Table of contents

Know the tricks of the trade used by professional option traders to make profits in an indecisive market.

The iron condor is an option trading strategy suitable for a market with low volatility. Condor, in literal terms, means a vulture with huge wings. This strategy gets its name from the graphical representation resembling the vulture’s wings.

What is an iron condor?

The iron condor option strategy is a technique to trade four different options at different strike prices but having the same date of expiry. The strategy aims to minimise risks and losses.

Components of the iron condor

- Call option – The option holder has the authority to purchase the stock. If the holder decides to exercise the right, the other party is obligated to sell.

- Put option – The holder has the option to right to sell the stock and the other party is obligated to buy the stock.

- Strike price – The original price of the options contract i.e., the pre-determined price agreed by both parties while entering into the contract.

- Spot price – Options are derivatives whose prices fluctuate based on the underlying asset. Spot price represents the current market price of the underlier.

- In the money – Price of underlier > Strike price

- Out the money – Price of underlier < Strike price

Understanding the iron condor strategy

Suppose, a bullish trader assumes that the price of the asset will increase. So, the trader enters a call option with a choice to purchase the set at a price agreed earlier. If the market price increases as per the speculation, the trader buys it at a lower price, thereby making a profit.

A non-volatile market makes speculation difficult. Hence, traders enter into different contracts to hedge themselves against risks.

The four option contracts are:

- Sell a put option @ out-of-the-money

- Buy a put option @ out-of-the-money (Strike price lower than the sell option)

- Sell a call option @ out-of-the-money

- Buy a call option @ out-of-the-money (Strike price higher than the sell option)

Iron condor strategy example

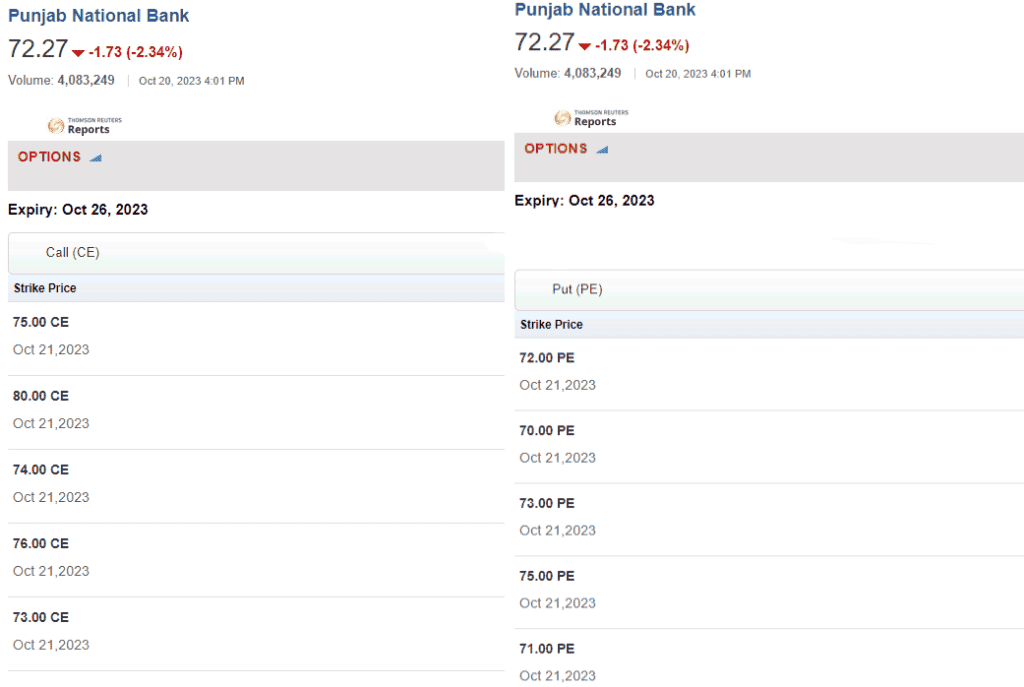

Take the example of the below stock option chain of Punjab National Bank listed on BSE as of 21 Oct 2023 with option contracts expiring on 26 Oct 2023.

So, a trader interested in iron condor may enter the below contracts:

- Sells a put option @ ₹71

- Buys a put option @ ₹70

- Sells a call option @ ₹74

- Buys a call option @ ₹76

The first two contracts represent a bullish mindset where the trader expects an increase in the price of the underlying asset.

So, the trader first buys a put option and pays a premium to the options writer. Then, the trader enters into another options contract to sell a put option at a price higher than the buy contract.

Since the trader is the writer here, the premium received is higher, too. So, the difference between the two premium costs is a profit to the bullish trader.

Similarly, the next two contracts benefit the bearish trader.

The bull speculates a price rise and enters a call option to purchase the asset at a lower cost. If the price increases as speculated, the bull also exercises the call option to make additional profits apart from the premium.

Similarly, the bear assumes a decrease in market price and enters a put option to sell the asset at a higher price. If the price decreases as speculated, the bear exercises the put option to make additional profits apart from the premium.

Iron condor vs. iron butterfly

While the iron condor has four options with different strike prices, the iron butterfly uses the same strike price for both selling options.

The iron butterfly is a strategy used when traders are willing to take more risks in exchange for higher returns.

Short iron condor and long iron condor

Long condors are option strategies to handle a market of non-volatility by entering into four contracts with different strike prices, where the highest and the lowest strike prices are assigned to buy options.

Short condors are options strategies when the market is volatile but the direction is uncertain. Here too, there are four options with different strike prices where the lowest and the highest prices are associated with sell contracts.

Summing up

The iron condor is a strategy that is complex to understand. However, it is one of the most popular techniques among option traders. In a market with low volatility, determining the correct strike prices for the iron condor strategy is the trick to earn profits.

FAQs

The iron condor is a popular options trading method and is considered a good strategy when the market is expected to exhibit low volatility, as it allows traders to potentially profit from the stability of the underlying asset’s price. The iron condor involves selling out-of-the-money (OTM) call and put spreads, which means the trader collects premiums upfront. The strategy is most effective when the underlying asset’s price remains within the range of the strike prices until expiration.

No trading strategy is entirely risk-free, and the iron condor is no exception. While it offers a defined risk profile due to its structure as a credit spread strategy, there is still the potential for losses. These losses can occur if the underlying asset’s price moves significantly outside the expected range, affecting the sold call and put spreads. Traders need to be aware of the risks and actively manage their positions to mitigate potential losses.

The iron condor strategy comes with several disadvantages. Firstly, it can incur higher trading fees because it involves multiple transactions. Secondly, the strategy is complex and requires a deep understanding of options trading mechanics. Thirdly, the maximum profit potential is capped at the net premium received, which can limit the upside compared to other strategies. Additionally, managing an iron condor can be time-consuming, and traders may have difficulty getting fills in certain market conditions.

Timing the sale of an iron condor is crucial. It is generally best to sell when the implied volatility of the options is high, which inflates the option prices and allows for collecting a higher premium upon selling. This typically occurs during periods of market uncertainty or ahead of major news events that can cause volatility. The trader must balance the desire for a higher premium with the risk of increased volatility potentially moving the underlying asset’s price outside the desired range.

Whether to let an iron condor expire or not depends on the position of the underlying asset’s price relative to the strike prices of the sold options. If the price is comfortably within the range and there is no risk of either side being breached, it might be beneficial to let the iron condor expire worthless, allowing the trader to keep the full premium collected.