Stocks are one of the most sensitive financial instruments. Do you agree? They are volatile. and instantly respond to evolving market conditions by altering their prices accordingly.

Of all the factors that influence stocks, did you know the climatic condition of the country is also one? Yes, weather has a significant impact on stocks.

Today’s article is about the impact of winter on stocks and examples of stocks that benefit your winter portfolio.

You may also like: Market cycles: Riding the rollercoaster of stocks

What are winter stocks?

Before getting into the depth of winter stocks, let’s understand the concept of cyclical and defensive stocks.

Cyclical stocks are the ones that react to market conditions and vary in prices accordingly. Defensive stocks stay stable irrespective of the market condition because such goods are required at all times. They are called evergreen stocks since they are always in demand.

Companies producing essential goods are classified as defensive stocks, whereas luxury goods come under the cyclical category.

Similar to cyclical stocks are seasonal stocks. While cyclical stocks react to economic conditions, seasonal stocks in India react to the weather conditions in the environment.

People’s preferences change according to the weather. In winter, the demand for products like woollen clothes, heaters, hot beverages, etc., increases. So, the price of such stocks increases, too. On the other hand, there are products rarely used in winter, for example, air conditioners. So, the stock price of companies manufacturing ACs decreases.

To put it simply, winter stocks are seasonal stocks whose demand and price change with the weather.

Must have stocks during winter

Now that we understand seasonal stocks, let us go through the impact of cold weather on different sectors.

Pharmaceutical sector

Medicines fall under the essential product category. Do you remember the lockdown days? Medical stores were one of the few functioning shops at the time.

People fall sick for various reasons, irrespective of economic or weather conditions. Hence, pharma stocks are defensive, given their stability despite unforeseen situations.

Considering the winter weather in particular, pharma stocks are generally seen to be rising. With winter comes viral infections like flu and other respiratory issues. So, the demand for medicines increases in winter, keeping pharma stocks green.

The pharmaceutical industry is worth $50 billion today. It is expected to grow to $65 billion in 2024 and $130 billion by 2030.

Also read: The pharmaceutical industry in India and its contribution to the world

Travel Sector

The winter season in India witnesses a rise in travel, as Indians gear up for the holiday season. Heavy inter-state travel happens during this season. The wedding season is also observed from November to February, which is also a reason for a significant increase in travel.

The travel sector includes stocks like hotel companies, air-ticketing companies, railway companies and travel agencies. By 2030, India aims to generate a substantial $56 billion in foreign exchange earnings and create around 140 million jobs, with a keen focus on cruise tourism, eco-tourism, and adventure tourism.

Infrastructure development, accommodation, adventure tourism, medical tourism, cruise tourism, eco-tourism, and MICE tourism all present promising opportunities in this thriving sector, with numerous startups actively participating in its growth.

Consumer discretionary sector

The consumer discretionary sector presents an exciting opportunity for investors who favour selecting stocks based on individual company performance. Consumer discretionary categories contain non-essential but desirable goods and services when individuals have the means to afford them.

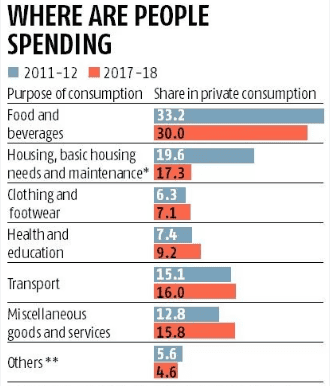

In the winter season, this sector includes products like appliances, automobiles, and entertainment, catering to consumers’ wants rather than their basic needs. As consumers become aware, their demands change and they opt for better quality or premium products in the same category.

This trend highlights a promising landscape for investors seeking to capitalise on evolving consumer preferences in India’s dynamic market. Few examples of consumer discretionary brands are Trent Limited, Arvind fashions Limited.

Vice sector

In recent times, one particular sector has increasingly become integrated into the festivities of many households. This sector encompasses products such as alcoholic beverages and cigarettes. As the winter season approaches, people tend to embrace a celebratory spirit, leading to a notable increase in their discretionary spending. Moreover, the festive season is set to follow the wedding season, where there is typically high consumption of these products.

From an investment perspective, it is reasonable to anticipate that this sector will exhibit strong performance in the winter season.

In 2023, the Indian tobacco products market is expected to generate approximately $12,730.0 million in revenue. Over the period from 2023 to 2028, it is forecasted to experience a yearly growth rate of 4.60% (Compound Annual Growth Rate or CAGR).

Also read: What are cyclical and non-cyclical stocks?

Bottomline

In conclusion, as winter approaches in 2023, savvy investors can seize opportunities by adding seasonal stocks to their portfolios.

The pharmaceutical sector promises stability and growth, with increasing demand for medicines during the cold season.

The travel sector, driven by holiday plans and weddings, opens doors for lucrative investments in various related industries.

Meanwhile, the consumer discretionary and vice sectors cater to evolving consumer preferences, offering a spectrum of non-essential but desirable products.

By recognising the impact of winter on these sectors and strategically diversifying their investments, investors can make the most of the seasonal fluctuations and potentially enjoy a fruitful winter season in the financial markets.