Table of contents

The stock market is no doubt a complex environment, but it provides a lot of valuable information that helps traders assess the future of stocks. It gives traders multiple hints about potential price movements. The trick here is to identify these hints and act upon them promptly. Hence, the knowledge of identifying and analysing such patterns and trends is fundamental for stock market traders.

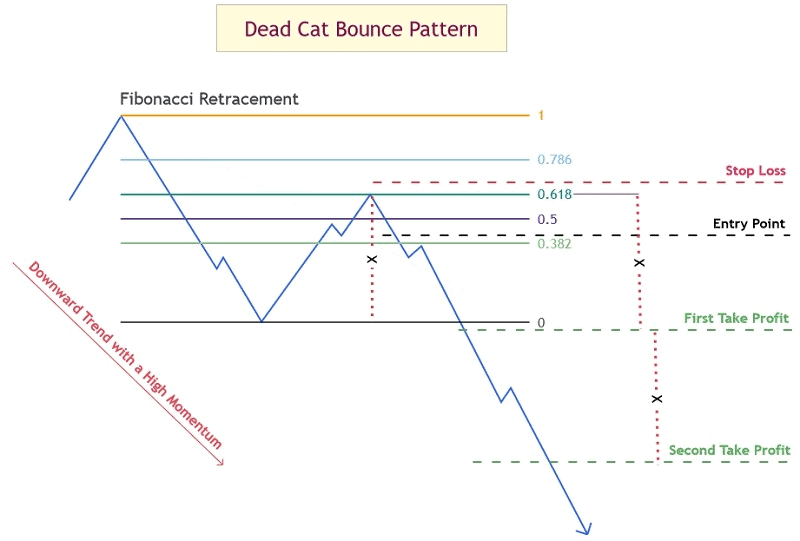

One such pattern that suggests the prospective direction of stocks is the dead cat bounce pattern. In today’s article, we will understand thoroughly what the dead cat bounce pattern is all about.

What is a dead cat bounce pattern?

A dead cat bounce is a situation where a stock’s price rises for a short time after it has been falling continuously for a considerable period.

So, does it mean the stock will see an uptrend? No, that is the uniqueness of the dead cat bounce pattern. It only suggests a short uptrend, after which the prices fall again. The dead cat bounce pattern is often confused with other bullish reversal patterns, but it is a bearish continuation signal as the price rise is brief and short-lived.

What causes the dead cat bounce chart pattern?

A dead cat bounce pattern usually occurs when bear investors slightly change their approach towards the market.

The dead cat bounce pattern appears after the stock has been seeing a downtrend for a long time. This suggests that the bears are dominant and are holding the prices down. Nevertheless, some bear traders may feel that the stock has reached its lowest and may decide to clear their short positions. As a result, the price sees a quick uptrend.

However, the price rise is not due to the strong fundamentals of the stock. Hence, sustaining the price rise becomes a challenge, leading to a decline in prices again.

Identifying the dead cat bounce trend

Three main aspects help in identifying a dead cat bounce pattern:

- The stock must be bearish for a long time.

- There must be a notable increase in price for a short period.

- The stock’s price must fall again.

Traders also use volumes to verify the dead cat bounce pattern. The uptrend is often backed by high trading volumes.

Trading the dead cat bounce

The dead cat bounce pattern is a helpful indicator for traders to take short positions. The dead cat bounce pattern becomes evident when prices fall again after rising temporarily. This is when traders can take their short positions and set stop-loss limits to avoid losses when prices decline further.

Example

Take the example of Yes Bank Ltd’s share price. Since 2018, the shares of Yes Bank Ltd have been declining due to various reasons, including inefficient management, poor loan ratios, etc.

The chart above shows Yes Bank’s share prices over the last five years. The dead cat bounce pattern has appeared quite a few times on this chart. The stock trading at ₹275.10 on March 29, 2019, has continued to decline and reached ₹134.15 on May 17, 2019. However, there has been a sharp but short increase where the price has gone up to ₹147.80 on May 31, 2019. But, this rise, as you can notice, is short-lived and is again followed by a decline, suggesting a dead cat bounce pattern.

Limitations of the dead cat bounce

One of the primary issues about the dead cat bounce pattern is its inability to confirm whether the price rise is a temporary change or an actual reversal. Traders must wait until the price falls again to verify whether the pattern is a dead cat bounce. Such delay may lead to missing out on opportunities and incorrect decisions.

What Is an Inverted Dead Cat Bounce and How Does It Work?

In the world of stock market lingo, you’ve probably heard of a dead cat bounce. It’s the brief and often misleading rise in a stock’s price after a significant decline. Investors may get excited, thinking the stock is bouncing back, only to see it drop even further soon after. Now, let’s flip this concept upside down — enter the Inverted Dead Cat Bounce.

What is the Inverted Dead Cat Bounce?

An Inverted Dead Cat Bounce refers to a situation in the stock market where a stock experiences a quick but temporary decline after a brief rally or price increase. Essentially, it’s the opposite of the classic “dead cat bounce,” where a stock’s price bounces back up after a fall, only to fall again.

With the Inverted Dead Cat Bounce, the stock price might spike upward momentarily due to market overreaction or speculation but is quickly followed by a significant drop. This sharp decline happens because the market realizes the price increase was unjustified, leading to a sell-off.

How Does It Work?

Here’s how the Inverted Dead Cat Bounce unfolds in a typical scenario:

- Initial Rally: After a stock experiences a sharp downtrend, there may be an initial surge in price due to factors like news hype, oversold conditions, or technical traders jumping in to capture a “recovery.”

- Temporary Optimism: Investors may see this uptick as a sign of recovery and jump into the stock, fueling the temporary rally.

- Realization & Sell-Off: Once the rally proves unsustainable, and the initial excitement fades, reality sets in. The stock crashes again as sellers flood the market, realizing the price surge was temporary and unsupported by strong fundamentals.

- Decline: The result is a steep price decline, often surpassing the lows it saw before the brief rally.

Why Is It Important for Investors?

Understanding the Inverted Dead Cat Bounce can help you avoid making poor investment decisions based on short-term volatility. If you spot a stock making a brief and unjustified rise, it’s essential to assess the fundamentals rather than relying on fleeting optimism.

A classic example of an Inverted Dead Cat Bounce would be when news or rumors briefly boost a stock price, only for the market to correct the overreaction. Keep in mind that these situations can lead to sudden losses for those who buy into the rally without thoroughly analyzing the underlying causes of the price movement.

Bottomline

Dead cat bounce is a pattern that occurs when the stock price rises after it has declined consistently. It is also essential that the uptrend is short-lived and is again followed by a downtrend.

The dead cat bounce is useful for bear traders in taking short positions. However, like other technical analysis tools, the dead cat bounce may mislead traders at times, leading to incorrect strategies. Hence, it is advisable to use it with other indicators to confirm trends before formulating strategies.

FAQs

There is a saying in English that even a dead cat bounces if it falls far enough. Since the stock price goes very low and then bounces back, which is similar to the dead cat, it is called the dead cat bounce pattern.

It is quite difficult even for experienced traders to predict a dead cat bounce. It is a lagging indicator, and traders must wait for the pattern to appear completely before identifying it as a dead cat bounce.

The dead cat bounce is often a temporary and short pattern. The uptrend may last for few days to weeks, while the preceeding downtrend must exist for a considerable period of time.

A trader can confirm the trend as dead cat bounce if the price declines for a long time, witnesses a short and sharp rise, and falls again.

The dead cat bounce is helpful for those who want to take short positions. However, it is also risky to form strategies until the pattern is confirmed, as it is difficult to determine whether the uptrend is reversal or a rally.