Have you heard the phrase “bad press is also good press”? It’s true, but not in the case of the share price. Case in point – Manappuram Finance. The company’s share price fell by 20 percent last week. Why? Two words – ED raids.

Well, Manappuram Finance’s shares have been performing well this week, with a 5 percent jump in its share price. But what went down last week deserves an ear!

Manappuram Finance’s shares fall 20%

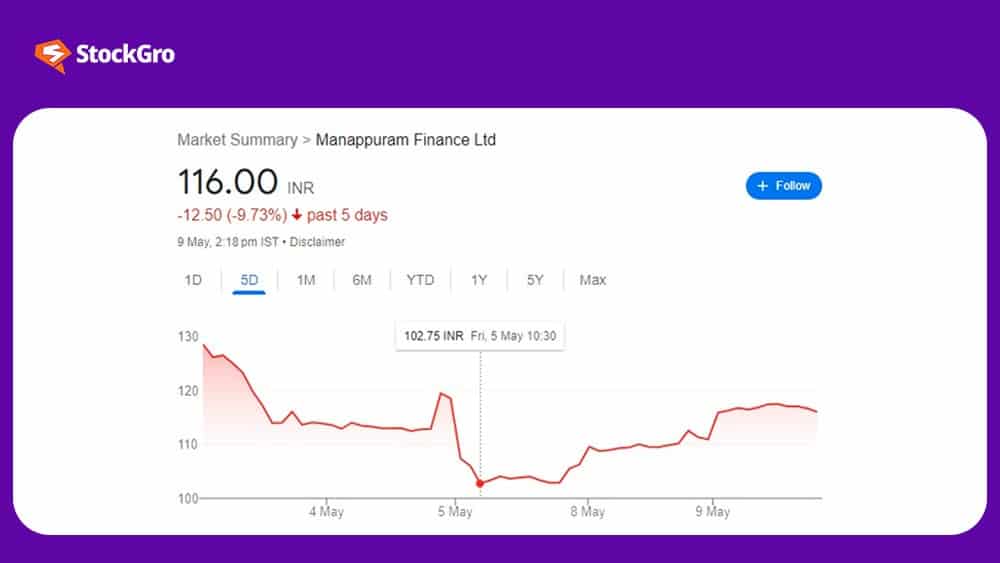

After the news broke of the Manappuram Finance ED raid, the NBFC’s shares fell by 20 percent, from Rs. 130 to Rs. 105, within just 3 days i.e., from May 02 to 05, 2023.

In fact, at around 10:30 am on May 05, the share price fell to its 3-month low of Rs.102.75. This performance was reason enough for analysts to recommend caution against buying as the price may fall another 15-20 percent, if the ED raid news continues.

Surprisingly, Manappuram Finance’s shares have performed better this week, with a 4-5 percent gain on Monday, May 08, 2023. In fact, the share price rose from Rs. 106.25 on May 05 to Rs. 109.55 on May 08.

After closing at Rs. 110.90 yesterday, share price again witnessed a 5-6 percent gain on Tuesday, May 09, ranging between Rs.116-118.

Check out today’s Manappuram Finance share price.

All about Manappuram Finance ED raid

What is Manappuram Finance?

Before getting into the saucy bits of the story, let’s understand some key points about Manappuram Finance. For starters, it is a non-banking finance company (NBFC) i.e., providing banking services without a banking license.

The company primarily disperses loans to salaried and non-salaried individuals at modest rates. Founded in 1949 by V.C. Padmanabhan in Kerala’s Thrissur district, the NBFC went public in August 1995. Currently, you can invest/trade in its shares on National Stock Exchange (NSE) and Bombay Stock Exchange (BSE).

Also Read – RIL demerger: Why is Reliance detaching from its financial services arm RSIL?

Why did ED raids happen?

It all started on Thursday, May 04, 2023, when the Enforcement Directorate (ED) conducted raids across six premises in Thrissur. And unsurprisingly, all six premises were the NBFC’s offices, ED revealed.

This news can ring warning bells in any trader’s mind. But wait, there’s more.

The investigative agency also froze assets worth a whopping Rs.143 crore of VP Nandakumar, Manappuram Finance’s MD and CEO. All this was part of a money laundering investigation.

The case pertains to allegations of money laundering through “illegal” collection of deposits from the public.

Enforcement Directorate

The question is – what became the end result of this investigation?

This can be answered in two parts –

- Conclusions of investigation

- Impact on share price

What did the ED raid reveal?

According to a report by the Press Trust of India (PTI), the ED found that the money collected illegally from deposits was invested in “immovable properties”. And these properties were in the CEO’s name, along with his wife and children.

A chunk of deposits collected were also pumped into Manappuram Finance’s publicly listed shares. Thus, ED was compelled to freeze the CEO’s Rs.143 crore assets under the Prevention of Money Laundering Act (PMLA).

It was also revealed that the frozen assets belonged to three categories, namely:

- Deposits stored in eight bank accounts

- Investment in other listed shares

- Investment in Manappuram Finance shares

Pretty straightforward case, right? But there’s more to this investigation than meets the eye.

To know this, let’s get into ‘when’ and ‘how’ collection of deposits becomes illegal.

What is the illegal collection of deposits?

Put simply, deposit-taking schemes are those which encourage people to save a fixed amount in exchange for interest income. For instance, in a fixed deposit scheme, you get paid monthly or yearly based on the interest rate.

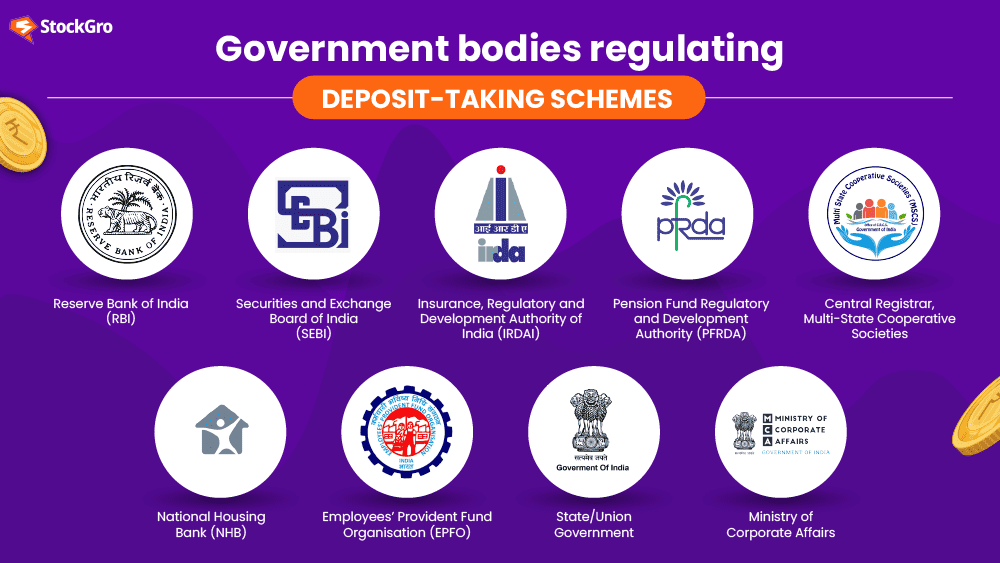

Presently, such deposit-taking schemes are controlled or regulated by nine government bodies.

Thus, if anybody mentioned above does not regulate a deposit-taking scheme, it is deemed “unregulated” and, by extension, “illegal”. In fact, there is a law protecting Indians from such schemes called BUDSA a.k.a Banning of Unregulated Deposit Schemes Act.

You may also like: A guide to value investing in India

Manappuram’s CEO collecting deposits illegally

Coming back to the NBFCs discussion, ED claims that the CEO was collecting deposits from the public “illegally”, possibly through an unregulated scheme.

The agency also claimed to have found evidence of large-scale cash transactions to prove this money laundering effort.

The deposits were, thus, collected by Manappuram Finance’s CEO, Nandakumar, from various branches. And these branches must have been the six premises raided by ED.

Discovery by RBI

Interestingly, the Reserve Bank of India (RBI) had already detected these transactions, which amounted to Rs.143 crore. It then asked the NBFC to repay the money to depositors.

PTI revealed that while Manappuram claimed to have repaid the money, ED could not find any proof or KYC of depositors. This may have compelled ED to freeze Nandakumar’s assets.

Here’s a twist – ED may not have found any exact proof of repayment to depositors. But it did find claims of “cash repayment” worth Rs.53 crore to the depositors. Again, with no proof.

Moreover, assuming this transaction to be repayment, what about the remaining Rs.90 crore?

Given the size of the supposed money laundering amount, ED is now looking at the involvement of other elements, such as the NBFCs chief financial officer.

A case like this is bound to prompt a response from the horse’s mouth. And well, it did!

It was based on a malafide FIR filed by a person who harbours a personal grudge against him and his family. The case pertains to the now defunct Manappuram Agro Farms (Magro), which was a 10-year-old matter

Manappuram Finance

Additionally, Manappuram Finance also clarified that ED attached shares worth Rs.2000 crore; not Rs.143 crore. Confusing, right?

This clarification raises more questions than it answers. But it succeeded in reassuring retail investors that the NBFC is working just fine.

Will this uptrend continue, only the future can tell.