Table of contents

An index records the performance or the growth of a sector. The main aim of the index is to offer a benchmark for the average price movements over some time. This article delves deeper into details about broad market indices. From optimising and diversifying portfolios to the main broad market indices under NSE, everything is discussed in detail for those who wish to make an informed decision.

What is broad market indices?

Broad Market Indices are measures of the overall performance of a particular financial market that represents a wide range of companies that are a part of the market. These indices comprise small-cap, medium-cap large-sized companies giving you a snapshot of the overall status of the market and the direction in which it is leading.

Broad-based indices comprise large and liquid stocks mentioned on the exchange. Some of the most famous Broad Market Index funds are Nifty 50 Index funds, Sensex Index funds, Nifty 500 Index funds and so on.

Broad Market Index serves as a benchmark for all investors and fund managers to gauge the performance of their investments. By studying the broad market index of a country, investors can make informed decisions about asset allocation against global market trends. However, they need to learn how to analyse broad market through the major indices.

How do broad market indices function?

Since the Broad Market Index follows global market trends, it allows investors to make investments in multiple sectors or industries. This reduces the risk involved drastically.

- Broad Market Indices enables diversification: These indices have multiple companies under their wing which enables them to create a broad investment base. The portfolio created is diversified right from the beginning as there are a vast number of firms involved.

- Passive management policy:

Unlike funds that need constant management and active participation on behalf of the managers, such indices allow passive investment via mutual funds. There is no need for sudden trading of funds and neither any regular supervision.

- Management expenses are low:

Since there aren’t any major decisions to be taken regularly, the management expenses levied by brokers are very low. Investors can benefit from the overall improvement of market growth without paying the higher costs that come with active management.

- Benefit investors with long-term outlook:

People looking for a long-term investment plan must understand the concept because the aim is to track the overall performance of the market. Although the growth will be slow, it will be steady and spread over a longer period.

Broad Market Indices of NSE

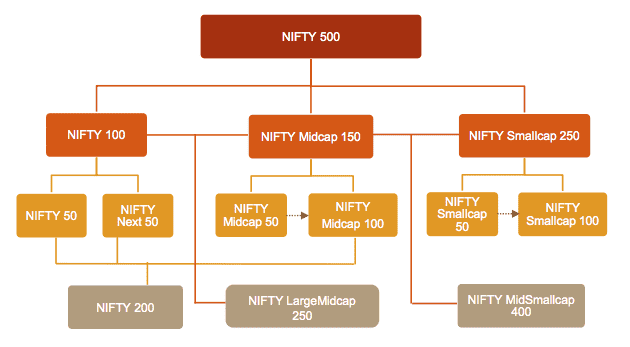

NIFTY Broad Market Indices

The National Stock Exchange or NSE has come up with multiple broad market indices which are the most liquid stocks. These NIFTY Broad Market Indices act as a proxy for the performance of professional investors or fund managers.

- NIFTY 500:

NIFTY 500 represents companies listed on the NSE based on full market capitalisation. These companies reflect the overall health and direction of the Indian economy as a wide range of companies across different market capitalisations are included.

- NIFTY 200:

Those companies that are included in the NIFTY 100 and NIFTY Midcap 100 indexes comprise the NIFTY 200. This category of NSE offers a more comprehensive representation of the Indian equity market over NIFTY 50 or NIFTY 100.

- NIFTY 100:

The top 100 firms out of the NIFTY 500 are called the NIFTY 100. These companies are included based on their market value and are designed to detail the performance of firms with substantial market value of equity.

- NIFTY 50:

This index comprises 50 companies selected from the NIFTY 100 based on their free-float market capitalisation and liquidity.

- NIFTY Midcap:

NIFTY Midcap 150 comprises 150 companies that are ranked 101-250 in the NIFTY 500. NIFTY Midcap 50 includes firms from the best 50 firms from the NIFTY 150 Index and NIFTY Midcap 100 comprises NIFTY Midcap 50 along with 50 other companies from the NIFTY 150 midcap based on their average daily turnover.

- NIFTY Midcap Select:

NIFTY Midcap Select comprises a group of 25 stocks out of the NIFTY Midcap 150 index. This selection is made based on market capitalization, average volume calculated daily and availability for trading on the NSE’s Futures and Options segment (F&O).

- NIFTY Smallcap:

NIFTY Smallcap 50 companies include the top 50 firms according to their average daily turnover out of the top 100 companies ranked by total market capitalisation within the NIFTY Smallcap 250 index.

NIFTY Smallcap 100 includes the above-mentioned NIFTY Smallcap 50 companies along with 50 more that are included based on an average daily turnover from the top 150 firms in the NIFTY Smallcap 250 index.

- NIFTY MidSmallCap 400:

All those companies that are included in the NIFTY Midcap 150 and NIFTY Midcap 250 indexes are a part of the NIFTY MidSmallCap 400. The main purpose of the index is to measure the performance of mid-cap firms and small-cap ones.

- NIFTY500 Diversified 50:25:25:

This fund allocates investments across large, medium and small-cap companies with weights of 50%, 25% and 25% respectively. These allocations are adjusted every quarter during rebalance dates.

Conclusion

Investing in broad market index funds allows an investor to gain exposure to a vast range of assets and cut down on the overall risks that daunt an average stock market investor. Investing here demands a straightforward approach. The risks are comparatively lesser because the market base is vast and the cost-effective way of participating in the long-term growth of the economy minimises the need for active management. To learn more, visit the StockGro website.

FAQs

The most prominent indicators of the stock market in India are BSE Sensex and NSE NIFTY. NIFTY 500 is the country’s most comprehensive stock index and along with Sensex, it is the most traded index in the country.

S&P 500 Index, Russell 3000 Index and NASDAQ Composite Index are some of the most well-known Broad Indexes in the world. FT Wilshire 5000 Index (FTW5000) is another large index.

The S&P 500 is a huge index that tracks the 500 biggest public sector firms in the world. The combined market capitalisation of the stocks tracked exceeds $30 trillion. This number is ten times greater than that of the FTSE 100.

Market capitalisation, sectoral indices, benchmark indices, Dow Jones Industrial Average, NASDAQ, AEX Index, NIFTY, Sensex and BSE DCI are some of the other major market indices.

BSE Sensex and NSE 50 are the top two popular board market indexes in India.