Table of contents

If you are curious to know about the driving forces shaping Indian financial markets, discover the major ones right here.

In finance, Foreign Institutional Investors (the full form of FII) and Domestic Institutional Investors (DIIs) significantly shape market dynamics, influencing asset prices, market trends, and economic stability.

After being net sellers, FIIs are now investing in Indian markets. FII data indicates investments of over $10 billion in FY24, pushing Nifty to a record high above 18,900 points.

Latest FII and DII dataTrends of August:

| FII Rs Crores | DII Rs Crores | |

| Date | Net Purchase/Sales | Net Purchase/Sales |

| 31 Aug 2023 | -2,973.10 | 4,382.76 |

| 30 Aug 2023 | -494.68 | 1,323.24 |

| 29 Aug 2023 | 61.51 | 305.09 |

| 28 Aug 2023 | -1,393.25 | 1,264.01 |

| 25 Aug 2023 | -4,638.21 | 1,414.35 |

The table shows that in August, FIIs sold more while DIIs bought more.

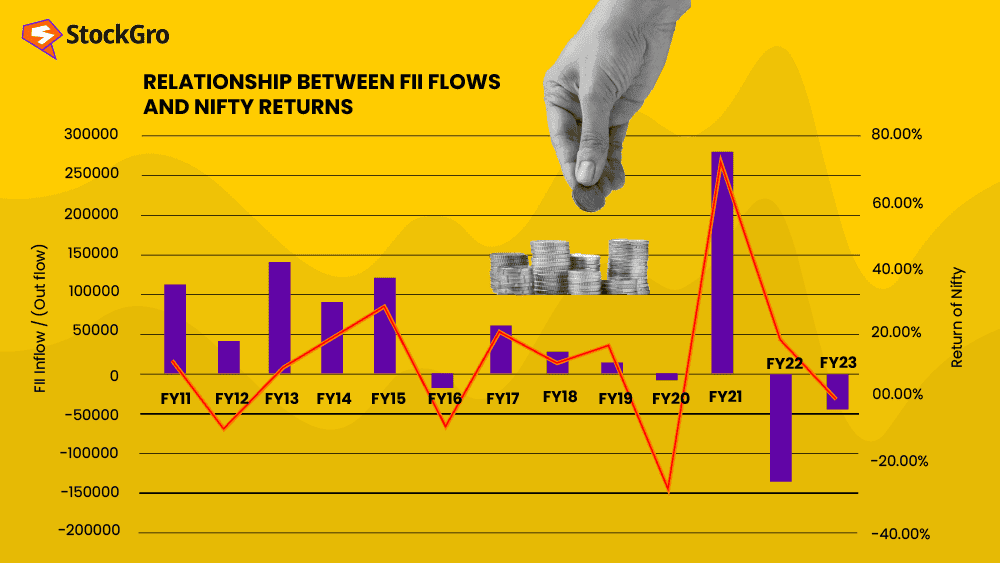

The historical link between Nifty and FII flows is strong. FII and DII activities have historically steered stock market trends.

We’ll explore the roles, investment behaviours, strategies of FIIs and DIIs, and their impacts on financial markets.

What is FII and DII?

What is FII in the share market? Foreign Institutional Investors (FIIs), also known as Foreign Portfolio Investors (FPIs), invest in financial assets beyond their home countries.

FIIs, including mutual funds and hedge funds, enhance market breadth and depth, significantly boosting India’s economy.

FIIs can invest in various financial assets under a country’s regulations. FIIs operating outside India must register with SEBI to invest in Indian markets.

Domestic Institutional Investors (DIIs) are entities that invest within their own country’s financial market.

DIIs, including insurance companies and mutual funds in India, can invest in various products and influence the stock market, especially as net sellers.

Investment behaviour

FIIs and DIIs have distinct investment behaviours as defined below:

- FIIs, with shorter investment horizons, are sensitive to macroeconomic indicators, global trends, geopolitical factors, and international market sentiments.

- DIIs typically focus on long-term growth of Indian companies, influenced by domestic economic conditions, regulations, and investor sentiment.

| FII Rs Crores | DII Rs Crores | |

| Date | Net Purchase/Sales | Net Purchase/Sales |

| Aug 2023 | -20,620.65 | 25,016.95 |

| July 2023 | 13,922.01 | -1,184.33 |

| June 2023 | 27,250.01 | 4,458.23 |

| May 2023 | 27,856.48 | -3,306.35 |

The table shows rising FII net purchases from May to August 2023, indicating positive market sentiment. On the other hand, DIIs showed a dynamic pattern in their trading activities.

Market impacts of FII

Market liquidity

FIIs boost market liquidity, increasing trade volumes and stabilising prices. Increased FII interest in Indian stocks can enhance investor confidence, leading to more retail participation and a livelier market.

Market sentiments

FIIs’ reactions to global trends can influence market sentiment. Positive economic or geopolitical news can draw FII investments, enhancing market confidence. However, bad news can cause FII pullouts.

Market volatility

FII decisions can cause market volatility, but they also bring significant foreign capital, adding to liquidity. FII investments can increase market volatility due to their entry or exit based on global events.

Price appreciation

Higher FII demand for Indian assets can raise prices, benefiting local investors. This price rise can attract more investors, further boosting demand and prices.

Market impact of DIIs

Price support

DIIs’ steady buying and long-term holdings stabilise stock prices. They often invest in financially strong companies, even during downturns, rather than making speculative trades.

They can significantly buffer against market downturns, providing stability and price support.

Market stability

DIIs’ holdings stabilize the market and increase efficiency by consistently funding Indian markets. Their investments typically reflect the health of the Indian economy.

Liquidity in markets

Liquidity is key for market efficiency and lower bid-ask spreads. DIIs’ trading activities significantly enhance market liquidity.

Risk and reward

FIIs invest in emerging economies for higher returns, facing potential rewards and risks like exchange rate, geopolitical, market, regulatory, and economic risks.

DIIs prioritise capital safety and stable returns, focusing on risk management. They’re less affected by short-term fluctuations but face economic and company-specific risks. Understanding broader market dynamics can help protect their investments.

Regulatory framework for FII in India

FII investments are regulated globally for economic safety. In India, the RBI and SEBI control foreign capital flow.

FII investments are capped at 24% of an Indian company’s paid-up capital, which can be raised with board approval. For public sector banks, the cap is 20%.

FII vs DII

| Aspects | FIIs | DIIs |

| Type of investors | Foreign entities | Institutions within the country |

| Investment focus | Financial markets of various countries | Home country’s financial markets |

| Market Impact | Impact on market dynamics due to large trades and contribute to market liquidity primarily | Impact on market stability primarily |

| Currency risk | Significant exposure to exchange rate risk | Less exposure to currency risk |

| Regulation | Subject to foreign investment regulations and need regulatory approval | Subject to local financial regulations and easier access |

Bottomline

FIIs and DIIs bring unique dynamics to economies. FIIs, contributing to global capital flows, can greatly influence market trends.

DIIs contribute to market stability. Understanding FII vs. DII operations, strategies, and impacts can help investors navigate market complexities.

FAQs

The FII (Foreign Institutional Investors) and DII (Domestic Institutional Investors) indicator provides insights into the liquidity and strength of the stock market. It represents the amount of money that FIIs and DIIs invest in or withdraw from the stock market. This data, made available by regulatory bodies like SEBI, helps investors understand the buying and selling activities of these institutional investors. Following these trends can offer insights into market dynamics and potential investment opportunities.

FDI (Foreign Direct Investment) and FII (Foreign Institutional Investor) both contribute to economic growth but differ in several ways. FDI involves direct ownership in foreign businesses, offering long-term interest and control. It’s ideal for long-term investments and brings long-term capital. On the other hand, FII focuses on investing in financial assets without ownership rights. It’s suitable for both short and long-term investments. While FDI contributes to economic growth and development, FII increases market liquidity. The choice between FDI and FII depends on the investor’s objectives and risk tolerance.

Foreign Institutional Investors (FIIs) are often referred to as “hot money” because their investments are typically short-term, seeking quick returns. They swiftly move their funds between various financial markets, often influenced by factors such as interest rates. This rapid movement of funds can lead to market instability, hence the term “hot money”. However, it’s important to note that while they can bring quick capital, they also pose risks due to their volatile nature.

Foreign Institutional Investors (FIIs) can include entities like pension funds, investment banks, hedge funds, and mutual funds. They are allowed to invest in the primary and secondary capital markets in India through the Portfolio Investment Scheme (PIS). However, there are restrictions on the size of investments. The Reserve Bank of India and SEBI monitor these investments and enforce regulations to control the flow of foreign capital.

Foreign Portfolio Investment (FPI) and Foreign Institutional Investor (FII) are both forms of foreign investment. FPI refers to investment by non-residents in Indian securities. FPIs include investment groups of FIIs, Qualified Foreign Investors (QFIs), and subaccounts. On the other hand, FIIs are institutions like Pension Funds, Mutual Funds, and Insurance Companies, and they are a part of the broad FPI category. Essentially, FPI is the superset as it includes FII.