In the realm of economics, the term ‘deflation’ can seem almost utopic. After all, who wouldn’t want falling prices and more purchasing power per rupee?

However, deflation isn’t all that it’s made out to be. The reality is far more intricate and nuanced than what appears on the surface. A deeper understanding of the economics and monetary policy behind deflation reveals a far more complicated picture.

Deflationary environments bring with them a host of unintended repercussions that, if left unchecked, could wreak havoc on economies and individuals alike.

That is the reason why it is important for you to dive deeper into deflation and understand what it’s really about. In this article, we’re going to explore the economics behind deflation, the pitfalls it might bring, and explain why falling prices might not always be a good idea.

How is deflation defined?

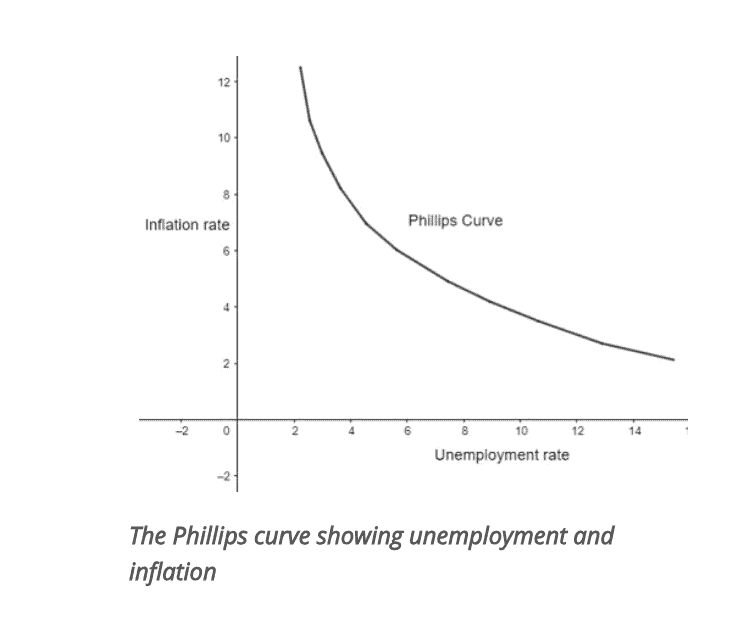

Let’s understand the far more common ‘inflation’ first. Inflation is the steady rise in prices for goods and services over time in an economy. Inflation is omnipresent in every functioning economy even though rates might differ from nation to nation.

This steady rise in prices is what decreases consumer purchasing power and corrodes the value of currency.

Deflation, on the other hand, is a general decline in prices of goods and services – meaning they become cheaper over time and purchasing power rises. While this might seem like the ideal situation for any economy, the deeper picture is less optimistic.

You may also like: What are inflation-indexed bonds, and why should you care?

What causes an economy to deflate?

Inflation is caused by an injection of excess money circulation in the economy. Since the supply of money grows more than its real demand, its value decreases, and everything costs more.

Similarly, deflation is, in theory, caused when there is a decrease in money supply or relatively liquid financial instruments.

In India, the Reserve Bank of India (RBI) predominantly formulated monetary policy to regulate money flow. When central banks tighten monetary policy, increase interest rates, or attempt to remove money from the economy, they reduce inflation. In some cases, however, they could overdo it and cause deflationary pressures.

Periods of deflation are typically caused after long periods of monetary expansion; which is basically just cash injection into the economy. Highly developed economies like the United States and Japan have faced deflationary pressures in the past due to this.

Triggers like global pandemics could also trigger deflation. Since reduced spending leads to reduced demand, there’s less cash flowing in the economy to keep everything going. Just like in 2020, when people were worried about job prospects and dwindling savings, they started spending less, contributing to reduced demand.

So, there are two main causes behind deflation:

- Tightening monetary policy – Rising interest rates might incentivise people to save their money instead of spending it. People borrow less, there’s less cash velocity and demand for goods and services goes down.

- Reduced confidence – This happens when adverse economic events reduce retail spending in all levels of the economy.

High aggregate supply in goods means that manufacturers have to lower their rates to be competitive in an environment where competition is perpetually increasing.

When production costs decrease, producers make more goods at the same price, which leads to increased supply, which in turn leads to lower prices.

What are the consequences of deflation?

Deflation can have several negative effects on the overall investing environment:

- Debt becomes more expensive – While your credit card debt is almost always a bad thing, corporate debt actually keeps an economy running smoothly. Deflationary environments usually come with unusually high interest rates, which makes companies averse to borrowing and investing in technology, innovation, and research. This contributes to the slowing down of the economy and negatively impacts growth.

- Deflationary spiral – Like we discussed above, deflation usually induces a vicious cycle of higher interest rates, lower demand, higher layoffs, and so on in the economy. Such a downward spiral can make things worse.

How are deflationary environments controlled?

Usually, the go-to tool that monetary policy applies to control inflation is interest rates. The same goes with deflation. By controlling interest rates, increasing cash flow in the economy, and responsibly planning fiscal policy, governments can take a big step towards avoiding deflationary environments altogether.

Also Read: Germany falls into recession as inflation hits the economy; Here’s why

Here are some more details:

- Boosting the money supply – The Reserve Bank of India has the power to employ monetary policy that increases the supply of money in the economy.

Usually, this happens when the bank buys back treasury securities. With more money circulation, its value decreases, encouraging people to spend more right now rather than save for the future. - Engaging in responsible fiscal policy reforms – Governments could affect the purchasing power of its people and aggregate demand in the economy by increasing public expenditure. This money spent in the country increases spending and leads to higher prices.

- Reduce interest rates – When the RBI lowers interest rates, two things happen. Firstly, it becomes cheaper for companies to borrow money and make large investments in expansion and development. This spending helps the economy. Secondly and more importantly, by altering the amount of cash banks are allowed to keep in hand to lend out, the RBI incentivises banks to give out more loans.

Conclusion

Deflation is, hence, the overall increase in the purchasing power of a currency in an economy, which is usually a consequence of falling prices. Deflation could sound ideal on the surface, but it has several adverse consequences.

Also Read: Sri Lanka’s comeback: Hosting Asia Cup 2023

It usually decreases consumer spending, leading to more unemployment and possible economic downturns due to abysmally low cash flow in the economy.

Deflation, however, is an economic extremity, which means that countries don’t become deflationary very often. With responsible fiscal policy, accountability, and skilful monitoring and adjustment of interest rates, governments can control spending in the economy and recover from deflationary environments.