Table of contents

The financial landscape has witnessed a significant transformation, with the process of investing in stocks and securities going digital.

The era of physical share certificates and paperwork is now a more streamlined and efficient approach, thanks to Central Depository Services Limited (CDSL) and its EASIEST facility.

Let’s explore the details of CDSL registration and how to carry out the process smoothly.

Significance of CDSL

Established in 1999, CDSL is one of the two primary depositories in India, the other being NSDL (National Securities Depository Limited). CDSL and NSDL operate under the regulatory oversight of the Securities and Exchange Board of India (SEBI) and play a pivotal role in the dematerialisation of securities.

Dematerialisation is the process of digitising share certificates from their physical form to make them more easily traded, stored, and transferred. CDSL provides a secure platform where investors can hold their shares and securities in a dematerialised or demat account.

Keep in mind that CDSL and NSDL do not allow investors to directly set up demat accounts. The alternative is to use a DP, or registered Depository Participant, such as a bank or brokerage.

You may manually move the shares stored in your demat account to another account besides the stock exchange, as you may already know. For that, CDSL has launched online services like Easi and Easiest, allowing you to access and manage your Demat account electronically. NSDL has a similar e-service to check your holdings.

The upgraded version of CDSL EASI registration is CDSL EASIEST. With EASIEST, investors can conveniently access their demat details online. Your login credentials (ID and password) will be sent to you when you complete the CDSL EASIEST registration process.

Understanding CDSL EASIEST

Before coordinating with the DP, you had to first sign the debit instruction slip (DIS) and turn it into the broker. An easier way to deal with online trading was to provide the broker power of attorney (POA) so that the funds could be automatically deducted from the DP account.

But the first one was rigid; while the second option put users at risk. This is where CDSL EASIEST comes into the picture.

EASIEST stands for Electronic Access to Securities Information and Execution of Secured Transactions. It is a web-based interface which gives you access to the demat account information. In addition to managing your demat account, the site allows you to transfer shares. Anyone having a demat account with CDSL has access to the EASIEST application.

Registration with NSDL and CDSL is pretty simple. For CDSL, choosing the platform’s new registration and then going to the CDSL register online option is all that’s required. Using appropriate authentication, the EASIEST method allows for electronic transaction authorisation on the demat account.

How to register with CDSL?

The following information is required before you can start the CDSL EASIEST registration procedure:

- 8-digit broker identification number, also known as a depository participant (DP) or CM ID (Clearing Member)

- You will need your BO (Beneficial Owner) ID. Eight digits is the standard format for this.

The next step in registering with CDSL EASIEST is to gather the following information:

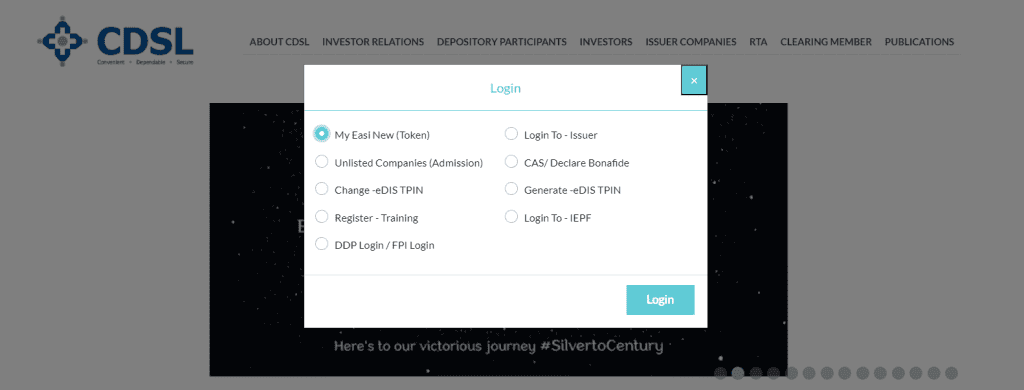

- Visit https://www.cdslindia.com/, and click the green Login button in the upper right corner.

- Navigate to My Easi New (Token) and hit the Login button.

- Locate the Click Here button next to To register for Easiest on the login screen.

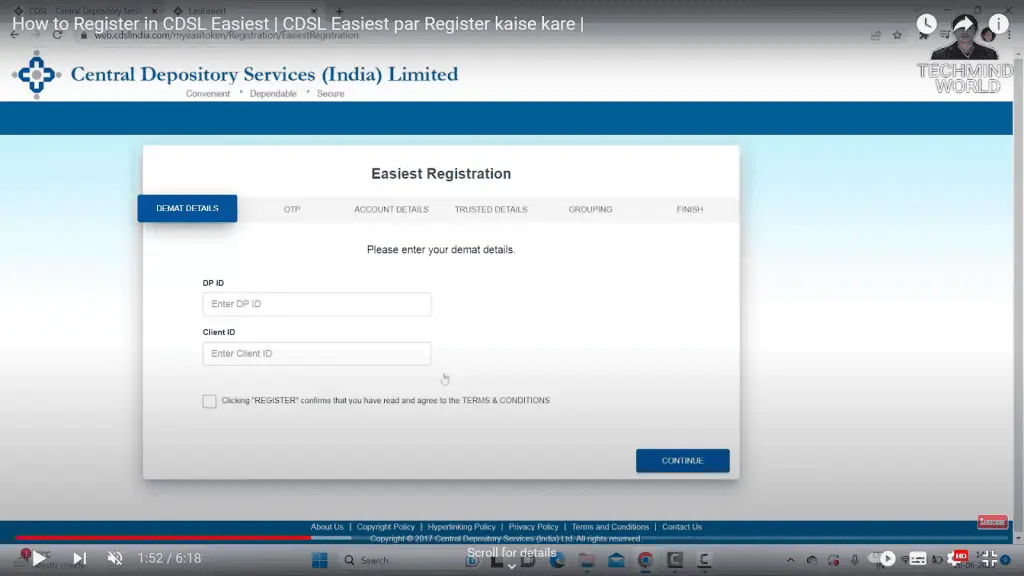

- To proceed, input your DP ID and client ID on the following page and confirm your agreement to the terms and conditions by checking the box.

- Click “CONTINUE” after entering the one-time password (OTP) sent to the associated number. Keep in mind that the OTP is only valid for the next fifteen minutes after receiving it.

- After you’ve entered all of the necessary details in the “ACCOUNT DETAILS” section, be sure to check the box next to “Trusted Account (Pin)” and then click “CONTINUE.”

- Put in the trusted account’s BO ID. After that, hit “SUBMIT” and then “CONTINUE.”

- Input the one-time password that was sent to the registered number.

- A request is submitted to your DP to map your trusted account. Choose “OK” to exit.

It may take up to two days for your CDSL EASIEST account to be authorised once you complete the registration process.

Conclusion

As the financial world continues its digital transformation, the importance of dematerialisation and services like CDSL cannot be overstated. By registering with CDSL, investors not only streamline their investment processes but also embrace a secure and efficient way of managing their financial assets.

FAQs

Choosing between CDSL and NSDL depends on individual preferences and requirements. Both are robust, SEBI-regulated depositories that offer similar services. CDSL is associated with the Bombay Stock Exchange (BSE), while NSDL is linked to the National Stock Exchange (NSE). The decision may be influenced by factors such as the range of services, ease of access, and the investor’s trading patterns. It’s not about which one is better; it’s about which one aligns better with your investment strategy.

CDSL is a secure platform for holding securities in electronic form. It implements stringent security measures, including encryption and firewalls, to protect investors’ holdings and personal information. These measures are designed to prevent unauthorised access and ensure the integrity of transactions. Investors can be assured of the safety of their electronic holdings with CDSL, making it a trusted choice for dematerialisation and trading.

One way to tell whether your demat account is with CDSL or NSDL is to examine the format of your account number. CDSL account numbers are 16 digits long and comprise solely of numbers, while NSDL account numbers begin with “IN” followed by 14 numerical digits. Either your demat statements or your trading platform should include this information. If you still need clarification, your broker may provide it to you.

While CDSL itself does not charge for holding a demat account, depository participants (DPs) may levy account opening fees, annual maintenance charges, and transaction fees. These charges vary among DPs and can depend on the services offered. It’s important to review the fee structure of your DP to understand all applicable charges. Some DPs may offer promotional waivers on certain fees, so it’s worth inquiring about any available offers.

CDSL’s EASI service provides investors with electronic access to their securities information, allowing them to view and monitor their demat account holdings. EASIEST, on the other hand, is an advanced version that includes all the features of EASI, with the added capability of executing secured transactions. This means that with EASIEST, investors can not only monitor but also transfer securities electronically without the need for physical instruction slips.