Table of contents

Confused about Section 194J? Get clarity on applicability, rate, due dates, and the types of professional services covered here!

Ever hired a lawyer, a consultant, or even a doctor? Believe it or not, the Indian government might take a small slice of that fee! Section 194J of the Income Tax Act deals with TDS, i.e., tax deducted at source concerning professional fees and technical services.

Let’s take a look at what this section is, who it applies to, fees and due dates and other details. If you are paying fees as a business owner or a professional receiving them – understanding section 194J can save you time and headaches.

What is section 194J of the Income Tax Act?

Imagine that you have hired a chartered accountant or lawyer. In India, the payer (who pays the fees) must deduct some money from the bill for tax reasons. This is a provision in India called TDS (tax deducted at source).

This section talks about this rule for professional fees and technical services. Here is the gist:

- Persons/companies (not every individual or HUF) need to withhold this tax.

- They need to take out a small percentage of the fee before paying the professional or technician.

- The exact percentage depends: it is usually 10% or 2%, depending on the service.

- If the professional/technician does not provide their PAN, the business has to withhold more (20%).

This way, the government collects some tax right away instead of waiting for the professional to file their tax return. The professional will get the withheld amount back when they file their taxes, if applicable.

Also read: Section 80M: Boosting Business with Tax Solutions

Who deducts tax?

Here, a person means:

- Central/state government

- Companies/firms

- Local authorities

- Trusts

- Registered societies

- Cooperative societies

- Universities

- An individual or a HUF who gets accounts audited u/s 44AB (a) and (b)

Types of services covered

Here are some services covered under section 194J of the Income Tax Act 1961:

- Any fee received for technical or professional services

- Any royalty received

- If a director who is not liable to TDS u/s 192 receives a fee/commission or remuneration.

List of technical and professional services

Some of the professional services included under section 194J of Income Tax are:

- Engineering services

- Advertising services

- Medical services

- Accountancy and consultancy services

- Interior decoration services

- Legal services

A few technical services include:

If someone has received any consideration for providing services like

- Technical

- Managerial or

- Consultancy services

Must read: Section 206AB of the Income Tax Act – TDS for Taxpayers Not Filing of ITRs

Threshold limit for deducting tax

If the payment to a professional or technician for their services exceeds ₹30,000 in a year – then only tax will be deducted.

Remember that this limit will apply to each payment independently.

For instance, let’s say a company made the following payments to “Mr X”.

| Particulars | Amount (₹) |

| For technical services | 24,000 |

| For professional services | 28,000 |

| Total payment | 52,000 |

Here, you might think that the total payment exceeds ₹30,000, so tax will be deducted, but that’s not the case. Since independent payments do not exceed ₹30,000 – no tax will be deducted.

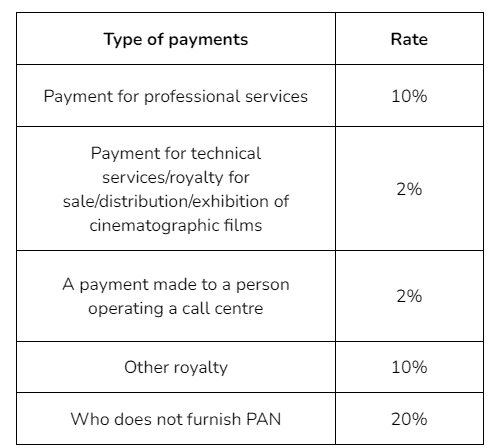

Rate of TDS under section 194J of Income Tax

| Type of payments | Rate |

| Payment for professional services | 10% |

| Payment for technical services/royalty for sale/distribution/exhibition of cinematographic films | 2% |

| A payment made to a person operating a call centre | 2% |

| Other royalty | 10% |

| Who does not furnish PAN | 20% |

Source: Income Tax Department

This rule says you need to deduct tax whichever comes first:

- When you record the expense in your accounts (like entering it in your business bookkeeping).

- When you actually pay the professional/technician.

You may also like: Section 234B of the Income Tax Act – Interest for Default in Advance Tax Payment

Due date of TDS under section 194J of the Income Tax

Deadlines for depositing this tax with the government are as follows:

| Particular | Time limit to deposit TDS |

| If you pay the amount in the month of March | The tax needs to be deposited by April 30th. |

| Other than March | You need to deposit the tax within seven days of the end of that month. |

Source: Income Tax Department

Conclusion

In short, section 194J of the Income Tax Act keeps things smooth for both businesses and professionals in India when it comes to taxes on professional/technical fees.

Businesses might need to hold onto a small part of the fee upfront to send to the government. This ensures the government gets its share and reduces paperwork later. But professionals/technicians can get it back when they file their taxes.

The key thing is – understanding this section saves you time and headaches!

FAQs

If you hire a professional/technician – then there is a rule that says the person paying the fees needs to withhold a bit of money for taxes upfront (TDS or Tax Deducted at Source). A person or a company (not every individual/HUF) needs to withhold this tax. The exact percentage of TDS depends: it is usually 10% or 2%, depending on the service. If the professional/technician does not provide their PAN, then the rate is 20%.

Here are the TDS rates:

Consultancy services fall under professionals’ work. This means it comes under section 194J of the Income Tax Act. In case you make any payment to any professional, then you are required to deduct TDS accordingly as per this section. Under this section, the TDS rate for consultancy services is 10%, but when PAN isn’t provided; it becomes 20%.

If the payment to a professional or technician for their services exceeds ₹30,000 in a year – then only tax will be deducted. Remember that this limit will apply to each payment independently.

For instance, let’s say a company made the following payments to “Mr X”. For technical services: ₹20,000 and for professional services: ₹28,000. The total payment is ₹48,000.

Since independent payments do not exceed ₹30,000 – no tax will be deducted.

Some of the professional services included under section 194J of Income Tax are:

Engineering services

Advertising services

Medical services

Accountancy services

Interior decoration services

Legal services

A few technical services include:

If someone has received any consideration for providing services like

Technical

Managerial or

Consultancy services