By 2025, analysts predict that India’s IT and business services market will be worth $19.93 billion. Step into the dynamic world of IT as we dissect Wipro Limited’s Q4 2024 earnings release. Worldwide, Wipro Limited is well-known as a top provider of IT, consulting, and business process outsourcing (BPO) services.

Wipro is a renowned IT services provider with a track record of over 60 years that has earned praise for its dedication to sustainability and new methods of providing value to businesses. When it comes to capital, people, and natural resources, Wipro is a champion for optimising their application and utilisation.

This article aims to provide an in-depth analysis of the Q4 results of Wipro, highlighting the key financial results and performance indicators that reflect the company’s growth trajectory and its commitment to delivering value to its shareholders.

About Wipro

Wipro Limited, formerly known as the Western Indian Palm Refinery Oil, is a prominent global company specialising in information technology, consulting, and business process services. Established on 29 December 1945 in Amalner, India, by Mohamed Premji, Wipro has expanded into a global corporation that caters to clients in more than 65 countries.

Wipro provides extensive IT consulting services, including cloud computing, cybersecurity, digital transformation, AI, robots, data analytics, and more. Wipro is globally renowned for its extensive range of services, strong dedication to sustainability, and responsible corporate practices, supported by a workforce of over 245,000 employees.

The company boasts a vast network of over 1,400 active global clients and utilises its wide range of expertise in consulting, design, engineering, operations, and emerging technologies to assist clients in achieving their ambitious goals and creating resilient, forward-thinking businesses.

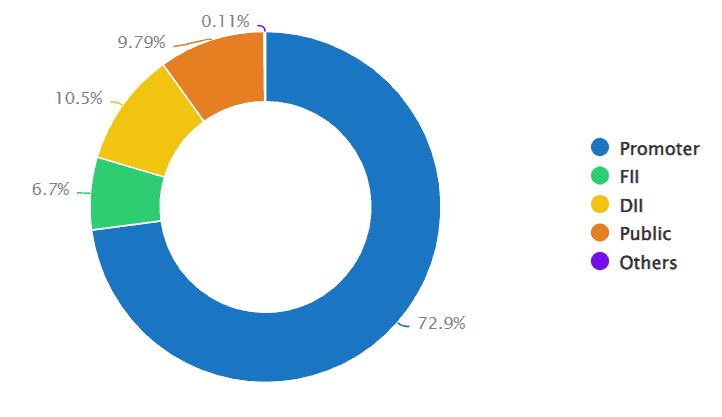

This is the current promoter holding structure of Wipro Ltd:

Also read: Difference between Fii and Dii

Wipro Q4 results 2024

In the fourth quarter, Wipro demonstrated robust financial performance. While the company’s revenues saw a slight decrease compared to the previous quarter, Wipro managed to improve profitability.

Despite the challenging market environment, Wipro was able to maintain a positive financial outlook, reflecting its resilience and strategic business approach.

This performance underscores Wipro’s ability to deliver value to its shareholders, even in times of decreased sales.

Let’s analyse Wipro Q4 results for the financial year 2024

| Jun 2023 – Q1 | Sept 2023- Q2 | Dec 2023- Q3 | Mar 2024- Q4 | |

| Sales | 22,831 | 22,516 | 22,205 | 22,208 |

| Change | -1.37% | -1.38% | 0.01% | |

| Operating profit | 4,204 | 3,970 | 4,198 | 4,381 |

| Change | -5.56% | 5.74% | 4.36% | |

| Profit before tax | 3,798 | 3,509 | 3,552 | 3,862 |

| Change | -7.61% | 1.22% | 8.73% | |

| Net profit | 2,886 | 2,667 | 2,701 | 2,858 |

| Change | -7.59% | 1.27% | 5.81% | |

| EPS | 5.23 | 5.07 | 5.16 | 5.42 |

| Change | -3.06% | 1.78% | 5.23% |

Source: Screener

Also read: What is eps

Expectations vs reality

For the financial year 2024, Wipro’s Q4 growth was expected to face some headwinds due to the ongoing effects of reduced technology spending and the scaling back of projects. According to Kotak Equities, Wipro was expected to experience a slight contraction in margins and a minor decline in revenue.

In Q1FY25, the brokerage company anticipated that Wipro would announce a modest growth guidance of -1 to +1%. This prediction was based on the way the business had strategically responded to the market situation at that time.

Additionally, IT companies were expected to maintain stable operating margins in Q4FY24. This stability was anticipated as a result of these companies’ ongoing efforts to address poor demand and moderate attrition by repairing their cost structures. Improving operational efficiencies was another area of emphasis for them.

After considering all of these considerations, it appeared like Wipro could approach the forthcoming quarters with a cautious sense of optimism.

| Actual Figures | Analysts’ Predictions | Expectations (Above/Below) | |

| Revenue (₹ crores) | ₹22,208 | ₹22,141 | In line |

| Net profit (₹ crores) | ₹2,858 | ₹2,746 | Above |

| EBIT (₹ crores) | ₹4,193 | ₹3,495 | Above |

Here is a quick look at how the company has done financially in comparison to what the market was expecting.

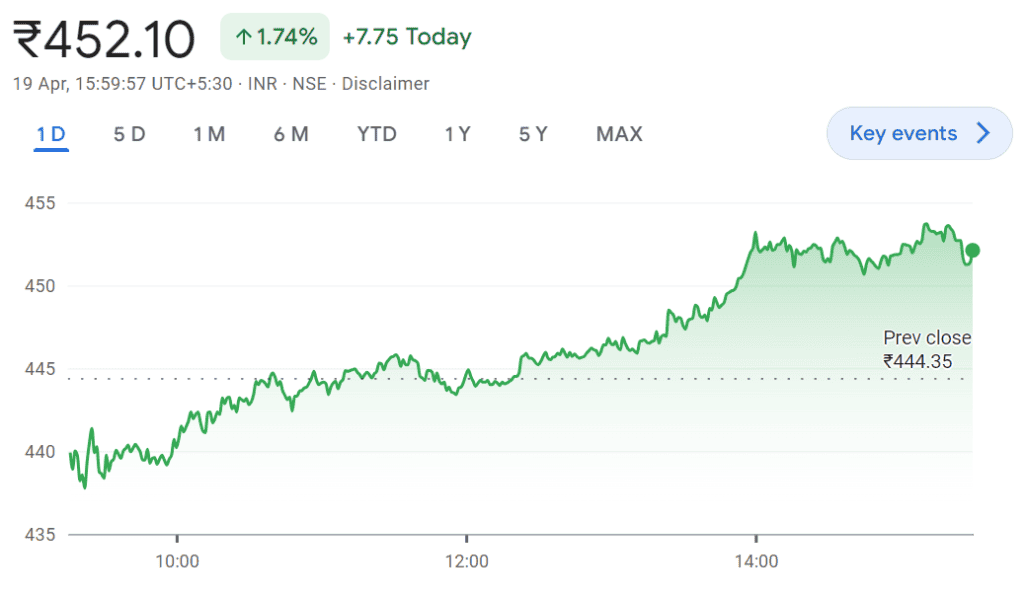

Wipro’s share price NSE

Before the earnings announcement on April 20, 2024, Wipro’s share price increased by 1.74% to ₹452.10.

Source: Google Finance

When it comes to Wipro’s share price history, as of April 20, 2024, the stock has returned 53.36% over the previous five years.

Competitor information

| Current price (as of April 22, 2024) | PE (TTM) | Market cap(₹ crores) | Net profit Q4 FY24(₹ crores) | Operating revenue Q4 FY24(₹ crores) | |

| Wipro Ltd | ₹462.00 | 21.8 | 2,41,041 | 2,858 | 4,381 |

| Tata Consultancy Services Ltd. | ₹3,830.15 | 29.8 | 13,86,451 | 12,502 | 17,164 |

| Infosys Ltd. | ₹1,416.60 | 22.5 | 5,89,382 | 7,975 | 8,784 |

| Persistent Systems Ltd. | ₹3,688.65 | 52.0 | 57,381 | 1,093 | 1,676 |

Investing pros and cons

Strengths of Wipro

- Global IT services presence: Wipro, a leading player in the global IT services industry, generated revenues of ₹90,488 crore in FY2023. However, in FY2024, the company’s revenue slightly decreased to ₹89,760 crore. Wipro is still a major player in the sector, even with this little drop.

- Diversified customer base: As of March 31, 2024, Wipro continues to maintain a strong customer base, with a significant percentage of its business stemming from dedicated, returning clients.

- Robust financial profile: The company’s operating profit margins have shown resilience, with a profit before tax of ₹147,210 million in FY2024. The operating activities resulted in a profit for the year of ₹136,099 million, reflecting a strong financial performance despite the dynamic market conditions

Weaknesses of Wipro

- Industry-specific challenges: Wipro is dealing with the challenges of forex fluctuations, high employee attrition, and exposure to policies in key markets such as the US, Europe, and India.

- Intense competition: The company faces intense competition from major international competitors, which puts a strain on its profit margins and limits its ability to adjust prices.

- Operational efficiency: There is a clear requirement for organisational transformation to enhance operational efficiency and facilitate margin expansion.

Further reading: Industry analysis

Bottomline

By delving into Wipro’s Q4 2024 earnings release, readers gain valuable insights into the performance of a key player in the global IT services industry, providing a glimpse into market trends and potential investment opportunities.

Whether stakeholders are shareholders, industry professionals, or market observers, understanding Wipro’s quarterly performance equips them with knowledge crucial for informed decision-making in the dynamic world of technology and business services.