Table of contents

Options trading provides many strategies to profit from different market conditions. One such approach is the long combo, which allows traders to potentially capitalise on an upside move in an underlying asset.

The long combo is an intriguing choice for bullish traders who either lack the capital or don’t have the risk appetite. Let’s understand the concept in detail.

Also read: Using options and derivatives in investment

What is the long combo option strategy?

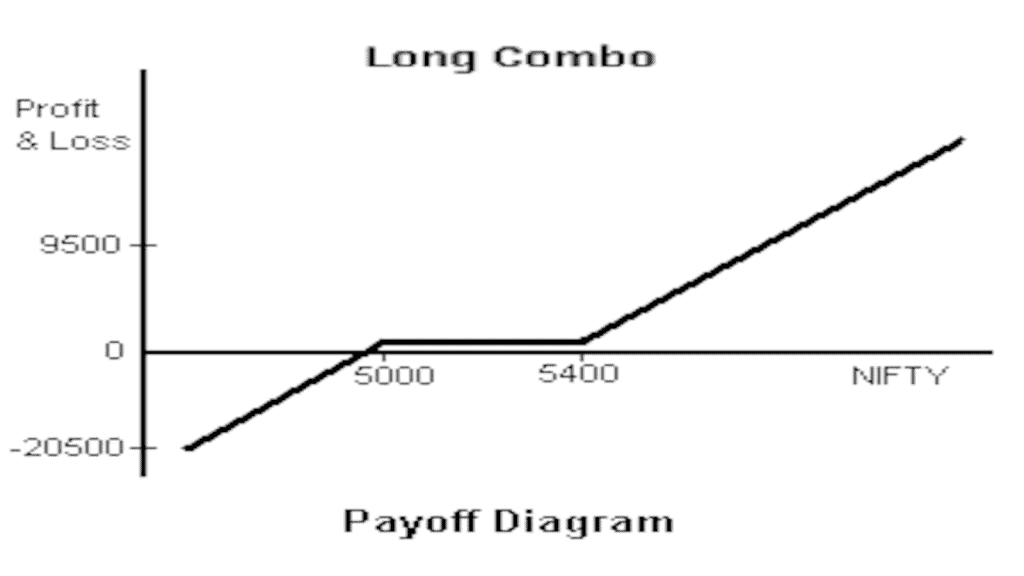

A bullish trading technique known as the “long combo” is used when a trader is holding onto a stock with the expectation of a price increase. The strategy includes buying an out-of-the-money call and selling an out-of-the-money put.

Both options have an identical expiration date and are for the particular underlying asset.

The strategy uses the difference in strike prices between the put and the call to provide some cushion if the price of the underlying asset drops. It’s often used as a temporary protection for a long position that already exists in the underlying asset.

The strategy is cost-effective because the premium from the sold put option helps offset the cost of the call option you’re buying.

Also read: The value add of exotic options trading

Example

Let’s understand the concept of the long combo option with a hypothetical example.

To implement such a strategy, a trader would sell an OTM 47200 put option for a premium of ₹655 and buy an OTM 47600 call option for ₹605 while the Bank Nifty is trading at 47,800 levels.

This approach would require a net investment of about ₹2500 for its execution. [(655-605) * 50 (lot size)].

Case 1: The investor would lose 20,050 [{ (655-605) + (46800 – 47200) * 50] if the Bank Nifty closes at 46800 and dips below the short put option at expiration, as opposed to increasing as expected.

Case 2: If the dealer predicts that the Bank Nifty will expire at 48100, the trader will receive 25,050 [{ (655-605) + (48100 – 47600) * 50].

How to enter and exit a long combo option?

The investor purchases an OTM call option contract and trades an OTM put option to initiate a long combo option. To use the technique, traders need a small amount of money. The premium collected from the sale of a put option offsets the premium paid to purchase the call option.

To enter the strategy:

- Purchase an OTM call option contract.

- Sell an OTM put option contract.

You can exit the strategy in one of two ways:

- When the value of the underlying asset increases, book your profit.

- By purchasing the short option contract and trading the long option contract, you may reverse the trade.

Also read: How to trade in options and maximise your profit?

Significance of long combo option strategy

The primary objective of the approach is to minimise downside risk while capitalising on an expected swing in the underlying asset’s value.

For some investors, the strategy has significant benefits that make it a desirable trade.

- As opposed to simply purchasing the asset, the long combo reduces downside risk by capping maximum loss at the net premium paid. In particular, the long put provides downside protection.

- Furthermore, compared to directly acquiring the asset, the method uses less capital to generate leveraged exposure. Leverage in options raises the potential profit from significant swings.

Drawbacks of the long combo option strategy

Now that we have covered the benefits of a long combo strategy, it is crucial to understand its drawbacks as well.

Unlimited risk: The long combo strategy comes with unlimited risk. Since the strategy involves selling an OTM put option, if the stock price drops, the trader faces potentially unlimited losses.

Premium loss: The premiums that are paid on the options might add to the total amount of loss that is incurred.

Conclusion

The long combo option strategy shines when traders anticipate a significant bullish move. By strategically selecting the strike prices of the out-of-the-money put option to sell and the out-of-the-money call option to buy, traders can tailor the strategy to their expectations of where the underlying asset’s price may head.

For traders who are confident in the underlying asset, this strategy is appealing since it offers a leveraged upside potential and takes less capital than investing directly.

FAQs

A long option strategy involves buying either a call option or a put option with the expectation that the underlying asset’s price will move significantly in a particular direction. Investors often use long call options when they anticipate an upward price movement and long put options when they expect a downward movement. These strategies allow traders to participate in the market without committing to owning the actual asset. However, it’s essential to manage risk, as the maximum loss is limited to the premium paid for the option.

A combo option trade combines both a long call option and a long put option on the same underlying asset. In India, this strategy is also known as a straddle. Traders use it when they expect significant price volatility but are uncertain about the direction. By buying both call and put options simultaneously, they aim to profit from substantial price swings. The risk lies in the combined premium paid for both options, so timing and market movement are crucial.

The safest option strategy often involves covered call writing. Here’s how it works:

The investor holds a long position in the underlying stock.

Simultaneously, they sell a call option (usually slightly out of the money) against their stock position.

The premium received from selling the call option provides downside protection.

If the stock price rises, the investor’s profit potential is capped, but they benefit from the premium income.

While profitability depends on market conditions and individual risk tolerance, some strategies tend to be more profitable:

Bullish markets: Bull call spreads (buying a lower strike call and selling a higher strike call) can be profitable during upward trends.

Bearish markets: Bear put spreads (buying a higher strike put and selling a lower strike put) may yield profits when the market declines.

Volatility: Iron condors (combining a call credit spread and a put credit spread) can be profitable in sideways markets with low volatility.

A long call option can be profitable. It gives the buyer the right (but not the obligation) to purchase shares of the underlying asset at a specific price (the strike price) on or before the expiration date. The potential profit is unlimited, while the maximum risk is limited to the cost of the option. To realise a profit, the stock price must exceed the strike price by at least the option’s premium.