Table of contents

Retirement planning is crucial to ensuring financial security in old age. The Atal Pension Yojana (APY), launched by the Government of India in 2015, aims to provide a guaranteed pension to India’s working population after 60 years of age.

This article covers all important aspects of APY – eligibility, flexible contributions, minimum guaranteed pensions, tax benefits, withdrawal rules, and more. Understand how APY provides old age income security in later years.

Atal pension yojana details

In 2015–16, the Atal Pension Yojana (APY) was issued. This government initiative provides savings account holders between the ages of 18 and 40 who do not pay income taxes with a safety net for their old age.

The PFRDA (Pension Funds Regulatory Authority of India) serves as the regulatory body in charge of overseeing and controlling this scheme.

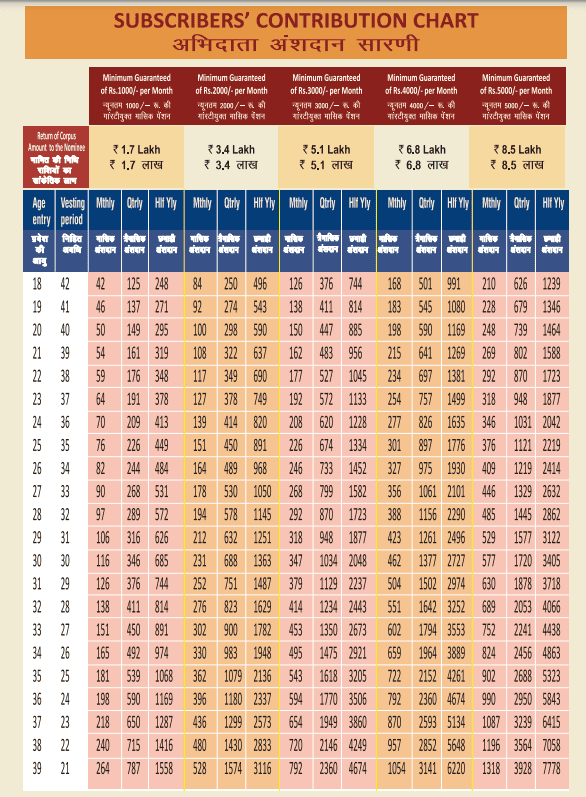

Members of the APY will be eligible to receive a guaranteed minimum pension ranging from ₹1,000 to ₹5,000 per month when they reach the age of 60, based on the amount they have contributed each month.

Below is the Atal pension yojana chart that describes the contributions and pensions that one may receive:

The fundamental objective of the programme is to provide a sense of safety to all Indian citizens by ensuring that they do not have to worry about unexpected diseases, accidents, or chronic illnesses as they age.

The programme is open to workers in the private sector as well, as well as those in the unorganised sector and even those whose employers do not provide retirement benefits.

Atal Pension Yojana eligibility

The APY plan is open to all Indian citizens. Here are the requirements to be eligible:

- On the other hand, APY’s age limit is 18 to 40. A subscriber must be a minimum of 18 and a maximum of 40 years old for this scheme.

- It is expected that they own a savings account with a banking institution or a post office.

- From the time they join APY until they reach the age of 60, participants must contribute the specified amount.

If the customer wants to get information on their APY account on an ongoing basis, they may provide the bank with their Aadhaar number and phone number when they register. Although enrollment does not need Aadhaar, it is recommended.

Features of the Atal Pension Yojana Scheme

The Atal Pension Yojana is a scheme that offers assured monthly payments at policy maturity or after retirement. The scheme’s features are:

- Adjusting contribution and pension amounts:

The amount you put into the APY programme each month is flexible, so you may adjust it to fit your budget or your requirements.

- Auto debit of contributions:

Members of the APY programme can choose to have their monthly payments deducted automatically from their bank accounts.

- Minimum age requirement:

The Atal Pension Yojana accepts applicants as young as 18 and as old as 40. Because of this, the duration of the contributions might be anywhere from 20 to 42 years (Until they reach the age of 60), based on the age of the subscriber.

- Rules for withdrawals:

It is only possible to withdraw from the plan before 60 years if the subscriber has a terminal illness or passes away. The spouse may choose between receiving pension benefits or leaving the programme to receive the corpus if the first spouse passes away before the age of 60.

If you withdraw from the APY plan before the 60th day, all you will receive is the principal plus interest.

- Payment for a penalty:

If you don’t pay for 6 months, the plan account will be frozen, and after 12 months, it will be closed. In the event of termination, you will get a refund that includes the accrued sum plus interest.

Atal Pension Yojana benefits

- The government aims to pass on the entire benefit of the scheme to its members. Hence, any deficit in the collection of contributions is compensated by the government. The contributions received in excess are credited back to the members.

- After 60, one can get a stable income, which helps them cover necessities.

- The purchase price of an annuity is not taxable to subscribers under NPS (National Pension Scheme) and APY, but their contributions and investment returns are. Pension earnings are subject to marginal tax rates.

Atal Pension Yojana tax benefits

Individuals may obtain a tax exemption on their APY payments under Section 80CCD of the Income Tax Act, 1961. Section 80CCD (1) states that an individual may deduct up to 10% of their gross total income, with a maximum deduction of ₹1,50,000, from their taxable income.

You may get an extra Rs. 50,000 tax break for your APY payments by using Section 80CCD (1B).

Conclusion

The Atal Pension Yojana aims to offer social security and guaranteed income in old age.

For eligible citizens, APY represents a useful retirement planning vehicle to build a pension corpus and achieve financial freedom after 60. Overall, APY lays the platform for old age protection from financial challenges.

FAQs

The amount of money that has to be deposited in the APY depends on the age of the subscriber and the pension amount chosen. The monthly contribution ranges from ₹42 to ₹210 for a pension of ₹1000 per month, and from ₹210 to ₹1054 for a pension of ₹5000 monthly.

There is no definitive answer to this question, as different pension schemes have different benefits. Some of the popular government pension schemes in India are APY, the National Pension System (NPS), and Pradhan Mantri Shram Yogi Maan-dhan (PM-SYM).

If the subscriber dies before 60, the spouse may maintain the APY account or get the pension. If the subscriber dies after 60, the spouse receives the same pension until death. The nominee receives the pension once the subscriber and spouse pass away.

Yes, the APY account can be closed upon :

– Attaining the age of 60, after which they will be eligible for a pension,

– Death of the subscriber or the spouse,

– Voluntary exit before 60 years with certain conditions, or

– Any default of contribution for a specified period.

The withdrawal of money from the APY account can be done in the following ways:

By submitting a request to the bank or post office where the account is held,

By using the APY e-PRAN or transaction statement, and

By using the APY mobile app or the APY web portal.