Table of contents

The mutual fund industry in India is experiencing rapid growth, with assets under management projected to increase significantly from $0.66 trillion in 2024 to an impressive $1.51 trillion by 2029, as per the research conducted by Mordor Intelligence. In this growth, an investment vehicle that is attracting attention is the interval mutual fund.

Imagine a fund that combines the best of both worlds – the flexibility of open-ended funds and the stability of closed-ended ones. That’s precisely what an interval fund provides!

In this article, we’ll explore the intriguing sphere of interval funds, examining their functioning, their advantages and much more!

What is an interval fund?

A balanced mix of open-ended and closed-ended funds, interval funds, have unique features that distinguish them apart from more conventional mutual funds. Debt and equity investments are both viable options for these funds.

However, these investments have limited liquidity and can only be bought and sold at specific times. Investors typically utilise interval funds to allocate their capital to debt funds.

Here is a list of a few of the interval funds in India:

| AUM (₹ crores) | YTD return | 5Y return | |

| Aditya Birla Sun Life Interval Income Fund – Quarterly Plan – Series 1 – Direct Plan-Growth | 268.74 | 0.43% | 5.32% |

| Nippon India Interval Fund – Quarterly – Series 2 – Direct Plan-Growth | 82.89 | 0.40% | 5.41% |

| UTI Annual Interval Fund – II – Direct Plan-Growth | 12.11 | 0.39% | 4.95% |

| UTI Annual Interval Fund – I – Direct Plan-Growth | 20.96 | 0.36% | 4.37% |

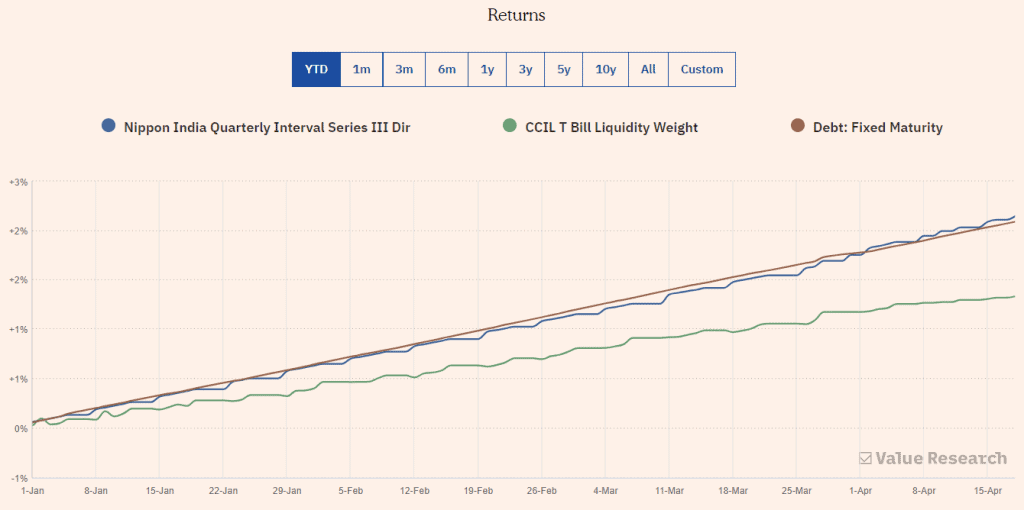

To understand better, let’s delve into the returns and comparables of one of these funds – Nippon India Interval Fund – Quarterly – Series 2 – Direct Plan-Growth as shown in the chart below. The YTD returns from the fund are compared with the returns from the CCIL T Bill Liquidity Weight and the Debt: Fixed Maturity.

The CCIL T Bill Liquidity Weight represents the yield on government-issued treasury bills, which are short-term debt instruments. The Debt: Fixed Maturity line represents the average market performance of fixed maturity funds.

How do interval funds work?

The interval scheme in mutual funds offers investors the opportunity to purchase or sell units at the current Net Asset Value (NAV) during the designated periods. The fund manager has the advantage of setting the redemption interval, allowing them to focus on developing a robust investment strategy without the concern of frequent redemption requests and liquidity.

Benefits of investing in the interval fund

- When compared to open-ended mutual funds, interval funds typically produce better returns.

- These funds offer retail investors the chance to broaden their portfolio by including non-traditional assets.

- They provide a platform for investors to explore high-quality alternative investments with relatively low entry points.

- From time to time, the fund management company offers investors the chance to sell their shares back at the Net Asset Value (NAV).

Risks and Considerations

- Liquidity risk: Interval funds have limited redemption opportunities, which can pose challenges when it comes to accessing funds in times of emergencies.

- Valuation risk: Investing in illiquid assets such as commercial properties, forestry tracts, business loans, and others, can present challenges when it comes to accurately valuing them.

- Market risk: As with any market-linked investment, interval funds are exposed to fluctuations in the market.

- Interest rate risk: The performance of debt instruments within the fund can be impacted by fluctuations in interest rates.

Points to remember before investing

Before making any investments in Interval Funds, it is important to take into account the following factors:

Carefully examine all the available information about the fund, including its prospectus and the most recent shareholder report. You can obtain this information from your investment advisor, directly from the fund, or by checking the fund’s filings on the relevant website.

Please note that your investment will be inaccessible until the fund provides another buyback opportunity. By that stage, it is crucial to prepare for the possibility of having limited access to your investment.

Evaluate the costs and fees of the fund and see how they stack up against other investment choices. Review the prospective returns and benefits to make sure they outweigh the expenses.

Verify that your investing objectives and comfort level with risk are compatible with the fund’s approach.

Bottomline

Interval funds provide investors with a distinctive investment opportunity that blends the adaptability of open-ended funds with the reliability of closed-ended ones.

You must thoroughly evaluate the potential risks associated with interval funds, such as liquidity risk, valuation risk, market risk, and interest rate risk, despite the benefits they offer.

Before making any investments, it is essential to have a comprehensive understanding of these factors, carefully examine all the available information about the fund, and verify that the fund’s investment strategy is in line with your financial objectives.

It’s crucial to approach any investment with meticulous planning and thoughtful consideration.

FAQs

Interval funds can be a good investment for those seeking diversification and the potential for higher yields. They offer access to alternative, often illiquid assets, which can provide higher returns. However, they come with risks such as limited liquidity and higher fees. Therefore, they’re best suited for investors with a longer-term perspective and understanding of these risks. As always, individual financial goals and risk tolerance should guide investment decisions.

A Systematic Investment Plan (SIP) is a method where investors put a fixed amount into a mutual fund at regular intervals. The interval could be weekly, monthly, or quarterly, depending on the investor’s preference. This disciplined approach allows investors to benefit from rupee cost averaging and the power of compounding over the long term. It’s well-suited for investors aiming for various financial goals.

Yes, an interval fund is a type of mutual fund. It’s a unique blend of open-ended and closed-ended funds. Interval funds periodically offer to buy back a percentage of outstanding shares at net asset value (NAV). However, unlike traditional mutual funds, they don’t trade on the secondary market. This structure allows interval funds to invest in a diverse range of assets, including illiquid ones.

Whether a Systematic Investment Plan (SIP) is better than a Fixed Deposit (FD) depends on your financial goals and risk tolerance. SIPs, being market-linked, have the potential for higher returns but also carry more risk. FDs, on the other hand, offer guaranteed returns and are considered safer. However, SIPs provide the flexibility of investing small amounts regularly, which can be beneficial for long-term wealth creation.

Closed-end funds offer shares once through an initial public offering (IPO), and then shares must be purchased from other investors on a secondary market. On the other hand, interval funds, while technically closed-end, continuously offer shares and allow investors to sell their shares back to the fund at predetermined intervals. Thus, interval funds combine features of both open-ended and closed-ended funds.