Table of contents

Trading and investing have become easier because investors can now convert physical securities into digital versions. The Securities and Exchange Board of India (SEBI) allows investors to digitise their shares and securities for online trading.

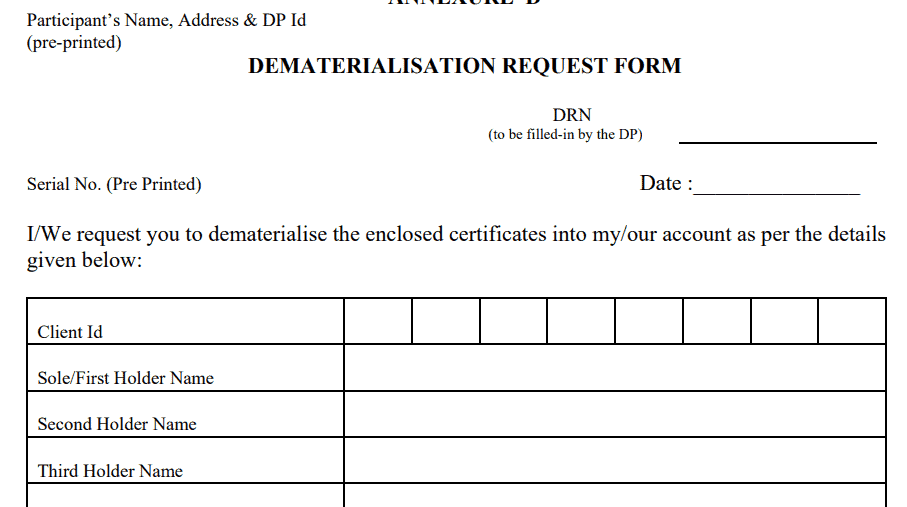

This change is possible due to dematerialisation, which involves converting physical certificates into digital form. Investors need to fill out a Demat Request Form (DRF) to make this conversion.

Let’s understand the concept behind DRF forms and the proper procedure to fill them out.

What is the DRF form?

The DRF form, or Dematerialisation Request Form, is essential in the securities market. It improves trading procedures and transparency, making it easier to manage and transfer financial assets.

An investor uses the DRF to request the conversion of physical assets like bonds or share certificates into digital or dematerialised versions. The investor contacts their broker, who serves as a middle-man between the investor and the depository or their Depository Participant (DP).

Types of DRF form

The DRF has three categories, each designed for a specific scenario. If you want to fill out the form, it’s ideal to familiarise yourself with the various types of DRF. Consider the following dematerialisation types and learn about their advantages based on your situation:

- Transposition-cum-dematerialisation:

In a joint-holding case, you can select this form if the names of the investors appear the same on both the physical share certificate and the demat account. This form is needed when you want to change the order of the names. First, ensure your name is spelled correctly. If they are identical, you can proceed with filling out this form.

- Transmission-cum-dematerialisation:

In the event of the death of a joint holder for joint holdings, the survivor can fill out this form. This process may remove the name of the deceased from tangible certificates.

- Normal demat request form:

You can use this form if the name on your physical share certificate and demat account match. The spelling should also be consistent. Additionally, no joint holders should have passed away before your physical securities are dematerialised. Under these conditions, you can fill out the DRF form using the Normal Demat Request Form.

How to fill out a dematerialisation request form?

You can download the DRF form by visiting this site: https://nsdl.co.in/downloadables/annex-d.pdf

After downloading, follow these steps to fill out the form:

- Provide your current phone number and the date on which you’re submitting the DRF.

- Enter the ID number issued to you precisely.

- Write the account holder(s)’ names in the same order as they appear on the demat account.

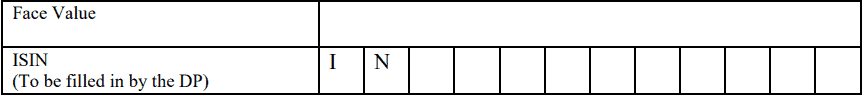

- Identify the security’s face value as stated on the physical share certificate and list the number of shares stated in the certificate.

- Insert the ISIN code, a unique 12-digit code assigned to the security when it is accepted into the depository system. The registration country is denoted by the first two digits.

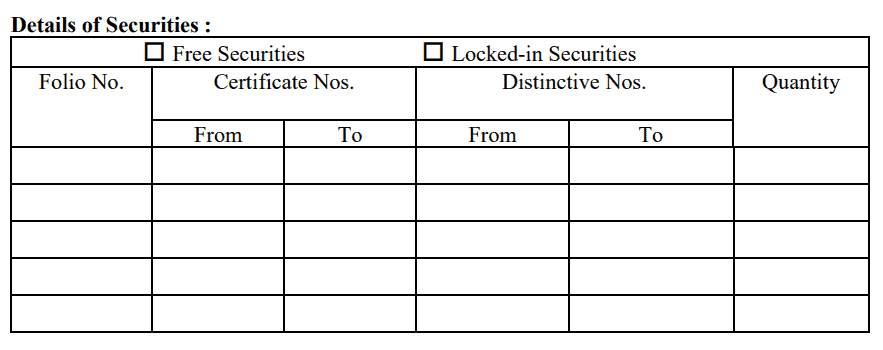

- Fill out the information on the securities, specify whether they are free or locked in, and enter the total number of certificates.

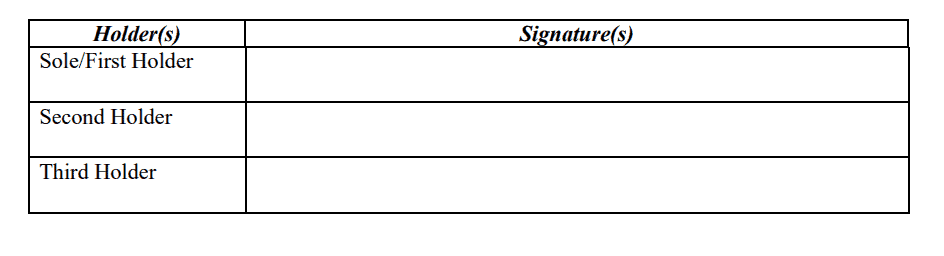

- Please ensure that all account holders sign the document in the sequence in which their names appear on the account. The signatures must correspond with those already recorded with the registrar.

- By signing this document, you attest that, to the best of your knowledge, all of the details provided on this application are true.

Why do depository participants reject the DRF form?

Here are four common reasons for rejection:

- If the DRF lacks essential information or is incomplete, the DP may reject it. Incomplete information could lead to account inconsistencies, so be careful when filling out forms.

- In the event of a signature discrepancy, DPs will match and determine whether the signature on file with the one on the DRF is the same. If there is a significant difference, the request may be denied to prevent unauthorised access to the account.

- The DRF often requires supporting documents like proof of identity and proof of residence. The DP retains the authority to decline the request if these papers are either absent or do not meet the specified criteria.

- The request can be rejected because there is a discrepancy between the given names of the owners of the accounts on the DRF and the demat account. This ensures account transactions are secure and accurate.

Conclusion

The DRF form is essential to make the securities market more efficient. It allows investors to engage in electronic trading with ease and take advantage of the benefits of a digital, paperless financial environment.

Converting your physical certificates into their digital counterparts is hassle-free with DRF. However, it is only true when you are familiar with filling out the form diligently and providing the right documentation.

FAQs

The Dematerialisation Request Form (DRF) is used in the Indian share market to convert physical share certificates into electronic form. This process is part of the dematerialisation, which is facilitated by the two main depositories in India, NSDL and CDSL. Investors fill out the DRF to request their Depository Participant (DP) to dematerialise their physical shares, making them easier to trade, transfer, and maintain.

Submitting a DRF form online is not a direct process, as the physical certificates need to be surrendered. However, some DPs offer online facilities where you can download the DRF, fill it out, and then submit it along with the physical shares to the DP’s office. The actual dematerialisation process will be initiated by the DP after they receive the physical documents.

Firstly, contact your Depository Participant (DP) to obtain a DRF application form.

Secondly, fill in all the required details accurately on the DRF form.

Thirdly, submit the completed DRF form along with the physical share certificates to your DP.

Additionally, sign the form in the same order as the account holders’ names appear.

Ensure that the signatures match the specimen signatures recorded with the registrar for your demat account.

Yes, it is mandatory for most shareholders in India to convert physical shares into demat form. SEBI (Securities and Exchange Board of India) introduced this requirement to enhance transparency, reduce paperwork, and improve security in the share market. However, small private companies are exempt from this mandate. Remember to consult your Depository Participant (DP) or brokerage firm for specific instructions and any additional requirements related to dematerialisation.

Dematerialisation request form: The DRF is the primary document needed to initiate the dematerialisation process.

Physical share certificates: These certificates will be defaced by writing “SURRENDERED FOR DEMATERIALISATION.”

Client master list: This document provides details of your demat account, including your unique demat account number and other relevant information.

Identity proof: Your PAN card, Aadhaar card, or passport. This ensures that the shares are registered in your name.