per annum for each month of delay.

Notional value

The notional value of a security refers to the total worth of the underlying asset at its current market price. It signifies the aggregate value of the position or the total value that a position governs.

Example

For example, let’s say, you wish to purchase a single silver futures contract, and the futures contract requires the buyer to purchase 20 ounces of silver. If silver futures are trading at ₹5,000, then one silver futures contract has a notional value of ₹1,00,000.

Premium value

This is the price that a buyer pays to the seller to acquire the rights that the derivative contract offers. The premium value is usually less than the notional value because it does not take into account the total value of the underlying asset.

Example

For instance, if you want to buy a call option on a stock that is trading at ₹500, and the strike price of the option is ₹510, you might pay a premium of ₹20 per share to buy this option. So, if the option contract is for 100 shares, the total premium value you pay to buy this option contract is ₹2,000.

This premium value is significantly less than the notional value of the contract, which would be ₹51,000 (the strike price of ₹510 times the 100 shares).

Impact of the directive

Let’s explore the possible reasons why the BSE share price is falling. The transition from premium turnover to notional turnover as the basis for calculating regulatory fees results in an increased regulatory fee expenditure. This is because the value of the investment typically surpasses the amount of money exchanged.

The notional turnover represents the overall strike price of every contract traded in derivatives, whereas the premium turnover represents the total premium paid for all traded contracts.

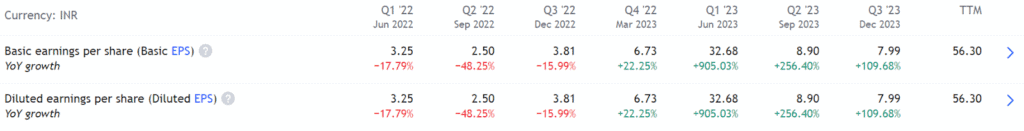

The directive from SEBI could have a substantial effect on BSE’s Earnings Per Share (EPS), a key indicator of a company’s profitability. Financial experts at IIFL Securities Ltd predict that the one-off expense and ongoing costs could result in a reduction of 30-40% in the EPS projections for FY25/26 in BSE India quarterly results.

According to analysts at Jefferies India, the immediate effect of the directive could cause a 15% reduction in BSE’s EPS for FY24. For the BSE financial results, as the contribution of derivatives to total revenue is expected to rise to around 45% by FY27, these additional regulatory fees could further reduce the EPS by 15-18% in FY25 and FY26.

Source: Tradingview

Potential financial implications for BSE

If we look at the past years from FY 2006-07 to FY 2022-23, the extra fees that SEBI might charge could be about ₹68.64 crore, plus GST. This includes an interest of ₹30.34 crore.

For the financial year 2023-24, if BSE is required to pay, the extra fees could be around ₹96.30 crore, plus GST. However, BSE has already made a payment of about ₹1.66 crore plus GST for FY 2023-24, based on the premium turnover.

Market reaction

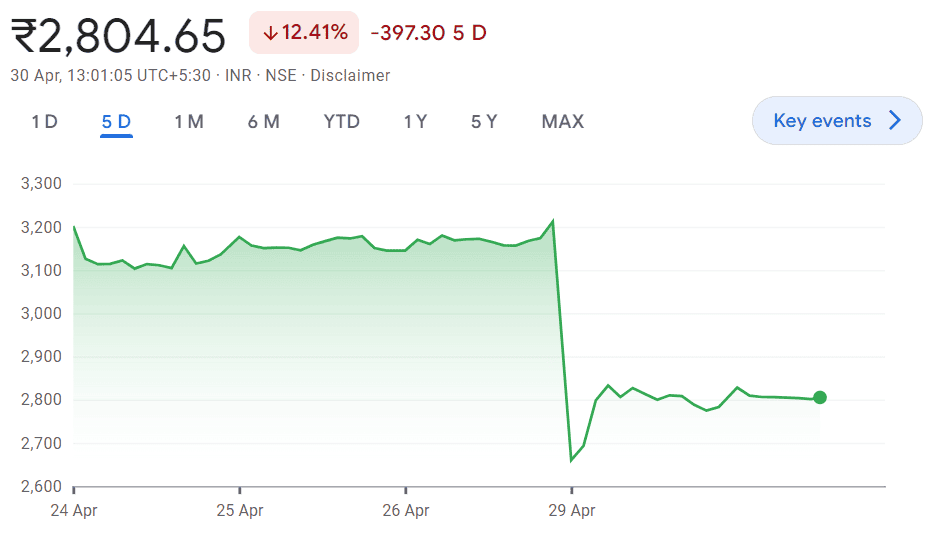

The announcement of SEBI’s directive led to a significant reaction in the market, which is evident in the BSE’s recent drop in share prices. BSE Ltd shares experienced a steep fall of over 17% during the trading session on Monday – April 29, 2024, marking the biggest one-day decline for the stock since it was listed in 2017.

Following the announcement, the BSE share price dropped to ₹2,612. However, it managed to recover some of its losses later, trading at ₹2,792, which was still a decrease of more than 13%. This BSE share news caused a sudden change in market sentiment and caught investors off guard, particularly considering the otherwise positive global and domestic indicators.

The volume of shares traded during this period was also significant. The traded volumes amounted to 10.11 million shares. The significant trading volume reflects the strong investor interest and concern surrounding SEBI’s directive.

This chart illustrates the 5-day trading pattern of the stock and clearly indicates a sudden drop.

Source: Google Finance (as of April 30, 2024)

Bottomline

The sharp and substantial drop in the share price of BSE Ltd. after SEBI’s directive on regulatory fees for options contracts has caused a stir in the financial market. This event highlights the complex relationship between regulatory decisions and market dynamics, which influence investor sentiment and market outcomes.