The Indian pharmaceutical sector is on a trajectory of robust growth, projected to burgeon to approximately $130 billion by the year 2030 and further expand to a colossal $450 billion market by 2047. Presently, the industry boasts a valuation of around $50 billion, with exports contributing over $25 billion to this figure.

In the midst of this burgeoning sector stands Windlas Biotech Ltd, a paragon of innovation and quality in the realm of Indian pharma. Since its inception in 2001, Windlas Biotech has distinguished itself through its dedication to delivering high-quality, cost-effective, and widely accessible healthcare products.

On the 21st of May, 2024, Windlas Biotech Ltd unveiled its financial achievements for the concluding quarter of the fiscal year. This article seeks to provide an insightful examination and thorough analysis of the Windlas Biotech Q4 results and financial outcomes.

About Windlas Biotech Ltd

Nestled in the lush landscapes of Dehradun, Uttarakhand, Windlas Biotech Ltd stands as a pillar of the Indian pharmaceutical contract manufacturing industry. Since its inception in 2001, Windlas has earned a reputation as a reliable entity within the sector, renowned for its extensive array of products and services designed to meet the varied demands of healthcare provision.

Windlas Biotech’s array of offerings is a showcase of its domain expertise and penchant for innovation. The company’s extensive product lineup includes a variety of pharmaceutical forms such as tablets, capsules, oral liquids, injectables, and powders. These products are crafted under rigorous quality control measures to ensure they adhere to the utmost standards of effectiveness and safety.

Beyond mere manufacturing, Windlas Biotech excels in adding value through its contract development and manufacturing organisation (CDMO) services. The company delivers comprehensive solutions that span the entire product lifecycle, from initial development through to mass production, packaging, and distribution. This comprehensive service suite positions Windlas as the partner of choice for numerous esteemed pharmaceutical firms, both domestically and abroad.

Additionally, Windlas Biotech is a trailblazer in innovation, offering advanced products like pellet coatings, medicated mouth sprays, protein powders, and nutritional supplements. These innovative offerings are indicative of Windlas’s dedication to meeting the changing health requirements of people worldwide.

The market cap of Windlas Biotech Ltd is ₹1,309.27 crores as of May 30, 2024. This is the shareholding pattern of the company, as of March 31, 2024:

Windlas Biotech Q4 and FY24 result financial highlights

Let’s look at a few of the key highlights revealed in the quarterly results of the company for the FY 2024:

- The company’s quarterly revenue was ₹171 crores, approximately 6% higher than the previous quarter.

- Windlas Biotech Ltd reported revenue of ₹631 crores, marking a year-over-year (YoY) growth of 23%.

- The company achieved an EBITDA of ₹78 crores, reflecting a YoY growth of 30%.

- The EBITDA for the fourth quarter was ₹22 crores, a 33.9% increase from the previous quarter.

- The profit after tax (PAT) stood at ₹58 crores, indicating a YoY growth of 37%.

- The earnings per share (EPS) was recorded at ₹27.97, showing a YoY growth of 42%.

- Windlas maintained strong liquidity with its cash and liquid assets amounting to ₹206 crores as of 31st March 2024.

- The company generated net operating cash flows of ₹109 crores.

- The return on capital employed (ROCE) was noted to be 27% and the return on equity (ROE) was 24%.

- The working capital days were maintained at 15 as of 31st March 2024.

- Windlas commissioned state-of-the-art injectable facilities, enhancing its manufacturing capabilities.

You may also like: Prestige Estate Q4 results: Mixed outcomes and new dividend proposal

Windlas Biotech Ltd’s quarterly performance

Here are the key financial metrics reflecting the company’s quarterly performance in relation to the previous quarter:

| Q4 FY24(₹ crores) | Q3 FY24(₹ crores) | Change(%) | |

| Revenue | 171 | 162 | 5.56 |

| Operating profit | 22 | 20 | 10.00 |

| Profit before tax | 23 | 20 | 15.00 |

| Net profit | 17 | 15 | 13.33 |

| EPS | 8.17 | 7.26 | 12.53 |

Windlas Biotech Ltd’s annual performance

Here are the key financial indicators of the company as compared to the preceding year:

| FY2024(₹ crores) | FY2023(₹ crores) | Change(%) | |

| Revenue | 631 | 513 | 23.00 |

| Operating profit | 78 | 60 | 30.00 |

| Profit before tax | 77 | 57 | 35.09 |

| Net profit | 58 | 43 | 34.88 |

| EPS | 27.98 | 20.04 | 39.62 |

Also read: On track or off the rails? IRCTC’s Q4 earnings and investor sentiment

Market reaction

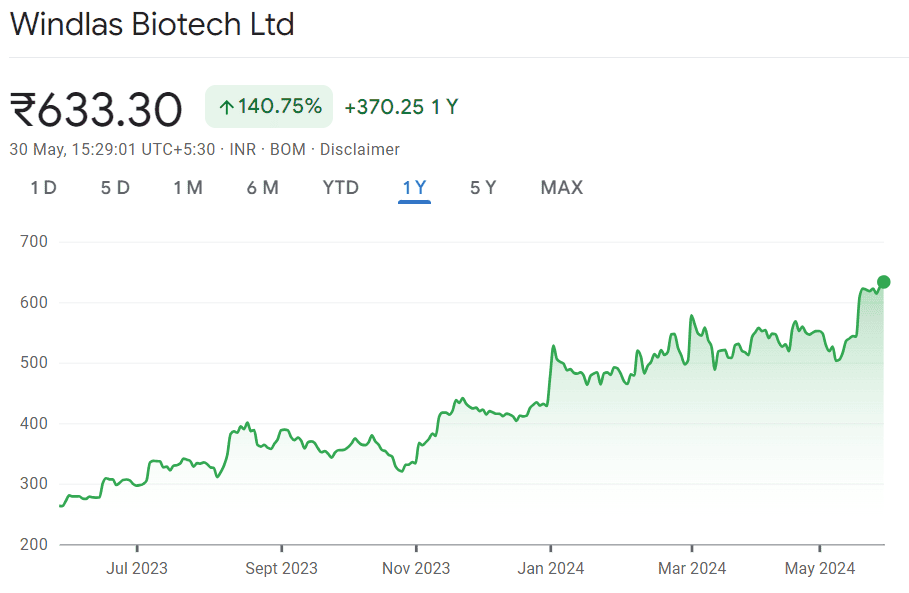

Windlas Biotech Ltd released its Q4 results on May 21, 2024. On that day the Windlas Biotech share price reached a 52-week high of ₹648.00. This was a surge of more than 17% as compared to the previous trading day when Windlas Biotech’s share closed at ₹553.10.

When looking at the Windlas Biotech share price history for the past year, the stock has given a return of 140.75%.

Peer analysis

Let’s compare the key financial ratios of Windlas Biotech Ltd with that of its competitors:

| Company | CMP (₹) | Market cap(₹ crores) | P/E | Earnings Yield (%) |

| Windlas Biotech Ltd | 633.3 | 1,308 | 22.5 | 6.15 |

| NGL Fine Chem Ltd | 2,257 | 1,395 | 36.2 | 3.60 |

| Beta Drugs Ltd | 1,260 | 1,211 | 33.2 | 4.34 |

| Syncom Formulations India Ltd | 12.4 | 1,165 | 49.3 | 3.10 |

| Lincoln Pharmaceuticals Ltd | 564 | 1,131 | 12.1 | 11.0 |

| Anuh Pharma Ltd | 228 | 1,143 | 19.0 | 6.84 |

| Kopran Ltd | 226 | 1,092 | 21.4 | 6.35 |

Must read: The pharmaceutical industry in India and its contribution to the world

Bottomline

Windlas Biotech Ltd has demonstrated significant financial and operational achievements in Q4 and FY24, underscoring its prominent position within the Indian pharmaceutical sector. The company has achieved notable growth across various financial metrics, reflecting its robust business model and strategic initiatives.

Windlas Biotech’s market reaction to these results was positive, with its share price reaching a 52-week high of ₹648.00 on the announcement day, representing a 17% surge. Operationally, Windlas Biotech has enhanced its capabilities with the commissioning of state-of-the-art injectable facilities and maintained strong liquidity.

Windlas Biotech Ltd’s impressive financial results, strategic operational enhancements, and strong market performance highlight its capability to capitalise on the growing pharmaceutical sector in India.