Table of contents

Keeping your savings safe is of the utmost importance in this digital age when most people do their financial activities online. A security measure known as TPIN has been used by numerous demat account providers to increase protection.

This article provides a comprehensive analysis of TPIN, examining its origins, generation process, and importance in protecting demat accounts.

What is TPIN?

A TPIN is a six-digit password that is used to authorise transactions in a demat account. Each transaction’s legitimacy is guaranteed uniquely and securely. One way to look at a demat account is as a digital safe for all of your investment assets. It saves them in an encrypted digital form.

You are required to input your TPIN whenever you wish to buy or sell stocks using your demat account. With the TPIN in place, your demat account is safeguarded against any unauthorised access or fraudulent transactions, giving you peace of mind.

Your TPIN is a security measure that you must take to protect your account from unwanted access. Do not share it with anybody. To safeguard your demat account from fraudulent actions, it is imperative that you change your TPIN promptly if you detect its breach.

How did TPIN come into the picture?

Now, let’s explore how the concept of TPIN emerged. Previously, when individuals chose to purchase or sell shares through their demat account, broking houses would request their approval before proceeding with the transactions.

To streamline this process, they used to require a Power of Attorney (POA) document that individuals have signed. This document grants authorisation to transfer securities out of your account upon their sale. Unfortunately, this arrangement gave rise to certain problems.

Certain brokerage firms abused the Power of Attorney (POA) by conducting unauthorised transactions. For instance, they would withdraw securities from the accounts of unsuspecting investors without a sell request. Moreover, they would transfer securities without the investor’s approval and coerce them into covering the losses from these transactions.

In June 2020, the idea of TPIN was suggested by the SEBI in response to this issue.

How to generate TPIN?

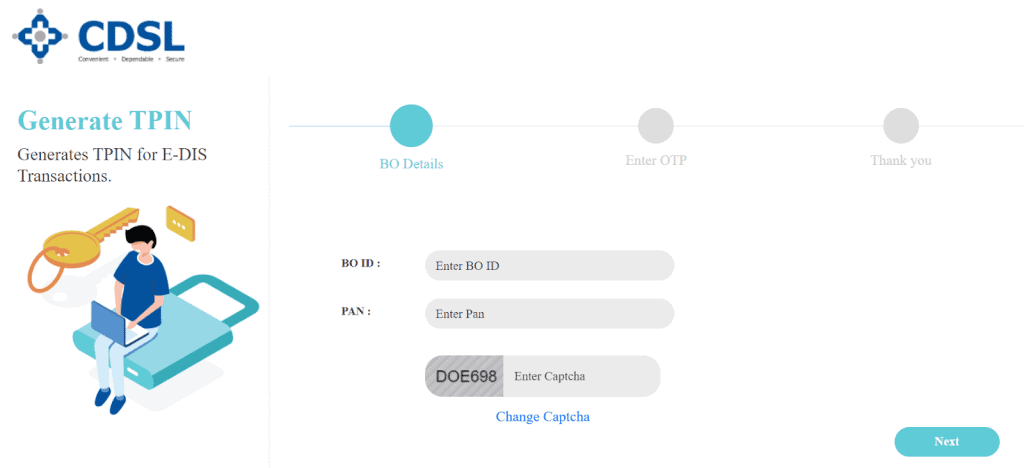

Let’s look at the CDSL TPIN generation process and see how you can generate TPIN:

- Navigate to CDSL: Begin by visiting the website of the CDSL.

- Find the ‘Generate e-DIS TPIN’ link: Look for the link labelled ‘Generate e-DIS TPIN’ and click on it to proceed.

- Input your BO ID: Entry to your demat account requires the submission of the 16-digit Beneficial Owner Identification Number, commonly known as the BO ID.

- Submit your PAN details: Provide the details of your Permanent Account Number (PAN) and click on the ‘Next’ button.

- Verify via OTP: Upon registration, a One-Time Password (OTP) will be sent to the email and mobile number you have submitted. You are required to input the OTP into the specified field to confirm your identity.

Upon finishing all five steps, your freshly generated TPIN will be sent to you via email and text message.

The elimination of the need for physical signatures on POA documents has made the process more streamlined and user-friendly. Ensure that your TPIN is not something predictable.

How to change TPIN?

The TPIN is directly provided to customers by CDSL. There are options available to establish a new TPIN, alter the current TPIN, completely reset the TPIN system, and even recover your TPIN through a specific link if you happen to forget it.

When using the online trading platform, you can connect to the TPIN service straight from the platform because it will be available as a third-party service on the platform. This increases the TPIN’s adaptability.

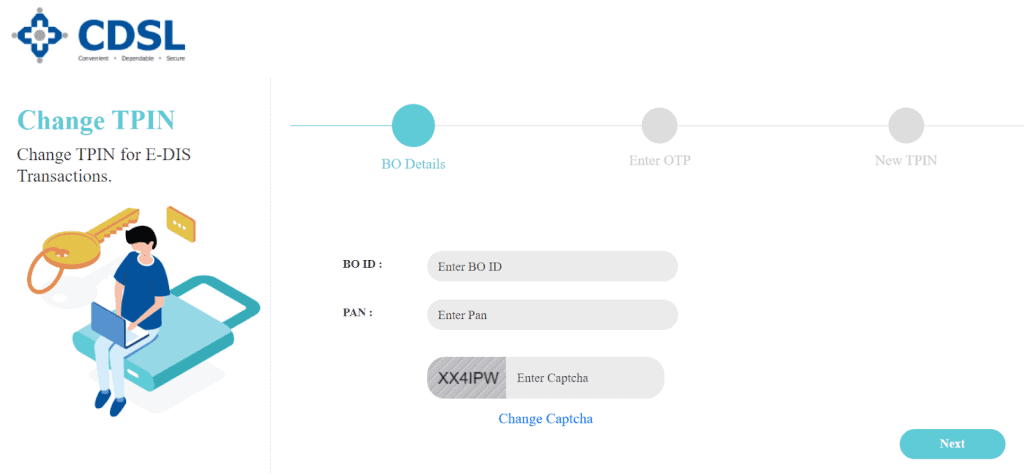

If necessary, you can also update your TPIN through the CDSL website. These are the steps:

- Go to CDSL: Begin by visiting the website of the CDSL.

- Enter your BO ID and PAN: After you’ve entered your BO ID and PAN in the required fields, click “Next.”

- Receive an OTP: You will receive a One-Time Password (OTP) from CDSL at the email and phone numbers you provided during registration.

- Input the OTP: Enter the received OTP and click on “Next” to continue with the verification process.

- Set a new TPIN: After successful verification of the OTP, you will be asked to input a new TPIN number.

- Wait for TPIN activation: Please be aware that the newly set TPIN will take a few minutes to activate before you can start using it.

What are the MPIN and TPIN differences?

TPIN and MPIN are both unique identification codes used for authentication.

TPIN is an authorisation code that you receive from CDSL (Central Depository Services Limited) on your registered mobile number and email address when your demat account is created. However, MPIN is a code that NSDL (National Securities Depository Limited) sends to you.

Bottomline

TPIN serves as an additional layer of security, protecting your investments from unauthorised transactions. Consequently, investors enjoy a more efficient and effortless process for verifying their identity.

The advent of TPIN has indeed revolutionised the way investors manage their demat accounts, providing them with greater control and peace of mind.

FAQs

Yes, you can hold multiple demat accounts. The only condition is that all your demat accounts must be linked to the same PAN card. However, you cannot have two demat accounts with the same broker. Each account you open will have to be with different brokers. While there’s no restriction on the number of demat accounts you can open, it’s advisable to consolidate them. Consolidating demat accounts helps you manage your investments more efficiently.

No, TPIN (Transaction Personal Identification Number) is not required for intraday trading. TPIN is primarily used for authorising the sale of stocks from your demat account. It’s not required for intraday trading as these trades are squared off within the same trading day. However, if you wish to convert your intraday sell orders to delivery orders, then TPIN becomes necessary. This is because delivery orders involve the transfer of shares from your demat account, which requires TPIN for authorisation.

TPIN and ATM PIN (Automated Teller Machine Personal Identification Number) are both unique identification codes used for authentication, but they serve different purposes. TPIN is used for authorising transactions in demat accounts. On the other hand, an ATM PIN is a numeric password used for authenticating transactions at ATMs. It’s associated with a bank account and is required for withdrawing cash, checking account balance, and other ATM transactions.

No, intraday trading is not tax-free. Profits from intraday trading are considered as ‘speculative business income’ and are subject to taxation. These profits are added to your income and taxed according to your income tax slab. It’s important for traders to keep track of their trades and calculate their tax liabilities accurately to avoid any legal issues. Therefore, understanding the tax implications is crucial for making informed trading decisions.

Yes, a demat account can become inactive. If you haven’t made any trades (buying or selling) in your demat account for a consecutive 12-month period, the account will become dormant due to inactivity. Also, if you fail to add a nominee to your demat account by a certain deadline, your demat account will become inactive. You can reactivate your account by following the procedures set by your brokerage firm.