Table of contents

Protecting options calls in various ways is possible by implementing simple strategies. Read on to learn how to protect your capital completely.

In the world of options trading, zero loss options strategy can be made with periods and both call and put options to create a spread that would not only provide profit but also give protection from any downside of the value of the underlying stock.

What is a zero-cost collar?

A zero-cost collar strategy involves buying out-of-the-money puts and selling out-of-the-money calls. The premium from the sold call offsets the cost of the purchased put, reducing risk and making the strategy costless.

When a borrower opts for a zero-cost collar, they set a cap strike rate to limit the maximum interest rate they have to pay. However, in return, they agree to pay a floor strike rate, which ensures a minimum zero-cost collar interest rate.

Use of zero-cost collar

This strategy is most useful when the “put” option is along with an “out-of-the-money” covered call. The premium received in the “call” option is the same as the premium paid in the “put” option. This “collar” is used as protection in long positions.

- It is essential to understand that while this strategy will limit your downside risk, traders should be ready to have less and limited upside gains. Applying this strategy limits the gains on a stock’s earning potential.

- It is essential to note other charges, such as bid-ask differences, trading charges and other taxes. They add to the overall cost of the trade.

- The zero-cost collar trade is one of the most complicated types of options trading. Hence, traders should attempt it only if they have the time to monitor this market movement.

Zero-cost collar example

A trader owns 100 shares of ABC company and trades at Rs 50 per share on the exchange. He wants to avoid any fall in the value of this portfolio, so he purchases a “put” option with a strike price of Rs 45 and sells a “call” option with a strike price of Rs 55. Thus, when the stock price falls to Rs 45, he can exercise the put option at Rs 45, but if the stock rises, his upside is limited to Rs 55.

How will the options P&L move?

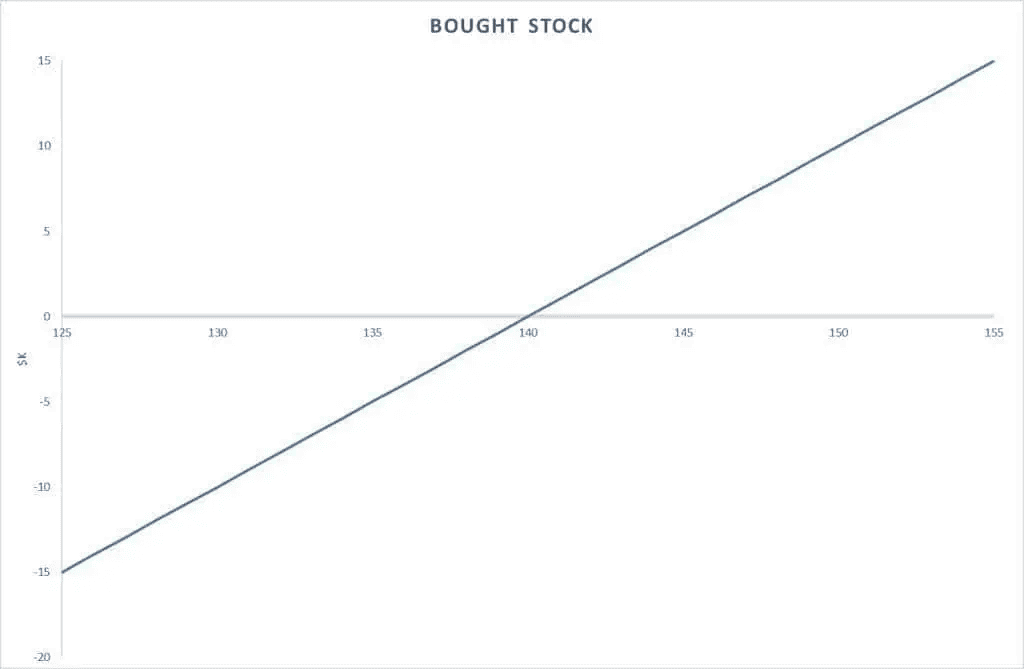

Let us see the diagrammatic representation of the trades with an example. If a trader purchases 100 shares of ABC company trading at Rs 140 per share, the P&L looks like the following –

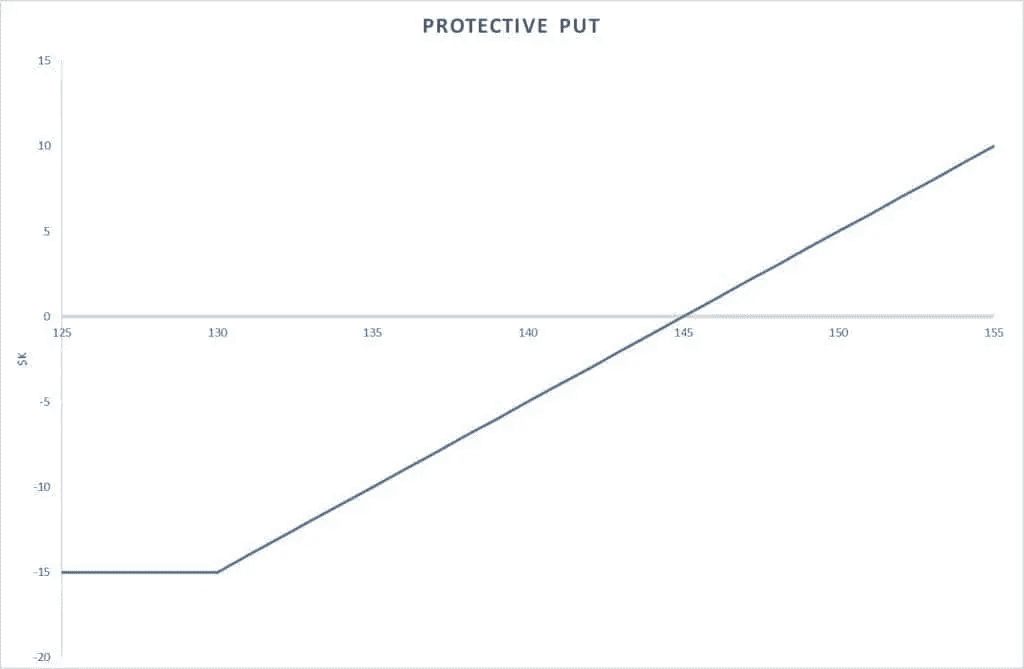

The trader can decide to limit the risk by buying 130 “put” options at the price of Rs 5 per share.

The new P&L will look at follows –

While the stock falls below Rs 130, it will limit the loss to Rs 15. But the Rs 5 “put” premium has caused the position’s breakeven to rise from Rs 140 to Rs 145. Thus, for the cost of option protection to work, the stock value has to rise from its current Rs 140 to Rs145.

The trader can overcome this cost by selling an “out-of-the-money”150 “call” option for Rs 5.

This opposing trade will offset the purchased “put” option cost. The flip side to this is the rise in stock price above Rs 150 will not be of any use.

This is a “zero-cost collar” with both loss and gain limited to Rs 10.

Benefits of zero-cost collar

The primary benefit of this strategy is protecting a stock’s loss potential at zero net cost.

Zero-cost collars help employees with vested stocks protect their valuation by offsetting future price fluctuations within a set range.

This strategy will still allow the trader/investor to keep accumulating dividends, unlike other option strategies.

Disadvantages of zero-cost collar

This is a cashless mechanism to lower risk with zero to low gains with an opportunity cost. The decision of length of time to keep the collar in place is also a tricky one. It involves the use of knowledge about market movements of the stock and awareness of any important related happenings.

The main disadvantage is the limited gain potential of the stock position once a collar has been put on. It is a complex spread with two option positions with each of its trading costs and premiums.

One practical limitation is that the premiums of appropriate puts and calls will normally not be as equal as our example. The out-of-the-money puts have relatively high implied volatility, thus affecting the price and cost of the position.

Should you use a zero-cost collar?

It is a great strategy to customise depending on an individual’s risk capacity and investment goals. The limits of the collar can be with a wide range if you are a conservative trader and if you wish to go aggressive, you can take a narrow range. This strategy can also be combined with other trades – protecting long-term investments while indulging in short-term risk-taking.

Conclusion

While option spreads are commonly used – knowing where to minimise costs is a great asset in building a successful options portfolio. The zero-cost collar is a complicated yet much-needed quiver in the arsenal of an options trader to create multiple combinations of strategies.

FAQs

A costless collar, also known as a zero-cost collar, is an options strategy used to hedge against volatility in an asset’s prices. It involves selling a short-call option and buying a long-put option. The prices of these two options cancel each other out, resulting in no net cost. This strategy limits potential losses but also caps profits if the asset’s price increases.

A zero-cost strategy refers to a decision that doesn’t entail any expense to execute. It costs a business or individual nothing while improving operations, making processes more efficient, or reducing future expenses. Investing involves creating a portfolio with no upfront costs and using financial instruments like options, stocks, and bonds to offset the costs of other investments.

A three-way collar is a strategy often used in oil and gas hedging. It involves three steps:

Buying a put option: This establishes a floor price below which the producer is protected from further price drops.

Selling a call option: This sets a ceiling price, above which the producer does not benefit from further price increases.

Selling a further out-of-the-money put option (also known as a subfloor): This is what differentiates a traditional collar from a three-way collar.

The net premium of a three-way collar is determined by the sum of each option leg. The three-way collar can provide oil and gas producers with a “lower cost” – and in some cases, revenue positive – hedge structure due to the sale (short) of an additional, further out-of-the-money put option or subfloor1. However, the producer is also taking on additional risk, specifically the risk that prices will not decline and settle below the price of the subfloor.

The FX collar strategy is a risk management technique used in Forex trading. It involves buying a protective put option and selling a covered call option on the same currency pair. This strategy limits both potential losses and gains. It’s used to hedge against short-term volatility while still allowing for potential profits. The strategy caps the potential profit at the call option’s strike price.

The butterfly strategy is a market-neutral options strategy that combines bull and bear spreads. It involves four options contracts with three different strike prices: a higher strike price, an at-the-money strike price, and a lower strike price. This strategy is designed to earn a limited profit when the future volatility of the underlying asset is expected to be low.