In the world of finance, few events can match the sheer dramatic intensity of a stock market crash. But what is a stock market crash? It’s a phenomenon that sends ripples across the global economy, affecting the fortunes of millions. One such significant event unfolded just before the Lok Sabha election results, leaving investors and market watchers in a state of heightened anticipation and anxiety.

The Indian stock market, represented by the Sensex, witnessed a sharp decline, falling a staggering 1200 points from 75,390 to 74,030 in just three straight sessions (as of May 30, 2024). The stock market crash before elections served as a reminder of the inherent instability and unpredictability of financial markets, particularly in an uncertain political climate.

This article explores the causes that have contributed to this significant market trend.

Must read: The anatomy of a stock market crash – StockGro Blogs

Uncertainty over Lok Sabha election outcome

Why is the stock market crashing? The root cause of the stock market downturn can be traced back to the ambiguity associated with the Lok Sabha election results. As India prepared for the final phase of the Lok Sabha elections 2024, exit polls were expected to flood the market. Yet, even after six rounds of voting, the market’s faith in the establishment of a stable government dwindled, leading to a decline over five consecutive sessions.

The India VIX index, a measure of market volatility, soared to an intraday peak of 24.52, signalling a volatile market. This represented a nearly 90% surge within a month. The market is projected to remain in a state of flux until the Lok Sabha election results are declared.

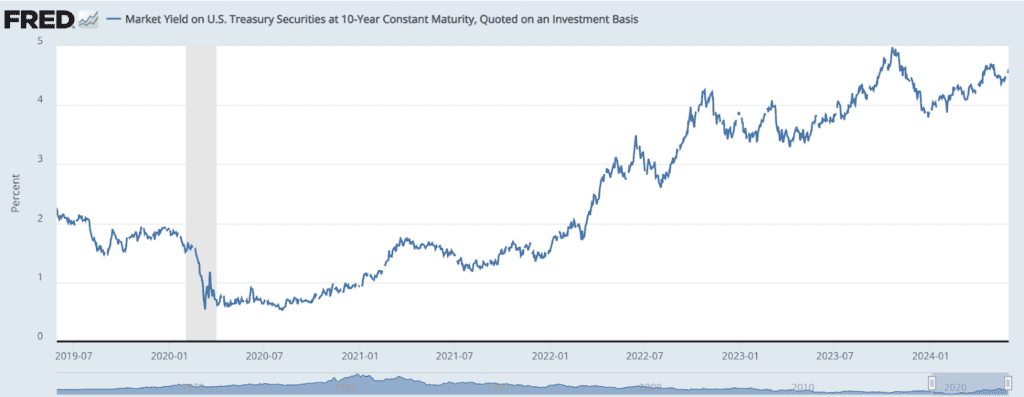

Rising US treasury yields

A pivotal element in the stock market downturn was the escalation in US Treasury yields. Strong consumer confidence data and bullish statements from US Fed officials fueled a significant increase in US treasury yields, reaching a one-month high.

Source: Federal Reserve Bank of St. Louis

An increase in US Treasury yields has a notable effect on the Indian stock market. Indian stock prices fell because investors transferred their money to safer investments like US government bonds, which offered greater yields.

Tensions in the Middle East

Looking back at stock market crashes in history, we can’t ignore the role geopolitical tensions play in shaping global financial markets. The recent tensions in the Middle East serve as a prime example of this dynamic. The recent escalation of tensions has once again put the global equity markets on edge.

An escalation of tensions in the Middle East leads to a notable rise in oil prices. This region serves as a significant centre for oil production, and any possible risk to its stability can cause concerns about potential disruptions in supply.

Rising oil prices can have a significant impact on companies’ cost of energy and production. This, in turn, can put pressure on profit margins and potentially result in a decline in stock prices.

The Indian stock market is affected in two ways. Firstly, India’s heavy reliance on oil imports means that any increase in oil prices can worsen the country’s trade deficit and contribute to inflationary pressures.

Furthermore, the unpredictability of the global market can result in foreign investors withdrawing their investments from emerging markets, such as India, leading to a substantial decline in the Indian indices.

Also read: Everything you need to know about Crude oil trading in India

Dented hopes for US Fed rate cut

The Indian stock market, like many emerging markets, is significantly influenced by the monetary policy decisions of the US Federal Reserve. When the US Fed signals a potential rate cut, it generally means lower borrowing costs in the US, which can lead to increased liquidity and a flow of funds into higher-yielding assets, including Indian stocks.

Conversely, when rate cut hopes are dented, as indicated by stronger-than-expected US economic data or assertive comments from Fed officials, it can lead to a pullback of funds from emerging markets.

Another important factor that played a role in the stock market crash was the diminishing hopes for a rate cut by the US Federal Reserve. With the US economy showing robust performance, thanks to positive data from the services and manufacturing sectors and a decline in unemployment claims, there has been a notable change in expectations.

In addition, the comments from Federal Reserve officials indicate a potential period of elevated interest rates. With the possibility of higher interest rates in the US, there is a potential for foreign funds to flow out of emerging markets such as India. This could occur as investors look for greater returns in the US.

You may also like: US Fed rate decision: Impact on India

Bottomline

The stock market crash before the Lok Sabha Election results was a complex event influenced by several interconnected factors. The uncertainty surrounding the election outcome, the rise in US Treasury yields, heightened tensions in the Middle East, and the diminishing hopes for a US Fed rate cut all played significant roles.

Each of these factors not only impacted investor sentiment but also had tangible effects on the market dynamics. The stock market in India, similar to other global markets, is deeply connected to international developments and patterns. Consequently, the market has shown volatility in response to these worldwide economic and geopolitical dynamics.

This event serves as a reminder of the inherent risks involved in stock market investments and the importance of understanding the various factors that can influence market movements. It underscores the need for investors to stay informed about global events and trends, and to consider these factors when making investment decisions.