Table of contents

The Employees’ Provident Fund Organisation or the EPFO helps the private sector working population save for retirement. Both the staff and employers each invest 12% of the basic pay and dearness allowance into the EPF. This fund earns a fixed interest rate every year, which is currently @8.25%.

The main goal is to build a solid fund for your later years. Yet, you can withdraw money early in certain situations. If you’re in such a state and want to learn how to fill the EPF Withdrawal Form? Read our guide for online and offline instructions.

About EPF claim form 19

The form is essential for withdrawing your provident fund, i.e., the PF savings. It allows access to your accumulated PF amount, which includes your contributions, your employer’s share, and the interest earned.

Two versions are available: Aadhaar-based and non-Aadhaar-based.

The first option is for those whose Aadhaar and bank details are linked to their Universal Account Number (UAN). For those without such linkage, the non-Aadhaar-based version is available.

What do you need? Your PF account number. This application is accessible even if you don’t have a UAN. You can submit it online or offline, based on your convenience.

For a full and final EPF settlement, this application is indispensable. It is also under composite claim form. It’s applicable if you’ve quit your job or retired.

However, if you join a new organisation within two months, your PF amount will be automatically transferred to your new account, so there’s no need for withdrawal. In case you’ve just quit, you need to provide proof of unemployment for at least two months to withdraw using Form 19. This period is non-negotiable.

You might also need other forms for different withdrawals. For pension claims after retirement, use Form 10D. Use 10C if you must access your pension early. In case of a member’s demise, Form 20 is used by the nominee to claim the EPF amount. For advances or partial access to your funds, you’ll need 31. Additionally, to pay LIC policy premiums, Form 14 allows fund access.

Also read: Personal Loan vs EPF Advance

Content overview

In order to process the claim as quickly as possible, this form gathers the necessary information about the individual and their job details.

- Personal details: First, you’ll need to provide your name in full, mobile contact, and birthdate.. Plus, mention your father’s or spouse’s name, as applicable. This section establishes your identity.

- Employment specifics: Next, fill in your organisation’s name and address. Include your PF account number and UAN. Record the dates of joining and leaving, along with the reason for departure.

- Tax and address information: Your PAN and postal address are also required. These details are crucial for tax purposes and correspondence.

- Payment preferences: Specify your preferred payment method: direct bank transfer or cheque. If you choose a cheque, attach an advance stamp receipt with a ₹1 revenue stamp and your signature.

- Signatures: Both you and your employer need to sign the form. This stage verifies the legitimacy of the info you submitted.

- Offline requirements: For offline claims, the advance stamp receipt is mandatory. If opting for electronic credit, this isn’t needed.

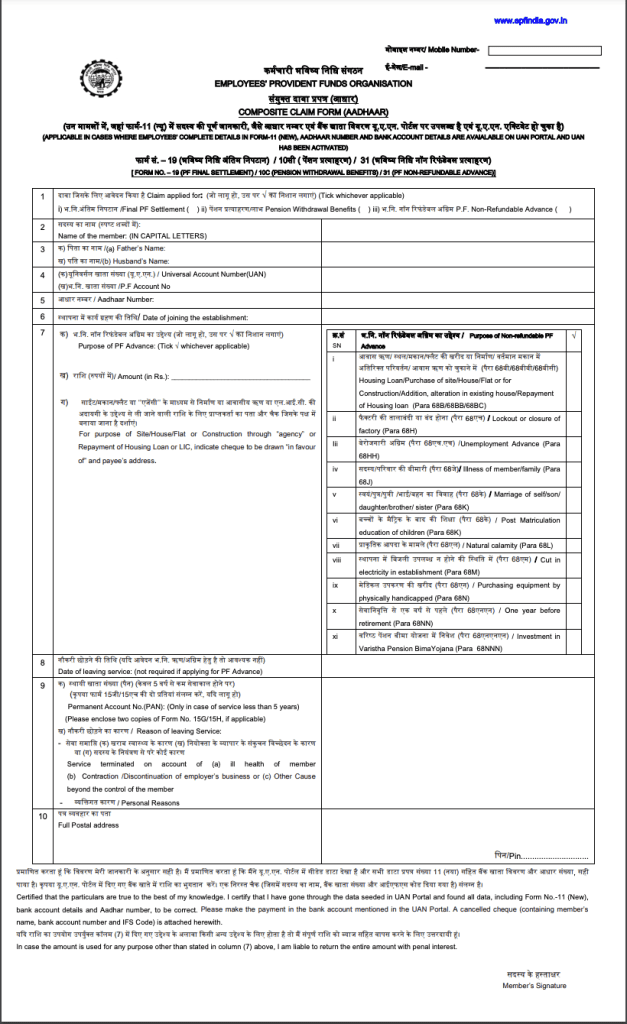

This is how the form looks for Aadhar-based option:

Source: EPFO

You may also like: General Provident Fund explained: Your path to financial freedom

Steps to fill EPF Form 19 online

Here’s how to do it:

Sign in

First, go to the official EPFO website. Enter your UAN, passkey, and the captcha code to log in.

Access online services

Go to the online services tab in the logged in page & move to claim from the given menu. This will direct you to the section for claims.

Verify bank account details

After entering the banking account details that are connected to your PFaccount, get it verified.

Choose the claim type

In the next page drop-down pick the type of claim- Only PF Withdrawal (Form 19) .

Aadhaar OTP verification

A disclaimer page will appear. Select Aadhaar OTP after checking the box to accept the terms. To validate all of your details, enter the code provided to the contact number on file.

Submit the application

After OTP verification, submit your application. A reference number will be given to you so you may follow the progress of your claim. Save this ref for any upcoming communications.

Await employer approval

The last step is to wait for your employer to approve the withdrawal request. After approval, the payment for PF will normally take 20 days to appear in your paired bank account.

EPF withdrawal form 19 offline steps

Begin by EPF form 19 download and printing. Keep your PF account number, bank details, and other necessary information handy.

Enter all the fields with precision. A blank, cancelled cheque should be attached for bank account verification. If you want to avoid TDS deduction, include Form 15G or 15H. Also, as noted earlier, affix a ₹1 revenue stamp and sign across it if you prefer cheque payment.

Make sure your employer signs the form. Their signature is crucial for verifying your claim. Send the completed form and any supporting documentation to the EPF office that is closest to you. Make sure there are no errors by going over everything again and wait for EPF form 19 claim time.

Also read: Tax-efficient withdrawal strategies for retirement in India

To sum up

Completing EPF Form 19 is manageable with the right steps. Verify all details, collect essential documents, and secure required signatures. This ensures a smooth withdrawal process.

FAQs

Form 19 in EPF is used to withdraw your provident fund savings. You need it when you retire or leave your job. It helps you get your money, including your contributions and your employer’s share. The form requires basic details like your PF account number, bank details, and personal information. Submit it online or offline to access your funds.

Yes, you can very well withdraw full of your PF amount if you retire or unemployed for more than two months. This includes both your contributions and your employer’s share. Make sure to provide proof of unemployment when you apply.

Start by signing in to the EPFO portal using your UAN and password. Select “Online Services” and choose “Claim.” Enter your bank details and verify them. Pick “PF Final Settlement” from the drop-down menu. Agree to the terms and verify using Aadhaar OTP. Submit your claim.

If you’re employed, you can withdraw up to 75% of your EPF balance or three months of basic wages and dearness allowance, whichever is less. You can also opt to withdraw a smaller amount if you prefer. This is useful for meeting financial needs while still being employed.

Download and print Form 19 from the EPFO website. Fill in your details and employment information. Include your bank account info. Attach a cancelled cheque for verification. If needed, add Form 15G or 15H to avoid TDS. Affix a ₹1 revenue stamp and sign it. Get your employer’s signature on the form. Finally, submit everything to the nearest EPF office. Double-check for any mistakes.