Table of contents

Investing through a Portfolio Management Service (PMS) offers the advantage of professional expertise in managing your investment portfolio. However, becoming familiar with the tax implications of PMS investments is a step forward in maximising your returns.

Let’s look at how PMS taxation takes place and what factors you should consider.

What is PMS?

A Portfolio Management Service is a specialised investment service offered by qualified portfolio managers registered with the Securities and Exchange Board of India (SEBI).

With a minimum investment amount of ₹50 lakhs, these portfolio managers create and manage a customised portfolio of securities, such as stocks, bonds, and other investment instruments, on behalf of their clients.

PMS is a methodical way to increase profits and decrease losses in your investments. With no effort required, you can make data-backed, well-informed decisions with PMS. It also makes you bounce back easily in times of market downturns.

PMS services are typically sought by high-net-worth individuals (HNIs) and institutional investors due to their personalised and professional management of the investments.

Source: Business Today

How is PMS taxed?

PMS taxation is the tax treatment of income and gains earned from investments managed through a Portfolio Management Service. Investors in PMS are subject to a tax system similar to that which applies to capital gains. The fact that profits on PMS investments are treated as capital gains makes them tax-efficient.

In contrast to mutual funds, PMS transactions are carried out straight from the client’s demat account. As a result, the earnings generated by PMS are taxed similarly to the client’s capital gains from their equity activities.

PMS tax implications

Capital gains tax:

The capital gains tax is an essential part of the PMS investment tax system. Any gains from selling PMS portfolio securities are subject to capital gains tax. Whenever an asset is held for less than one year, short-term capital gains (STCG) are taxable at the relevant slab rate.

Gains on investments held for more than a year are subject to long-term capital gains (LTCG) taxation at a flat rate of 10% (for LTCG more than 10 lakhs) that benefits from indexation.

PMS classification tax

Is PMS taxed as business income or capital gains? This is a crucial question as well. In this case, PMS does not play the role of an intermediary like a mutual fund. Transactions made by the PMS are considered buy and sell transactions in a demat account. The same rules for regular capital market transactions also apply to how income is classified for PMS.

The factors determining the taxation of earnings from share transactions (volume, holding period, etc.) serve as a reference for the classification of PMS income. This is because there are no regulations defining PMS taxes.

Factors impacting PMS taxation

The kind of assets owned in the portfolio, the time, and the tax bracket of an investor are some elements that affect how PMS investments are taxed.

- PMS’s non-equity and equity holdings

Stocks and mutual funds with an equity focus are examples of equity holdings in PMS. According to Indian tax laws, profits from equity investments held for more than a year are regarded as long-term gains and are subject to a lower tax rate than profits from non-equity assets.

- Duration of holding and tax efficiency

The tenure an investment is held significantly impacts how tax-efficient it is. To reduce tax obligations, investors have to consider how long they plan to retain their assets in the PMS portfolio. Extended terms of ownership may lead to lower capital gains tax obligations.

Why should you invest in PMS?

- With limited risk and skilled monitoring, PMS offers the benefit of professional portfolio management to ensure steady, long-term earnings.

- There is less need for the client to micromanage. More performance flexibility is available to the PMS fund manager.

- PMS offers extensive reporting and communications, which contributes to its transparency.

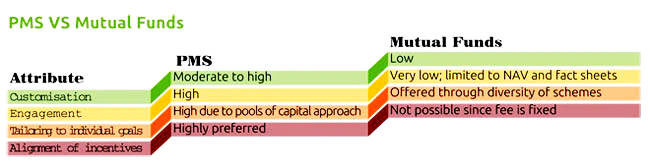

- Above all, there is personalised guidance instead of the type of bulk portfolio selections seen in mutual funds. They enable the customer to have a more customised portfolio that aligns with their specific risk tolerance and expected rate of return.

Conclusion

It is crucial for investors to comprehend the tax implications of investing in PMS in India in order to make well-informed choices that complement their financial objectives and tax planning techniques. Additionally, when investing, it’s important to do thorough research and look closely at the PMS provider’s prior experience.

FAQs

Portfolio Management Services (PMS) and Alternative Investment Funds (AIFs) differ in taxation. PMS investors are taxed based on individual ownership of securities, with taxes applied according to their income tax slab. AIFs, particularly Category I and II, offer a ‘pass-through’ status, meaning income is taxed in the hands of the investors, not at the fund level, which can simplify tax obligations.

Portfolio Management Services (PMS) cater to affluent investors, offering bespoke investment strategies. With a minimum investment threshold of ₹50 lakhs, PMS provides direct ownership of securities, unlike mutual funds. Investors benefit from tailored portfolios aligned with their financial goals and risk preferences, managed by professional portfolio managers.

Choosing between PMS and AIF depends on investment goals and preferences. PMS offers a more personalised investment experience with active portfolio management, suitable for investors who prefer direct stock ownership. AIFs provide access to a diverse range of assets and complex investment strategies, often appealing to those seeking exposure to alternative asset classes.

PMS investments are considered tax-efficient due to the treatment of returns as capital gains. This allows investors to take advantage of lower long-term capital gains tax rates, provided the securities are held for the requisite period. It’s important to note that while PMS can offer tax advantages, especially for high-value investors, the actual tax impact should be evaluated in conjunction with one’s investment horizon and financial goals.

Investing in a PMS can be a strategic move for investors who have a clear understanding of their investment goals and are seeking a high degree of personalisation in their portfolio. The ability to tailor investments to specific needs, coupled with professional management, can lead to significant advantages, particularly for those with substantial investable funds. As with any investment, due diligence and a thorough assessment of the PMS provider’s track record are essential.