Table of contents

Trading was revolutionised in 1996 when the Securities and Exchange Board of India (SEBI) introduced demat accounts. Before this, trading involved physical certificates. Now, it’s all digital.

Dematerialisation is referred to as demat. It describes the process of transforming tangible securities into digital form. This change has made trading more straightforward, secure, and efficient.

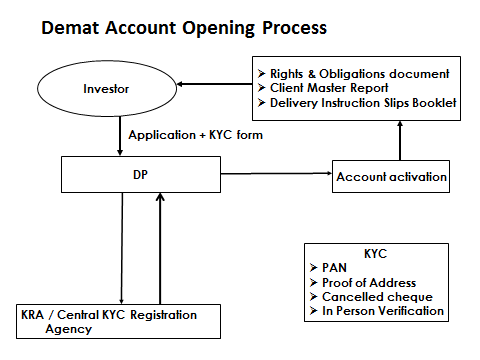

To trade in securities like stocks or mutual funds, having a demat account is essential. This process involves registering with a Depository Participant (DP), linking investors to the digital financial marketplace.

You will obtain a client ID in the demat account after it has been set up. This ID is unique to you and is used to identify your holdings electronically. This piece will explore the role of client ID in demat accounts, highlighting its importance in the seamless trading of securities.

What is a depository participant?

Just like banks hold your money, depositories hold your securities like stocks and mutual funds in a digital format. They ensure the safekeeping of your financial assets.

India hosts two main depositories:

- The Central Depository Services Limited (CDSL)

- The National Securities Depository Limited (NSDL)

A DP acts as a depository’s agent and mediates disputes between investors and the depository. They are permitted to provide investors with depository services. Financial organisations that can become DPs include banks, stockbrokers, and trading platforms. Through DPs, investors open Demat accounts so they can trade and keep stocks electronically.

What is the client ID in demat account?

Every demat account holder receives a distinct client ID. This eight-digit number is essential for identifying and managing the account holder’s investments. It forms part of the 16-digit demat account number.

The demat account number is a 16-digit unique identifier assigned to account holders, essential for trading and holding securities electronically.

The NSDL and the CDSL have different formats. In CDSL, it’s a straight 16-digit numeric code, such as 0123456789101112. In the case of NSDL, it begins with “IN” and consists of 14 numbers, such as IN01234567891011.

The client ID and the DP ID make up the two halves of the demat account number.

- The DP ID is the first eight digits, indicating the Depository Participant.

- The client ID, the subsequent eight digits, is unique to each investor, generated by the brokerage or bank.

For example, consider a demat account number of NSDL: IN01234567891011.

Here, “IN012345” represents the DP ID, indicating the Depository Participant, while “67891011” is the client ID.

This client ID in demat account is central to an investor’s ability to organise and access their investment portfolio efficiently. It connects all of an investor’s assets, making tracking and management easier.

Unique to each investor, the client ID is assigned by the Depository Participant, not influenced by depository institutions like NSDL and CDSL. It empowers investors with easy access to their investment history, underscoring its significance in the demat account system.

What is DP ID and Client ID in a demat account?

| Element | DP ID | Client ID |

| Definition | Unique identifier for each depository participant | Special code for people or companies having a demat account |

| Purpose | Identifies the depository participant | Links the demat account to its owner for tracking transactions |

| Holder | Assigned to financial institutions or brokers | Assigned to the account holder |

| Function | Locates the financial intermediary of an investor’s demat account | Ensures accurate recording of transactions and holdings |

| Usage | Critical for identifying the account’s associated DP | Used for transaction tracking and account management |

| Significance | Essential for investor-DP communication | Vital for maintaining transaction records |

How to locate your demat account’s client ID?

- Welcome letter: The initial welcome letter or email from your depository participant contains detailed account information, including your client ID.

- Demat account statements: Regularly issued demat account statements, either monthly or quarterly, display your client ID prominently at the top or in the account details section.

- Online demat account portal: Logging into your online demat account dashboard directly through your depository participant’s website usually shows your client ID in the account overview or profile section.

- Linked trading account: For those who have linked their trading account with their demat account, the client ID can often be found in the account details or profile section of the trading platform.

- Contact your broker: If you’re unable to locate your client ID through these means, reaching out to your stock broker or depository participant directly can help. They can provide you your client ID once they have confirmed your identity.

Bottomline

The client ID is a pivotal element of your demat account, serving as a digital fingerprint that uniquely identifies your holdings in the vast financial landscape. It guarantees safe and effective transactions in addition to making tracking and managing your investments easier.

Remember, your demat account, along with its associated client ID, is your gateway to participating in India’s dynamic securities market, making it crucial to keep this information accessible and secure.

FAQs

To find your Demat client ID, check the welcome letter or email received from your depository participant (DP) when you first opened your account. Alternatively, look at the top or account details section of your Demat account statements, which are usually sent monthly or quarterly. You can also log into your online Demat account dashboard or linked trading account to view your client ID. If these methods don’t work, contact your DP directly for assistance.

The DP name refers to the depository participant with whom your demat account is registered, acting as an intermediary between the investor and the depository (like CDSL or NSDL). This can be a bank, brokerage firm, or financial institution authorised to offer demat services.

In Central Depository Services Limited (CDSL) , the 16-digit client ID is your unique Demat account number, which is crucial for trading and holding securities electronically. The first 8 digits represent the DP ID, which identifies your Depository Participant (broker or bank), and the last 8 digits are your specific client ID, unique to you. This combination helps in efficiently managing and accessing your securities portfolio. It’s essential for executing trades and tracking investments within the CDSL system.

No, a trading ID and a client ID are not the same. The trading ID is provided when you open a trading account, enabling you to buy and sell shares in the stock market. It focuses on the transactional aspect of trading activities. On the other hand, the client ID is associated with your demat account, which holds your securities in electronic form, including stocks, ETFs, and mutual funds.

No, DP ID and client ID are not the same. DP ID (Depository Participant Identification) is a unique identifier assigned to a Depository Participant (such as a brokerage firm). It indicates the firm through which an investor opens their demat account. Client ID is a unique identifier assigned to the investor, distinguishing their individual account under that DP. Together, DP ID and client ID form a demat account number, ensuring precise identification and management of an investor’s securities.