A trending market is a chance for investors to make profits. But how do traders determine their positions in a non-trending market?

A non-trending pattern is where the market is moving sideways, suggesting low volatility of prices. Since the price of securities is one of the prime determinants of trading strategies, the sideways market can be a confusing pattern for traders.

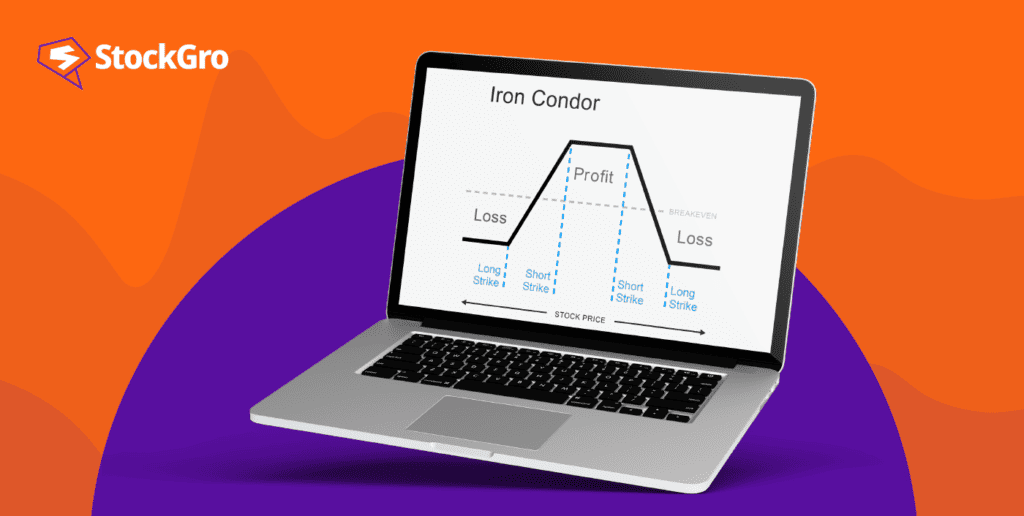

What is an iron condor?

The iron condor is an option trading strategy suitable for a market with low volatility.

Condor, in literal terms, means a vulture with huge wings. This strategy gets its name from the graphical representation resembling the vulture’s wings.

The iron condor is a strategy to trade four different options at different strike prices but having the same date of expiry. The strategy aims to minimise risks and losses.

You may also like: What is the strangle option strategy?

Components of the iron condor

- Call option – The option holder has the authority to purchase the stock. If the holder decides to exercise the right, the other party is obligated to sell.

- Put option – The holder has the option to right to sell the stock and the other party is obligated to buy the stock.

- Strike price – The original price of the options contract i.e., the pre-determined price agreed by both parties while entering into the contract.

- Spot price – Options are derivatives whose prices fluctuate based on the underlying asset. Spot price represents the current market price of the underlier.

- In the money – Price of underlier > Strike price

- Out the money – Price of underlier < Strike price

Understanding the iron condor strategy

A bullish trader assumes that the price of the asset will increase. So, the trader enters a call option with a choice to purchase the set at a price agreed earlier. If the market price increases as per the speculation, the trader buys it at a lower price, thereby making a profit.

A bearish trader assumes that the asset price will decrease. So, the trader buys a put option with the authority to sell the asset at a price agreed as per the contract. If the price of the asset decreases, the trader sells the asset at a higher price, making a profit.

A non-volatile market makes speculations difficult. Hence, traders enter into different contracts to hedge themselves from risks.

The four option contracts are:

- Sell a put option @ out-of-the-money

- Buy a put option @ out-of-the-money (Strike price lower than the sell option)

- Sell a call option @ out-of-the-money

- Buy a call option @ out-of-the-money (Strike price higher than the sell option)

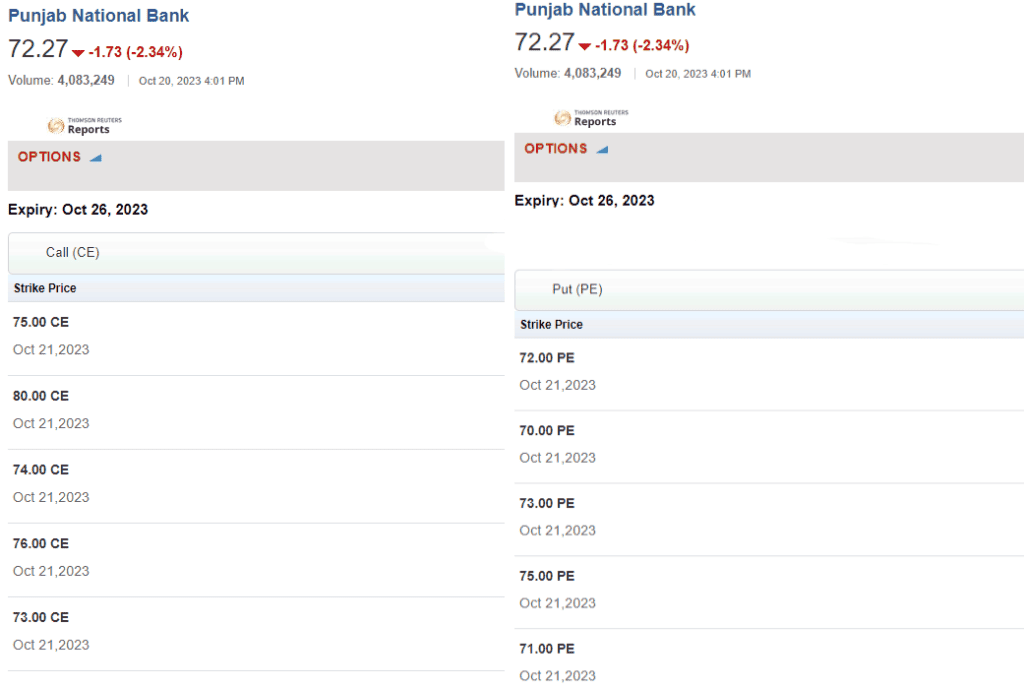

Take the example of the below stock option chain of Punjab National Bank listed on BSE as of 21 Oct 2023 with option contracts expiring on 26 Oct 2023.

So, a trader interested in iron condor may enter the below contracts:

- Sells a put option @ ₹71

- Buys a put option @ ₹70

- Sells a call option @ ₹74

- Buys a call option @ ₹76

Source: Moneycontrol

The first two contracts represent a bullish mindset where the trader expects an increase in the price of the underlying asset.

So, the trader first buys a put option and pays a premium to the options writer. Then, the trader enters into another options contract to sell a put option at a price higher than the buy contract.

Since the trader is the writer here, the premium received is higher, too. So, the difference between the two premium costs is a profit to the bullish trader.

Similarly, the next two contracts benefit the bearish trader.

The bull speculates a price rise and enters a call option to purchase the asset at a lower cost. If the price increases as speculated, the bull also exercises the call option to make additional profits apart from the premium.

Similarly, the bear assumes a decrease in market price and enters a put option to sell the asset at a higher price. If the price decreases as speculated, the bear exercises the put option to make additional profits apart from the premium.

Iron condor vs. iron butterfly

While the iron condor has four options with different strike prices, the iron butterfly uses the same strike price for both selling options.

The iron butterfly is a strategy used when traders are willing to take more risks in exchange for higher returns.

Short iron condor and long iron condor

Long condors are option strategies to handle a market of non-volatility by entering into four contracts with different strike prices, where the highest and the lowest strike prices are assigned to buy options.

Short condors are options strategies when the market is volatile but the direction is uncertain. Here too, there are four options with different strike prices where the lowest and the highest prices are associated with sell contracts.

Also Read: Iron fly strategy – A simplified guide with examples

Example of the iron condor strategy

Consider the price of stock ABC trading at ₹ 100 in the market.

You enter into an options contract using the iron condor option strategy.

- You buy a put option for ₹ 100 at a strike price of ₹ 80.

- You sell a put option for ₹ 150 at a strike price of ₹ 90.

- You sell a call option for ₹ 150 at a strike price of ₹ 110.

- You buy a call option for ₹ 100 at a strike price of ₹ 120.

Your initial profit is ₹ 100 (150+150-100-100).

Case 1:

Assume that the market price of the stock during the expiration of the contract is at ₹ 105.

- The first option is invalid as you will incur a loss, since the market price to sell is ₹105, while the strike price is ₹ 80.

- The second option is invalid as your counterpart wouldn’t sell the stock at ₹90 when the market price is 105.

- The third and fourth options are invalid, too, as neither of you would buy the stock at ₹ 110 or ₹ 120 when the market price is ₹ 105.

So, your final profit stands at ₹ 100.

Case 2:

Assume a scenario where the market price went up to ₹ 140.

You exercise the fourth option and buy the stock at ₹120, making a profit of ₹ 20.

Your overall profit, in this case, stands at ₹ 120 (100+20)

Case 3:

Assume a scenario where the market price is ₹ 80.

The last two options are invalid as the strike price to buy is higher than the spot price. The second option is valid since the buyer of the contract can sell the stock at ₹90 when the market price is 80.

Here, you incur a loss of ₹ 10, and your overall profit stands at ₹90 (100-10).

Also Read: What is a straddle option strategy?

Summing up

The iron condor is a strategy that is complex to understand. However, it is one of the most popular techniques among option traders. In a market with low volatility, determining the correct strike prices for the iron condor strategy is the trick to earn profits.