Table of contents

What Is Earnings Per Share (EPS)? Definition & Importance

Earnings per share or EPS is the value of earnings per share of the company’s common stock. Companies often use this metric as an indication of their value and profitability. EPS reflects the amount of money made by a business.

To derive EPS, divide the outstanding shares of stocks of the company by its net profit. The higher the EPS, the more attractive it looks to investors. EPS is not only an indicator of a company’s current financial standing but also its performance over the past years. Read on to learn more about what is eps in the share market, its calculation and its different types.

How to Calculate EPS? Formula & Step-by-Step Guide

Earnings per share of a company can be calculated by dividing the company’s net income by the total number of outstanding shares. This EPS calculation can be done in two different ways:

1. EPS = Net Income after Tax / Total Outstanding Shares

2. Weighted EPS= (Net Income after Tax- Total Dividends) / Total Outstanding Shares

Why EPS Matters? Importance & Role in Financial Analysis

- It helps in comparing the performance of promising companies and suggests which among them offers a profitable investment avenue.

- A company can use EPS as a metric to compare its financial position over the years. A steady EPS rise reflects the stability of a company, making it a sound investment option. On the other hand, investors shy away from companies with irregular EPS.

- A higher EPS is a sign of profitability, indicating that the company’s dividend payout may also increase.

You may also like: Index Options: Understanding its types and function

Types of Earnings Per Share (EPS) & Their Uses

Generally, EPS can be classified into 3 prime categories:

- Trailing EPS– This EPS calculation is based entirely on the previous year’s numbers of a company.

- Current EPS- It is based primarily on the current projections and figures available.

- Forward EPS– Based on projected and estimated figures for the future.

There are 5 different types of EPS. Let’s look at them in detail.

- Reported EPS or GAAP EPS

It is derived by applying the Generally Accepted Accounting Principles. It is also disclosed in the SEC filings. However, GAAP may often reflect a distorted version of a company’s earnings.

A company’s EPS will increase if it generates income as operating income through a one-time payment according to GAAP. Treating regular expenses as unusual expenses will artificially boost earnings per share.

- Ongoing EPS or Pro Forma EPS

The base of this EPS is ordinary net income, and it excludes income that is generally considered a one-time, unusual income. Although this type of EPS reflects anticipated income from core business ventures, it is not an ideal indicator of the company’s real earnings.

Also Read: Dividend Rate vs. Dividend Yield

- Retained EPS

A company retains EPS when it keeps its profits instead of paying out dividends to shareholders. The company uses these earnings to pay off any debts it incurs during expansion. The business may also retain this EPS for future requirements.

Retained EPS = (Net earnings + current retained earnings) – divided paid/total number of outstanding shares.

- Cash EPS

Cash EPS is an indicator of the company’s financial standing. It reflects the exact amount of cash a company has earned. Cash earnings per share can be calculated as follows:

Cash EPS = Operating Cash Flow/ Outstanding Shares Diluted

- Book Value EPS

Book Value EPS gives the average amount of company equity in each share. To estimate a company’s stake worth in the event of liquidation, one can use Book EPS. Since this EPS focuses primarily on the balance sheet, it is only a static representation of the company’s performance.

Limitations of EPS & Factors to Consider

- A business can easily manipulate EPS to project a profitable venture. In the long run, it tarnishes the business image and leads to investors losing trust.

- EPS calculation does not take into account the cash flow of a company. One cannot consider a high EPS as a true indicator of a company’s financial health as it does not indicate solvency. The cash flow of a company reflects its debt-repayment ability.

- EPS calculations also do not factor in inflation. Hence, this financial metric may not show the company’s actual growth. For instance, the overall prices of goods and services may go up with inflation.

Also Read: What is Short-Selling, and how does it work?

Earnings Per Share (EPS) vs Other Financial Ratios: Key Differences

| Ratio | Purpose | Key Difference from EPS |

|---|---|---|

| EPS (Earnings Per Share) | Measures net earnings per share of a company. | Focuses only on per-share profitability. |

| P/E Ratio (Price-to-Earnings) | Shows how much investors are willing to pay for ₹1 of earnings. | Uses EPS in its formula but evaluates market valuation. |

| ROE (Return on Equity) | Measures profitability relative to shareholders’ equity. | EPS measures per-share profit, while ROE shows overall efficiency. |

| ROA (Return on Assets) | Assesses profit generation relative to total assets. | ROA considers asset efficiency; EPS focuses on shareholders. |

| Dividend Yield | Shows the percentage of earnings paid as dividends. | Dividend Yield focuses on cash payouts, EPS measures earnings. |

Why EPS Matters:

- Helps investors compare profitability across companies.

- A rising EPS indicates strong earnings growth.

- Used in valuation metrics like the P/E ratio.

Examples of EPS Calculation & Real-World Applications

EPS Calculation Example

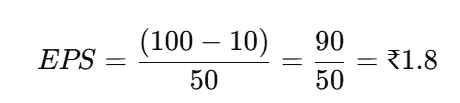

Let’s assume ABC Ltd. has:

- Net Profit = ₹100 crore

- Preferred Dividends = ₹10 crore

- Outstanding Shares = 50 crore

So, ABC Ltd.’s EPS is ₹1.8 per share.

Real-World Applications of EPS

Stock Valuation & Investment Decisions

- A company with consistent EPS growth is often a strong investment.

- Investors compare EPS of different companies in the same sector before investing.

Impact on Share Price

- A higher EPS boosts investor confidence, leading to stock price appreciation.

- A declining EPS can signal financial trouble, causing share prices to drop.

Earnings Announcements & Market Reactions

- Companies report EPS quarterly.

- If EPS beats expectations, stock prices rise.

- If EPS disappoints, stock prices fall.

Use in Mergers & Acquisitions (M&A)

- Acquiring companies analyze target firm’s EPS before making buyout offers.

- EPS growth post-merger determines the success of acquisitions.

EPS in Action: Example from the Indian Market

- TCS (Tata Consultancy Services):

- Reported an EPS of ₹118 in FY23.

- Investors use this to compare it with Infosys and Wipro.

- Reliance Industries:

- Reports EPS in multiple segments (Retail, Jio, Oil & Gas).

- Helps investors understand which sector is driving profits.

Concluding thoughts

Investors use EPS as an important financial metric for gauging a company’s worth as an investment option, but they should also consider several other essential factors while evaluating a company as an investment option.

Earnings per share of a company should be considered along with other various financial parameters and not in isolation to get a clear picture of a company’s profitability and performance.

FAQs

Earnings per share determine the amount of profit per share, dividend determines the amount of profit per share that is actually paid out to investors, in cash. So, in a normal scenario, the dividend is a portion of profits that is paid out, while the rest is retained by the company as the remaining EPS.

Basic EPS considers the earnings per share on common stocks issued by companies. Diluted EPS, on the other hand, considers all other securities which can be converted, such as preference shares, debentures, etc., while calculating the earnings per share.

A company XYZ has a net income of ₹10 lakhs and must pay ₹4 lakhs as dividends. It has 3 lakh outstanding shares.

So, EPS for company XYZ is:

= ₹(10 lakh – 4 lakh)/3 lakh

= ₹2 per share

There is no fixed number that determines what a good EPS ratio is. Whether the company offers a good EPS or not can be analysed, by comparing the EPS of its peers. The historic EPS values can also be considered to see how the company is growing.

Yes, a company’s EPS can be negative. It happens when the company’s income is negative, i.e., when the company is undergoing a loss. Investing in a company with negative EPS may still be worth it if the share price in the market is increasing, provided all other factors are favourable.