The food delivery sector in India is rapidly expanding and ranks among the quickest-evolving markets worldwide. Advancements in technology have revolutionised the food delivery landscape in recent times. It is projected that by 2026, the Indian market for online food delivery will escalate to a value of $24 billion.

In this dynamic realm of digital meal services, Zomato stands out as a culinary giant. Established in 2008, this global enterprise originating from India has paved the way, delivering an array of gastronomic experiences to epicureans worldwide.

The article aims to provide a comprehensive analysis of Zomato’s Q4 results, exploring its implications on Zomato’s share value.

About Zomato Ltd

Zomato, a prominent player in the food services sector, primarily operates in three key areas: food delivery, quick commerce, and B2B supplies. Its food delivery platform enables customers to explore local eateries, place food orders, and benefit from speedy and dependable delivery.

Zomato is dedicated to sustainable growth and corporate responsibility. The company’s ESG initiatives encompass efforts to attain net-zero emissions across its food delivery value chain by 2033 and to achieve complete plastic neutrality in deliveries since April 2022. Additionally, Zomato supports Feeding India, a non-profit entity focused on alleviating hunger and malnutrition in underprivileged Indian communities.

Source: Zomato

In terms of governance and investor relations, Zomato upholds transparency through routine financial disclosures, shareholder communications, and an ESG microsite. Zomato has 28 subsidiaries, 1 trust and 1 associate.

The company’s technology platform bridges customers, restaurant partners, and delivery partners, catering to their varied needs. Customers use the platform to search for restaurants, discover new dining venues, contribute and read reviews, post and view photos, order food delivery, book tables, and handle payments during dine-out experiences.

On the other hand, Zomato provides restaurant partners with specialised marketing tools that aid in attracting and retaining customers, thereby boosting their business. The company also offers a reliable and efficient last-mile delivery service.

Furthermore, Zomato oversees Hyperpure, a comprehensive procurement solution that supplies high-quality ingredients and kitchen products to restaurant partners. Additionally, the company offers delivery partners clear and flexible income-earning opportunities.

Zomato Q4 results 2024

These are the key financial metrics of Zomato’s Q4 quarterly results as compared with the same quarter of the previous year:

| Q4 FY2024(₹ crores) | Q4 FY2023(₹ crores) | |

| Revenue | 3,562 | 2,056 |

| Operating profit | 86 | -226 |

| Profit before tax | 161 | -204 |

| Net profit | 175 | -188 |

| EPS | 0.20 | -0.22 |

Source: Screener

Must read: Piramal Enterprises Q4 results: Key takeaways

Annual performance of Zomato Ltd

These are the key financial metrics of the company as compared with the previous year:

| FY2024(₹ crores) | FY2023(₹ crores) | |

| Revenue | 12,114 | 7,079 |

| Operating profit | 42 | -1,211 |

| Profit before tax | 291 | -1,015 |

| Net profit | 351 | -971 |

| EPS | 0.40 | -1.14 |

Source: Screener

Other performance indicators revealed in Zomato’s Q4 results

- Growth acceleration: The company saw a year-on-year surge of 51% in its B2C operations, with notable expansions in the sectors of food delivery, quick commerce, and outdoor activities.

- Profitability improvement: The company saw a significant enhancement in its consolidated Adjusted EBITDA, which stood at ₹194 crore, marking an increase of ₹369 crore compared to the previous year.

- Quick commerce success: The quick commerce division achieved profitability in terms of Adjusted EBITDA in March. Furthermore, the company has set ambitious plans to significantly increase its number of stores to 1,000 by the conclusion of FY25.

- Strategic focus: The company is strategically targeting the major cities in India for growth, specifically the top eight urban areas, with the goal of significantly enhancing its market presence and Gross Order Value (GOV).

Source: Zomato

Blinkit, a subsidiary of Zomato, saw its gross order value (GOV) nearly double to Rs 4,027 crore in Q4FY24, up from Rs 2,046 crore in Q4FY23, according to Zomato Q4 results 2024 dated May 13.

This surge was primarily driven by a significant rise in the number of dark stores. As of March 31, the company operated 526 stores, marking a 40% increase from the 377 stores it had at the end of the same period the previous year, reflecting a growing demand for its services.

Also read: EBITDA explained: Definition, calculation, significance, and more

Market reaction: Zomato shares news

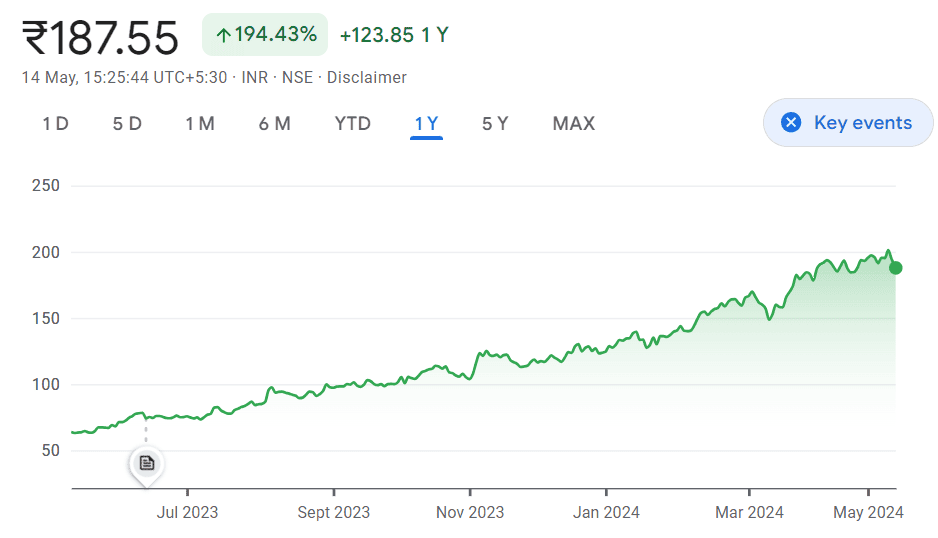

Despite the encouraging financial outcomes, Zomato’s share price experienced a 7% drop shortly after the announcement of the financial results on May 13, Monday, hitting an intraday low of ₹186.75 per share on the NSE.

However, the stock later rebounded, gaining over 5% from the intraday low and closing the final trading session 2% lower than the previous close, at ₹196.5 per share. Zomato’s share today (May 14), a day after the results, has opened at ₹191.70.

Zomato share price target by various brokerage houses:

Nuvama Institutional Equities has kept its ‘buy’ rating for Zomato, adjusting its target price from ₹180 to ₹245, citing the company’s rapid growth and leadership in quick commerce. It values Zomato’s food delivery and Blinkit at $10 billion and $13 billion, respectively.

Similarly, CLSA has retained its ‘buy’ recommendation for Zomato, increasing its target price to ₹248 per share. The reasons for this upgrade include strong guidance for Blinkit and Zomato’s clear emphasis on quick commerce growth.

Citi, which also endorses a ‘buy’ rating for Zomato, has raised its target to ₹235 per share. It points out that the company achieved adjusted EBITDA breakeven in quick commerce by the end of the March quarter and is on track with its guidance for Q1 FY25.

Bernstein, maintaining an ‘outperform’ rating, has increased its target for Zomato to ₹230 per share. It continues to express confidence in the quick commerce business reaching the breakeven point.

Moreover, Jefferies, while holding onto its ‘buy’ rating, has revised its target price for Zomato to ₹230. It underscores the achievement of breakeven in quick commerce as a major highlight of the March quarter and notes the shift in focus towards aggressive growth as the store count is expected to double in the next year.

Despite trading with losses intraday, looking at Zomato’s share price history for the past 12 months, the stock has given a return of 194.43%.

Source: Google Finance

Also read: Tata Motors Q4 results 2024: A comprehensive analysis

Bottomline

Zomato Ltd., a key player in India’s rapidly evolving food delivery sector, has reported notable financial performance in its Q4 results, reflecting significant growth and strategic initiatives across its business segments.

Despite facing a drop in its share price immediately following the announcement, Zomato’s robust performance indicators, coupled with positive market sentiment from brokerage houses, suggest a promising outlook for the company.