Table of contents

The capital adequacy of financial institutions became a subject of great concern after the 2007-2008 financial crisis. A debt instrument was introduced to manage this issue – AT1 Bonds. High risk and high returns are the characteristics of these bonds. Moreover, they have some close association with mutual funds.

The SEBI and Ministry of Finance, Government of India have bifurcating stands regarding the valuation of these bonds. Read more to decode the relations of AT1 bonds, mutual funds and SEBI regulations.

What are AT1 Bonds?

The debt instruments issued by financial institutions to fulfil the required capital norms are known as AT1 bonds. The ‘AT1’ bond in full form is an ‘Additional Tier 1’ bond. These instruments do not have any maturity. However, investors can sell these listed bonds in the market. These bonds are also known as ‘contingent bonds’ as during tough financial situations, banks can write off these bonds to minimise their losses. Yes Bank proceeded similarly during its crises, which resulted in heavy losses for the investors.

After the financial crisis in 2008, the Basel III regulatory framework was established to assess the risk adequacy of banks. The capital adequacy ratio (CAR) indicates the risk capacity of a bank at the capital level. RBI mandates banks to follow this framework. As per the RBI rules, Indian commercial banks have to maintain the CAR at 9%, and Indian public sector banks have to maintain the CAR at 12%. The Basel III regulatory framework categorises the capital of banks into mainly three parts – Common Equity Tier I, Additional Tier II and Tier II. So to raise funds AT1 and AT2 bonds (tier 2 capital) are issued

Features of AT1 bonds

- Maturity

The bonds do not have any fixed maturity period. The investor can sell them in the market as they are a listed instrument. The bonds are thus considered to be perpetual bonds.

- Call option

AT1 bonds come with a unique ‘call option’ through which banks can purchase them back from the investors after a specified period. This feature is not compulsory so, the banks may never even use this option. Moreover, the AT1 bonds definition suggests that it is an instrument investing in additional tier 1 capital having a nature similar to equity capital.

- Minimum investment

The minimum investment required for AT1 bonds in India is ₹1 core. Due to this only corporates, HNIs and mutual funds usually have a high exposure to such bonds. The AT1 bonds mutual funds are quite popular with retail investors.

- Risk

The risk associated is very high due to the perpetual nature and no guaranteed returns. Moreover, the risk of early calls lurks over the instrument. The banks can write off even the principle of the AT1 bonds during crunch situations to absorb their losses.

- Interest payment

The coupon rates are not guaranteed. Banks are allowed to cancel the payments in terms of inadequate reserves or losses for the banks. However, these bonds offer higher interest rates than any other debt instrument due to high risk.

- Pricing

The AT1 bond pricing is done according to the discounted cash flow (DCF) method. In this method, the future cash flows (coupon payment and redemption proceeds in the case of AT1 bonds) are discounted to the present value of the instrument. In the case of AT 1 bonds, the usual period considered for valuation is 3 to 5 years (usually after this, the bonds can be called by the banks).

However, SEBI has issued some norms for changing these valuations.

Also read: Understanding the potential of debt funds.

SEBI’s regulations for mutual funds

The Securities Exchange Board of India (SEBI) is the apex body overlooking all the norms for different securities in India. SEBI issued some regulations for the AT1 bonds in its circular issued on March 10, 2021. The two main guidelines were as follows:

- Mutual funds cannot invest more than 10% of their debt portfolio’s net asset value (NAV) in AT1 bonds. Also, less than 5% of the debt portfolio’s NAV should be from one issuer.

- For valuations, the maturity of these bonds should be considered 100 years.

The interventions and their impact

The impacts of SEBI guidelines mentioned previously in the article are as follows:

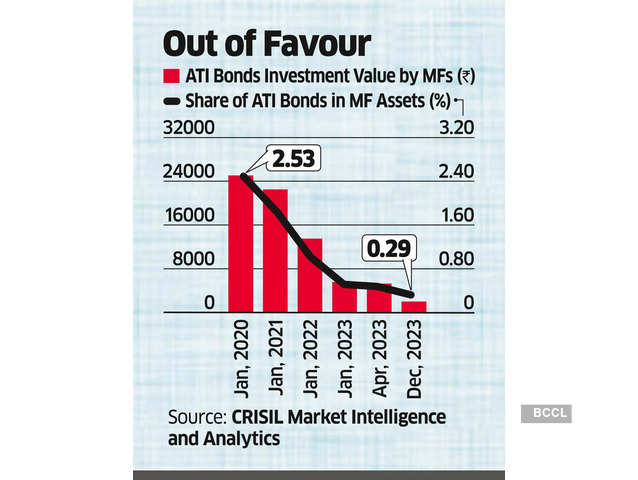

- The mutual funds fear that it would adversely impact by reducing the NAVs of debt portfolios. They had a large chunk of debt funds invested in AT1 bonds before these guidelines, but due to changed norms, their investment in AT1 bonds has started reducing.

Source: Economic Times

- The valuation norms changed by SEBI would affect the discount future value of AT 1 bonds. If we value the instrument with a 100-year maturity, there is a drastic change in its present value. The usual logic is that repayment after 100 years is similar to no repayment.

The Ministry of Finance has some bifurcating views regarding the valuation norms of SEBI. As per its letter to SEBI, the government is concerned that decreasing the NAV of funds would hurt the capital available to banks. It may eventually lead to more dependence on the government for the capital.

Later, the SEBI altered its valuation norms for maturity as below:

Source: Associations of Mutual Funds in India

Read about this unique debt instrument: The ‘Debt+Equity’ Jackpot: Partially convertible debentures.

Bottomline

The AT 1 bonds are explained as very unique yet risky investment instruments. They are issued as bonds (debt instruments) but are part functioned as equity in the banks. This ‘quasi-equity’ feature is quite harmful to the funds of retail investors, who are investing in it through mutual funds. So, the SEBI norms pave a path for regulating the excess investments of mutual funds in AT 1 bonds.

However, the concern of the Finance Ministry stands valid as a potential issue for banks. So, the revised valuation norms by the SEBI will help limit immediate havoc in the NAVs of debt funds and provide sufficient time for mutual funds to liquidate the excess investments in AT1.

Read more about debt: Want to be debt-free soon? Here are some strategies to manage your debts!

FAQ

The AT 1 bonds are debt instruments with a unique quality of perpetual maturity and high interest rates. They are issued by banks for Additional Tier 1 capital. These are very risky due to the attached ‘call options’. Also, the interest rates are higher than other debt instruments but its payment can be skipped by the banks.

In India, the AT1 bonds are issued to raise additional tier 1 capital so they are regulated by the apex bank – The Reserve Bank of India (RBI). However, the norms for investment in AT1 bonds are regulated by the Securities Exchange Board of India (SEBI).

There is no maturity limit for the AT1 bonds, that is these bonds have perpetual maturity. However, they are accompanied by a ‘call option’ that allows the banks to buy back them anytime after a certain number of years of issuing.

The perpetual status, high coupon rates that are not guaranteed, the attached ‘call option’, and the write-off facility make the AT1 bonds very risky for investors. The banks can write off these bonds if they are financially stressed due to which there is also a risk of losing the principal amount.

The Basel III framework categorises the capital as Common Equity Tier I, Additional Tier II and Tier II. The AT1 bonds are issued by the banks to raise the additional tier 1 capital.