For decades, commodity futures have played a crucial role in the world of finance. These distinctive financial tools allow traders and investors to engage in the price fluctuations of fundamental raw materials, including agricultural goods, energy sources, metals, and various other resources.

In this blog, we will delve into the world of commodity futures and explore what they are, how they work, and why they matter in today’s financial markets.

Also read:Stock Lending and Borrowing [Explained]

What are commodity futures?

Commodity futures are standardised contracts that obligate the buyer to purchase, and the seller to deliver, a specific quantity of a commodity at a predetermined price on a specified future date. These contracts provide a way for market participants to hedge against price fluctuations or speculate on the future price movements of various commodities.

Commodities available for trading are typically classified into distinct categories based on their inherent characteristics:

Hard commodities

- Precious metals: Examples include gold, platinum, copper, and silver.

- Energy resources: It has commodities like crude oil, natural gas, and gasoline.

Soft commodities

- Agricultural products: This category includes soybeans, wheat, rice, coffee, corn, and salt.

- Livestock: This category comprises commodities such as live cattle, pork, and feeder cattle.

In the Indian commodity exchanges, some commonly traded commodities include crude oil and silver. Crude oil is a critical energy source essential for various industries, while silver holds significant value as one of the most precious metals, second only to gold, and enjoys consistent demand.

How does a commodity futures contract work?

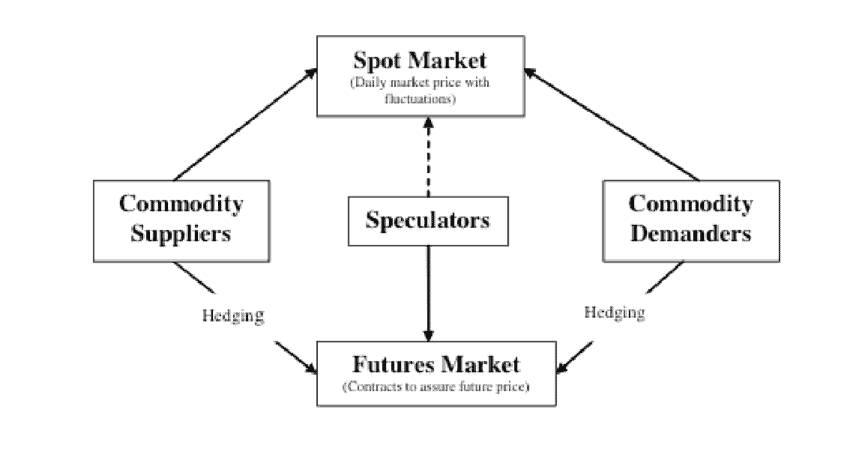

Commodity futures contracts typically conclude or offset their positions upon expiration, with the price difference between the initial trade and the closing trade. Commodity futures settle in cash. These contracts are commonly used for taking positions in underlying assets, presenting opportunities for both potential gains and substantial losses due to the significant price volatility of certain commodities.

Commodity futures and commodity forward contracts serve similar functions, but they differ in their trading environments. Futures and commodities trading happens on regulated exchanges and come with standardised contract terms, while forward contracts are traded over-the-counter (OTC) and feature customisable terms.

Speculators employ commodity futures contracts to make bets on the future price movements of the underlying asset. These contracts allow investors to take either long (buy) or short (sell) positions in the commodity. Leveraging plays a crucial role in commodity futures trading, as it enables investors to participate in these markets by committing only a fraction of the total contract value as margin with their broker. The required leverage degree can vary depending on the specific commodity and broker.

Also read: Risk management in stock market

Commodity futures example

Picture yourself as an oil producer. You know that in six months, you’ll have a lot of oil to sell, but you are worried the oil price might go down, hurting your profits. To protect yourself from this, you decide to use commodity futures contracts.

Here’s how it works:

You find someone who wants to buy your oil or is willing to bet on its price.

You both agree that you will sell 1,000 barrels of oil for $80 each in six months.

Let’s say it goes up to $70 per barrel in the next six months.

When those six months are up, you have to sell the oil for $80 each, even though it’s worth $70 on the market.

Now, here’s the deal:

If you didn’t use this contract, you’d have sold your oil for $70 each barrel. But because of the contract, you get to sell at the agreed price of $80, which means you make a profit even though the market price went down.

So, this example shows how commodity futures help people like you, the oil producer, secure a fixed price for your stuff, no matter how the market changes. Others, like traders, use these contracts to make bets on price changes and potentially make money.

How can you begin trading commodity futures?

To get started in commodity options trading, consider the following step-by-step guide on how to trade commodity futures online:

- Step 1: Select an online commodity brokerage firm that aligns with your needs and preferences.

- Step 2: Complete the Know Your Customer (KYC) process, as required for account opening.

- Step 3: Fund your trading account with the necessary capital.

- Step 4: Create a well-thought-out trading strategy that matches your risk

tolerance and financial objectives.

- Step 5: Once you have your plan in place, you can commence trading commodity futures.

Commodity trading is done only in futures and options. Each commodity has its lot size, which is the minimum quantity of a commodity that can be bought or sold. The tick size varies for different commodities. The upfront initial margin that you are required to pay when buying a commodity lot is 25% of the total contract value.

Keep in mind that commodity futures and options trading can be intricate and risky due to the inherent volatility of commodity prices and potential fraudulent activities in the market. It’s essential to gain a solid understanding of the market and have a clear strategy to manage your risks effectively and achieve your desired returns.

Also read: Do all technical analysis tools work equally well?

Why do future commodity markets matter?

Futures and commodity trading play a vital role in the global economy and financial markets for several reasons:

- Price discovery: Futures markets provide valuable price discovery mechanisms for commodities, helping producers, consumers, and investors gauge future price trends.

- Risk management: Producers of commodities use futures contracts to hedge price changes. For example, a farmer can hedge against falling crop prices by selling grain futures.

- Investment diversification: Commodity futures offer investors diversification opportunities beyond traditional asset classes like stocks and bonds.

- Economic indicators: Prices of commodities often serve as economic indicators. Changes in commodity futures prices can reflect shifts in supply, demand, and economic sentiment.

- Speculation: Traders and investors engage in commodity futures markets to speculate on price movements and potentially profit from their forecasts.

Conclusion

Commodity futures are a dynamic and essential component of the global financial system. They allow market participants to manage risk, discover prices, and diversify investment portfolios. Whether you’re a farmer looking to protect your crop’s value, an investor seeking portfolio diversification, or a trader aiming to profit from market trends, commodity futures offer a valuable avenue for achieving your financial goals in the ever-evolving world of commodities.