Table of contents

Are you in a dilemma to select the best – provident fund vs pension fund? Read more to discover the possibilities.

Financial planning is the secret key to safeguarding the value of hard-earned money in the long term. The time value of money leads to a decrease in the buying power of the money over a considerable number of years. The retirement phase of life is spent usually enjoying these financial planning benefits.

Various investments are rolling out high returns over a long time. However, the longer span also needs higher security from constant market volatility. There are some specifically designed investment instruments which cater for all such requirements.

The investment should start early to earn a considerable corpus in the later part of life. So, a wise decision should be made among the investment alternatives available. Let’s discuss the two ideal retirement investment options – Pension funds and provident funds.

What is a pension fund?

The retirement period is a phase with no fixed income as salary and an increase in expenses, such as medical expenses. Pension funds are one of the best diversifying investments for such a phase. They accumulate funds over the years, invest them, and earn returns during retirement. These funds function through 2 stages mainly:

- Accumulation of funds

- Vesting the returns for accumulated funds

Usually, it is at the employer’s discretion whether to contribute to the pension funds. The employees can separately contribute a part of their salary to these funds offered by the government, banks, financial institutions, etc. These funds are regulated by the Pension Funds Regulatory and Development Authority of India (PFRDA).

The National Pension Scheme (NPS) is one such pension fund by the government. It offers the facility to select investment patterns while registering.

Retirement annuity plans are unique to offer the facility of regular income for every year after retirement. Also, the facility of lump sum payment is available.

Must read: Importance of Pension Plans.

What is a provident fund?

PF is a government scheme to induce savings behaviour in salaried employees during the service. Employee provident funds (EPF) are compulsory contributions made by the employer and the employee. The main purpose of this scheme is to provide a reliable corpus to the salaried individual at the end of the service.

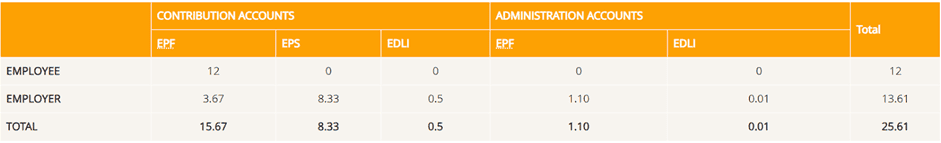

The scheme contributes to EPF, Employee Pension Scheme (EPS) and Employee Deposit Linked Insurance Scheme (EDLI). There are certain criteria, such as death, resignation, etc, for withdrawal of EPF before maturity. The rates for contribution are as follows:

Source: National Portal of India

Read more on EPF: The concept of EPF – All you need to know about this tax-saving fund.

Like EPF, the government also has a scheme for ordinary people – the Public Provident Fund (PPF). This scheme is for 15 years and can be accessed through any public sector bank or financial institution. Here, the funds can be withdrawn after a minimum of 7 years. Also, its interest is tax-free.

There is a constant debate regarding selecting the best plan – provident vs pension funds vs retirement annuity plans. However, retirement annuity plans are individual contracts, so the most famous are the provident and pension funds.

The debate: Provident fund vs pension fund.

| Point of difference | Provident Funds | Pension Funds |

| Contribution | Both- Employee and Employer contribute (compulsory). | Employer’s contribution is at the company’s discretion. Individuals can separately contribute. |

| Return % | They are fixed by the government. | As per the market, pension plans can be selected. |

| Risks | EPF and PPF are government schemes.Less risk. | Employers and fund managers decide on investment.Moderate. |

| Withdrawal window | PF can be claimed after the service- Lump sum or annual.EPF – before five years for special situations.PPF – after 15 years. | Partial withdrawal up to 25% for a maximum three times. |

| Tax benefits | Tax free. | Tax as per the income tax slab. |

Summary: Which is better?

The selection of the best option solely depends on an individual’s requirements. A salaried employee has compulsory exposure to EPF. Moreover, these employers also contribute a small amount to pension funds like NPS. Non-salaried people can invest in PPFs, starting with a minimum contribution of ₹1000/-.

Factoring various aspects regarding the contribution, ownership, returns, etc, would be helpful to evaluate the most suitable option. However, it is always suggested to diversify the investment. Such diversification is possible with the help of such retirement benefit funds. A salaried employee can invest in NPS and different retirement annuity plans. However, the non-salaried person can diversify with PPF contributions.

Best tool: Financial Planning Calculator.

FAQ

The PF refers to the provident fund. The PF and pension cater for the need for retirement benefits and thus are used synonymously. However, the main difference between the two is that PF contribution is compulsory for employers while pension fund contribution is at the company’s discretion. Moreover, PFs are government schemes, while pension fund plans can be offered by the government, banks, and financial institutions.

The retirement annuity plan is a type of pension plan for individuals. It offers a certain annual amount every year after retirement. However, it also has the option to avail the sum in lump sum. Various financial institutions offer this plan. During retirement, when there is no fixed income, such as salary, these annuity plans help secure medical expenses, loan repayments, children’s expenses, etc.

After resigning from an organisation, one can transfer the PF amount to the new employer’s PF accounts or withdraw the whole amount. If an individual is discontinuing salaried work (shifting to freelancing), then amount withdrawal is a suitable option. If an individual is in the service, this accumulated PF can be transferred to the new employer’s account.

The employee provident fund is calculated by the contribution of both – employer and employee. The employee makes a 12% contribution to the EPF. While the employer has to segregate it – 3.67% to EPF and 8.33% to the employee pension scheme (EPS). Moreover, the employer also contributes 0.01% to the EDLI. This whole calculation is based on the sum of the basic pay of the salary and the dearness allowance (DA).

The contribution and savings can be calculated here: EPF calculator

The National Pension Scheme is the type of pension fund plan that is offered by the government. It is a voluntary fund, and the contribution of the employer is solely at the discretion of the company. Moreover, as the name suggests, it is a long-term fund. For an employee-employer contribution, the rate is 10% each. The income tax deduction benefit offered by the investment is a crucial feature. NPS is regulated by the PFRDA of India.