Table of contents

Have you ever heard financial experts say: “The company’s EBITDA turns positive despite net profit falling”?

EBITDA: Core metric revealing the company’s profitability sans interest, taxes, depreciation, and amortisation.

Everyone relies on this metric as a compass to gauge the company’s potential, from investors to stakeholders to analysts. In this blog, we will understand EBITDA in detail, its formula, its significance, its limitations and more.

Decoding EBITDA: The key financial metric

EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortisation, is a financial measure used to evaluate a company’s operational performance, excluding taxes, interest, and non-cash expenses like depreciation and amortisation.

This ratio indicates a company’s core operational earnings, excluding non-operational expenses.

EBITDA is a neutral measure of profitability as it excludes factors like capital structure, debt, and taxes.

EBITDA excludes non-cash items like amortisation and depreciation, which do not impact dividend payments.

EBITDA isn’t GAAP-compliant, and there have been concerns about companies inflating their metrics to show higher profitability. It’s best used alongside other metrics for a comprehensive financial analysis.

Breaking down EBITDA: Exploring its components

Let’s break down the various components of EBITDA for a clearer understanding of this metric:

E for earnings:

“Earnings” typically means either Net Income or Operating Income, where Net Income reflects earnings after deducting taxes and interests, while Operating Income is revenue minus operating expenses.

B for before:

In this context, it signifies that the earnings considered are before any expenses or costs.

I for interest:

Interest expenses directly affect operational profit, providing a clearer view of profitability by excluding the distortion from debt servicing, and ensuring a more accurate financial assessment.

T for taxes:

Excluding taxes provides a clear view of operational performance, free from tax complexities.

Taxation, being jurisdictional, doesn’t reflect management and operational performance, so it’s added back to cash flow for fair comparisons between businesses.

D for depreciation:

Depreciation represents the cost of tangible assets over their useful life and is excluded from profitability calculations.

A for amortisation:

Amortisation accounts for the cost of intangible assets over their useful life and is excluded from profitability calculations.

Note: Both D and A are passed for investments and not current expenses. These expenses are calculated assuming an asset’s salvage value, depreciation, and economic life, making it a non-cash expense. Therefore, it is added back to the cash flow.

Crunching the numbers: How to calculate EBITDA effectively

Here are two simple formulas to use:

Using operating income or EBIT:

EBITDA = EBIT or Operating income + Depreciation + Amortisation

Using Net Income:

EBITDA = Net income + Interest + Taxes + Depreciation + Amortisation

While calculating it from financial statements, you can find the earnings, taxes, and interest in the income statement. Whereas the depreciation and amortisation in the cash flow statement or the notes to operating profit.

Example of Calculating EBITDA

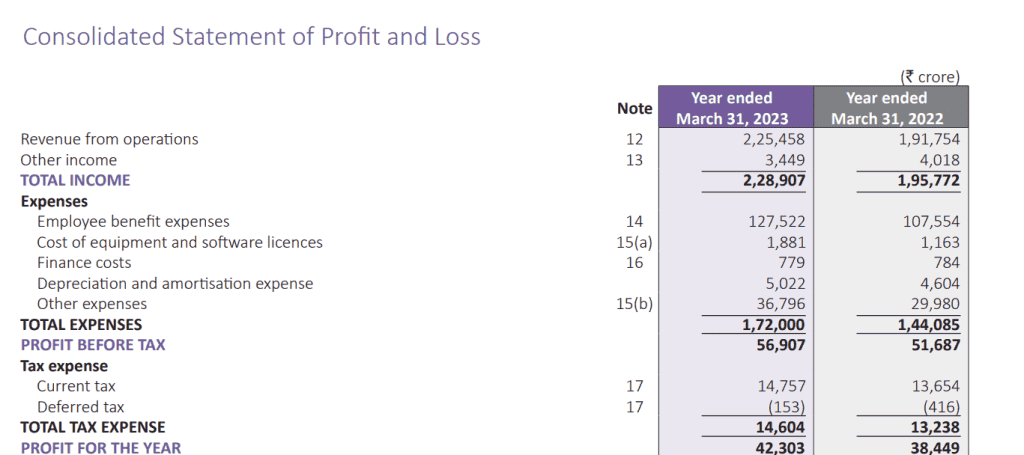

Let’s take the example of TCS.

Let’s calculate using operating income or EBIT:

EBITDA = EBIT or Operating income + Depreciation + Amortisation

Operating income = Revenue from operations – Cost of goods sold (COGS) – Operating expenses – Depreciation – Amortisation

Operating profit = 228907 – 127522 – 1881 – 5022 – 36796 = Rs. 57,686

EBITDA = 57686 + 5022 = Rs. 62,708

Using Net Income:

EBITDA = Net income + Interest + Taxes + Depreciation + Amortisation

EBITDA = 42303 + 779 + 14604 + 5022 = Rs. 62,708

Significance of EBITDA

Comparing companies:

EBITDA is a standardised metric for comparing companies of similar size within the same industry, facilitating easy analysis of profit generation from core operations.

Debt assessment:

EBITDA informs about operational results, aiding the assessment of debt service capabilities.

Investment decision-making:

EBITDA is a crucial financial measure for investors when deciding on investments. EBITDA offers a comprehensive view of a company’s operational success and profitability, excluding tax and interest payments, allowing for a more accurate investment assessment.

Limitations of EBITDA

Ignoring capital structure and taxes:

This overlooks key concerns by excluding capital structure and tax responsibilities, critical variables in assessing a firm’s overall operational and financial health. It makes the company appear less costly, complicating long-term value assessment for investors.

Exclusion of certain costs:

EBITDA facilitates easy company comparison by excluding taxes, interest, depreciation, and amortisation, focusing solely on operational success and management competence.

But, in the long run, it falls short of providing a fuller picture of a company’s financial health.

Misinterpretation:

EBITDA lacks standardised calculation, resulting in variations across companies and industries, leading to discrepancies and hindering effective comparison and decision-making.

Conclusion

When it comes to financial analysis, EBITDA acts as a significant ally in comparing the company’s profitability and operational strength. It helps compare the company’s financial insights, allowing better decision-making for the investors.

Though EBITDA is a great strategic tool, it does have its share of limitations, which you must consider. Therefore, you need to use this metric along with financial metrics like gross margin, net income, and EBIT to make an informed decision.

FAQs

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortisation) was introduced by billionaire investor John Malone. He invented it in the 1970s to focus on the cash-generating ability of a business before interest payments, taxes, and depreciation or amortisation charges. This approach was unconventional at the time.

To calculate EBITDA in Excel, start by importing your company’s financial data. Then, locate the EBIT (Operating Income) on the income statement. Find Depreciation and Amortisation on the statement of operating cash flows. Add these values together to arrive at EBITDA.

If EBITDA is negative, it indicates that a company’s operating activities are not generating enough revenue to cover its operating expenses. This could be due to high costs, low sales, or both. It’s a sign of poor cash flow and potential financial difficulties. It’s important for the company to identify and address the issues causing the negative EBITDA.

No, EBITDA and Gross Profit are not the same. Gross Profit measures the profit a company makes after subtracting the costs associated with making its products or providing its services. EBITDA, on the other hand, shows earnings before interest, taxes, depreciation, and amortisation. They are designed to measure different aspects of a company’s profitability.

The Profit & Loss (P&L) statement, also known as the income statement, provides a comprehensive overview of a company’s revenues, costs, and expenses to calculate net income. EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortisation), on the other hand, is a specific measure of operational profitability, focusing on earnings from core business operations before accounting for interest, taxes, and non-cash expenses. They serve different purposes in financial analysis.