Portfolio overlapping: The barrier to holding a diverse range of investments.

Riskless investments offering high returns are not often available in the market.

So, how do investors manage their risks and yet earn good returns?

The key is to use various strategies available for mitigating risks. Portfolio diversification is one of the primary strategies to manage risks.

Mutual fund overlap is a situation that contradicts diversification. Read further to know how this impacts an investor’s portfolio. Learn about different types of stock market portfolios to generate maximum profits.

Mutual funds

The concept of mutual funds is well known today.

Mutual funds are companies that collect money from investors, pool them together and invest them across various securities available in the market.

These funds are managed by professional managers who intend to help investors achieve their financial goals with respect to risks and returns.

The primary reason for investors to choose mutual funds over regular trading is the diversification it offers.

You may also like: A simple guide to understanding NAV in mutual funds

Mutual fund portfolio

In the financial world, a portfolio is a basket of different kinds of assets.

Investors today prefer to spread their investment across different funds rather than investing the entire sum into one fund. Evaluate this effective portfolio diversification strategy to experience a profitable investment journey.

The purpose of maintaining a portfolio is to have a balance between risks and returns.

For example, one fund may offer high returns but may be risky. Another fund with low risk but stable income will balance this out.

So, investors create their mutual fund portfolios upon assessing their financial capabilities, risk tolerance and investment goals.

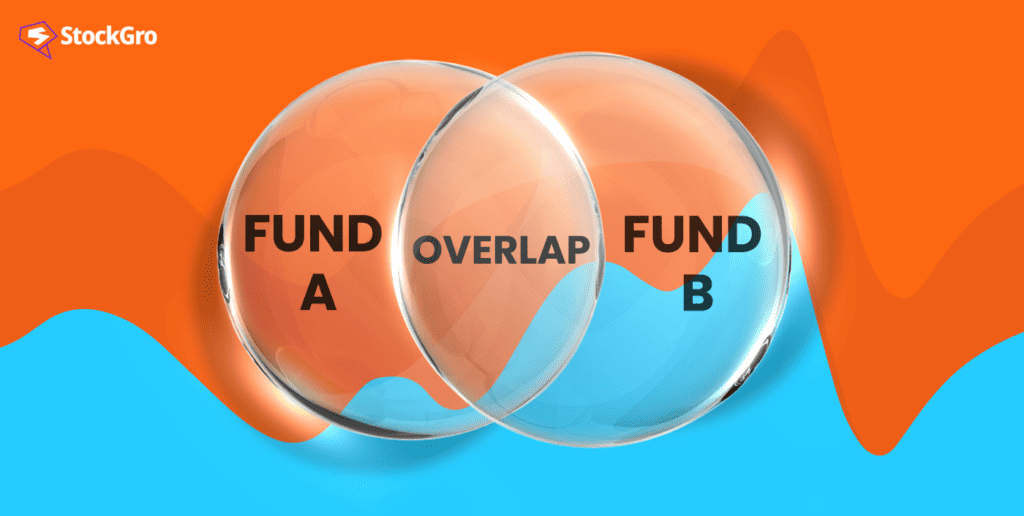

What is Overlap in Mutual Fund?

When an investor holds a portfolio of mutual funds where a large portion of funds are invested in similar kinds of assets, it creates a situation of mutual fund portfolio overlap. The primary objective of mutual fund investments is to divert the risk. But, mutual fund overlap is a situation that contradicts this idea.

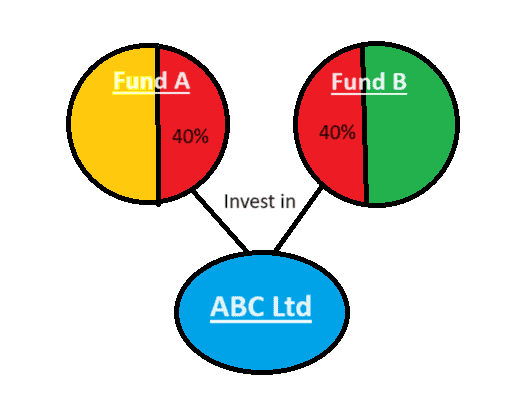

example for mutual fund overlap, an investor invests in 3 different mutual funds, and all the mutual fund managers invest these funds into the top 3 IT firms in the market.

Causes of portfolio overlaps

The two main reasons for mutual funds to overlap are:

- SEBI (Securities and Exchange Board of India) guidelines to mutual fund companies. The SEBI has laid down the guidelines regarding investments by mutual fund companies.

Large-cap funds must invest in companies with large capitalisation. The mid and small-cap funds must invest in companies with similar market capitalisation. So, the funds are exposed to similar kinds of stocks, leading to identical investments.

- Overlaps can occur when an investor invests in different funds handled by a single asset management company. The overlap happens because the objective and thought processes of the AMC managers might be similar and in line with the company’s vision, which may lead to choosing similar securities for investments.

Also Read: Understanding AUM: Mastering financial skills

Impact of mutual fund overlap on investor’s portfolio

- The first and foremost impact of overlaps is that it defeats the basic purpose of investing in mutual funds.

An investor resorts to mutual fund investments to have an assorted portfolio with different securities that manage risks and returns. However, overlap leads to the concentration of funds in similar assets.

- Investors incur huge amounts of losses when there is an overlap of funds.

Imagine a situation where a stock value diminishes in the market, and multiple funds have invested in this stock. The investor faces loss from all the funds, and the portfolio’s value falls, too.

- In case of portfolio overlaps in mutual funds, investors end up paying fees to multiple managers to manage similar stocks. So, the cost of managing mutual funds becomes expensive unnecessarily.

- Overlaps lead to the trading of similar stocks in the market. Since mutual funds mostly deal with bulk quantities, the overlap impacts the liquidity and prices of stocks.

Strategies to manage the risk of mutual fund overlap

- Prevention is better than cure. So, it is ideal to read through the fund’s objectives before investing. Investors should avoid investing in funds that offer similar schemes and objectives.

- Investing in funds handled by different asset management companies may help in avoiding overlaps. Although overlaps are still possible, the probability reduces.

- Mutual funds are handled by professional managers, but it is essential for the investor to review the portfolio regularly. Investors must use the various mutual fund overlap tools available online to assess overlaps and take corrective actions when necessary.

Types of mutual funds available to mitigate overlap risks

Diversification is the core objective of mutual funds. To reap better benefits, investors must make sure that they choose a diverse range of mutual funds to invest in.

Rather than investing all the money available into one kind of fund, the investors must try to strike a balance between these three kinds of mutual funds:

- Equity funds – These funds pool money from investors to invest in equity shares of different companies.

- Debt funds – These funds are invested into various debt instruments offered by corporations and the government.

- Balanced funds – These funds invest in both equity and debt instruments.

Also Read: An overview of TRePs in mutual funds

Bottomline

Mutual fund overlap is an unintentional occurrence in most cases. However, it is indeed one of the major risks associated with investing through mutual funds.

Mutual fund companies promptly mention the disclaimers about the risks involved. So, it is the responsibility of investors to ensure their investments are going towards the correct avenues.

Generally, mutual funds disclose all the details of the securities they invest in. It is of extreme importance for investors to study this thoroughly to assess if the mutual fund’s schemes are in line with the investor’s financial goals.

Diversification is a significant component for investors, and it should not be overlooked due to situations like overlapping. A diversified mutual fund portfolio helps secure your money in any market conditions. Find out how to diversify your mutual fund portfolio.