Table of contents

When investing in mutual funds, most people are familiar with the basic concept of pooling money that gets invested across different securities by a professional fund manager. However, not many investors are aware of the various ‘share classes’ that mutual funds offer.

Share classes determine the fees you pay as an investor, which can significantly impact your overall returns in the long run. They may also come with different voting rights.

Understanding mutual fund share classes

Different mutual funds have separate classes that reflect the types and fees associated with their shares, similar to how stock classes reflect the total amount of voting rights per share. Shares in most mutual funds are available in a variety of classes that meet investors’ preferences and objectives.

A, B, and C are the three distinct share classes in mutual funds. There is no differentiation between the various share classes; all invest in the same underlying assets, with related investing goals and policies. What differentiates each class is the timing and amount of fees, which have a significant effect on the performance of investments over the long run.

For example, your entire cost of purchase is invested on your behalf if there is no sales charge when you invest in the fund. However, if you spend more on fees during the investment’s lifetime, your return may be lower in the end.

Every kind of share has its own set of expenses. There is a different pricing structure for each class of shares. You need to be aware that the mutual fund may impose a sales load on certain share classes, in addition to charging fees like 12b-1 fees or redemption fees, all of which might have an effect on your investment return in the long run.

Example of share classes

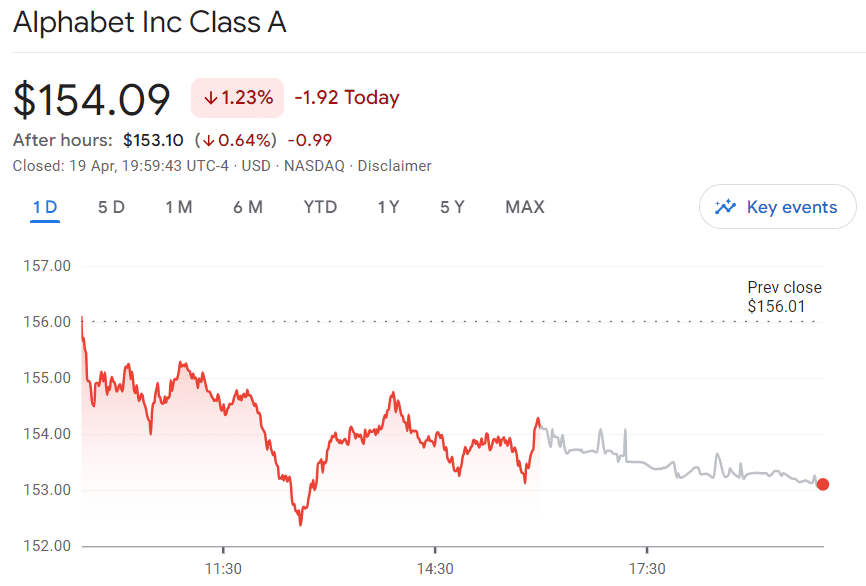

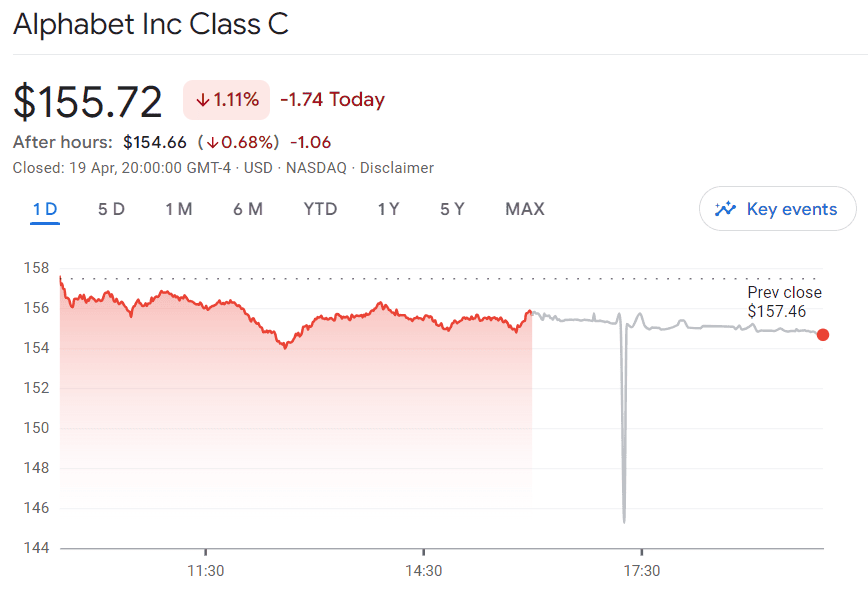

To understand the concept of share classes, we may look at Google’s parent company, Alphabet. Alphabet has two distinct share classes that are traded using separate ticker symbols: GOOGL and GOOG.

Alphabet’s stock, GOOGL, is classified as a class A share. GOOGL can be held by an ordinary shareholder with ordinary voting rights.

GOOG represents the Class C shares of the corporation. Class C shares, similar to Class A shares, offer investors an ownership stake in the business but do not provide them voting rights.

Class A, Class B, and Class C shares are available in countries with developed stock markets, like the United States and the UK, that allow companies to issue shares with different rights and benefits. The concept of Class A and Class C shares is not as common in India as it is in these countries.

What is A share mutual fund?

An A share is a popular share class that requires you to pay an upfront sales charge or a front-end load when you invest in the fund. The charge may vary based on the fund, but it often falls between 3% and 5%. Additional fees may be required for Class A shares as well. For instance, the fund’s cost ratio includes things like the 12b-1 fee.

In unstable public markets, it is common practice to use Class A shares to offer voting rights to a company’s management committee.

Other types of mutual fund share classes

Class B shares: This share class does not have as many voting rights in corporate affairs as Class A shares. In terms of advantages, they are comparable to second-best shares. Compared to other shares, the front-end load of these is low. Additionally, investors are not required to pay the back-end load as long as they keep their investments for an extended period.

Class C shares: In most mutual funds, class C shares frequently have lower expense ratios than class B shares. However, their expense ratios are greater than class A shares, with an annual fee of around 1%.

Class D shares: Class D mutual funds, sometimes known as no-load funds, do not charge any transaction fees when purchased or sold.

Only the 12b-1 charge and the annual expense ratio are payable in this case. As a result, Class D shares are much more cost-effective for short- and long-term investments compared to the other classes.

Types of Class A shares

- Traditional Class A shares

The owners of these shares are usually insiders, and they come with benefits, including greater voting power.

- Technology Class A shares

The public may buy and sell these shares on public exchanges; each share is equal to one vote. In these cases, insiders own the non-publicly traded class B shares, which often have 10 times the voting power. On the other hand, Class C shares are held and traded openly but do not have voting rights. The Google Share class is a well-known example among tech companies.

- Expensive Class A shares

Individual investors often cannot afford them, although theoretically, these shares are held and sold by the public. Instead of a stock split, businesses create Class B shares and sell them at a lower price than Class A shares. Class B shares have limited voting power, which is a drawback in this case.

Importantly, no rule says a particular class of shares must have an equal price and voting power. Class A shares may cost ₹4,000 and have one vote each, whereas Class B shares may cost ₹600 and have one vote each.

Class A shares vs C shares mutual funds

| Feature | Class A shares | Class C shares |

| Front-end load | May have a front-end load. | There is no front-end load but may involve a back-end load if shares are sold within a year of purchase. |

| Expense ratio | Lower expense ratio. | Higher expense ratio, which can diminish returns over time. |

| Voting rights | Most voting rights. | There are no voting rights. |

Conclusion

Investors need to carefully consider each class since they come with a distinct set of features, fees, and rights.

They may better achieve their financial goals by making informed decisions when they know the distinctions between different classes, like Class A, which comes with voting rights, and Class C, which is ideal for short-term investments.

FAQs

The decision to buy Class A or Class C shares depends on your investment goals and preferences. Class A shares typically offer more voting rights and may have priority in dividend payments, making them suitable for investors who wish to have a greater say in company decisions. Class C shares, on the other hand, usually do not offer voting rights but may be more accessible due to their lower price.

Yes, Class A shares do pay dividends, and in some cases, they may have priority over other classes of shares when it comes to dividend payments. In India, dividends are paid out to shareholders based on the company’s performance and dividend policy, and Class A shareholders are often at the top of the list to receive these payouts. However, it’s important to note that not all companies pay dividends, and the amount can vary from year to year.

Whether Class A or B stock is better depends on what you’re looking for as an investor. Class A stocks generally have more voting rights than Class B stocks, which can be advantageous if you want to influence company decisions. Class B stocks might have fewer voting rights but can offer other benefits, such as lower prices or fewer restrictions.

In some cases, Class B shares can convert to Class A shares, particularly if held for a long period of time. This conversion can provide long-term investors with the benefits associated with Class A shares, such as increased voting rights or higher priority in dividend payments. However, the specifics of conversion will depend on the company’s policies and the terms of the shares at the time of purchase.

Companies issue different classes of shares primarily to diversify ownership and control. By creating classes with differential voting rights, companies can raise capital without significantly diluting the control of existing shareholders. Additionally, different classes of shares can cater to various investor preferences, offering options with different dividend rights or redemption terms.