Table of contents

The key factor for successful investments is to know how properly to assess a company’s value. A fundamental attribute of investors is the Price to Sales (P/S) ratio which is considered a pivotal factor. In this article, we answer the questions concerning the P/S ratio’s use in investment analysis and what implications this ratio has on investment decisions.

What is price to sales ratio?

The P/S (Price to Sales) ratio is a fundamental parameter used by investors to estimate the extent to which the company can take loans and other outstanding credit compared to the revenues.

The price to sales ratio formula can be defined by dividing a company’s market capitalization by its total sales.

This ratio is quite handy for analyzing the value of a company as well as drawing a comparison of the company with peers in terms of valuation.

For instance, Firm A has a $100 million market capitalization and, in the last 12 months, has recorded annual sales of $50 million. How to calculate price to sales ratio is as follows: we can calculate it and see that Company A has a P/S ratio of 2. Such a scenario is when the investors are ready to part with $2 for every $1 in Company A’s total sales.

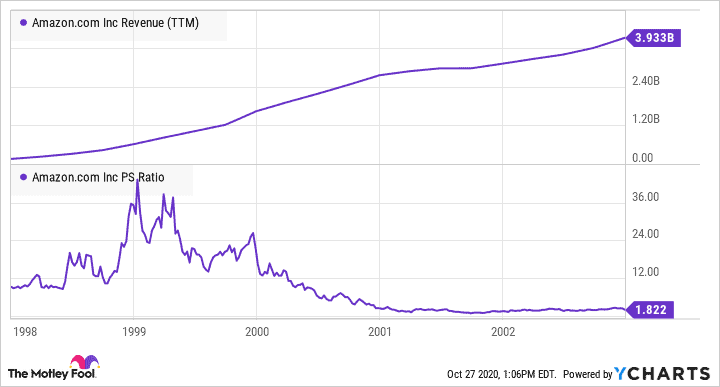

A sample Price to Sales Ratio Chart is as follows:

A high P/S ratio can be an indication that the stock doesn’t justify its price as an overvalued security or that the stock is undervalued than its present price.

Why does the Price to Sales ratio matter?

Contrary to P/E ratios, the P/S ratio is always related to direct fact sales, resulting in it being less susceptible to being changed. Alongside it, the P/S ratio gives an insight into how meticulously the company generates the revenues irrespective of whether the business is making a profit.

Through a comparison of a company’s good price to sales ratio analysis to historical data, industry benchmarks and competitors’ ratios, investors can identify those stocks, which may be underpriced or overpriced.

Example of P/S ratio

Let us take the example of Apple Inc. (AAPL), which has a P/S of 6.79.

- Apple’s P/S ratio indicates that investors are willing to pay approximately $6.79 for every dollar of Apple’s sales.

- This suggests that Apple’s stock is moderately valued relative to its revenue, neither significantly undervalued or overvalued (good P/S ratio)

- Considering Apple’s strong brand presence, diverse product portfolio, and consistent revenue growth, the P/S ratio reflects investor confidence in the company’s future performance.

Investors should consider a combination of factors, including industry dynamics, competitive positioning, and growth prospects when interpreting P/S ratios and making investment decisions.

Conclusion

Knowing the Price to Sales (P/S) ratio is the key to the cautious investor’s success. By virtue of its straightforwardness and clarity, the ratio serves as a representation of market sentiments eventually connecting to the revenue generation potential of a company.

Unlock financial insights with StockGro! Visit us today for expert tips to navigate the markets with confidence.

FAQs

A high Price to Sales (P/S) ratio suggests that investors are willing to pay a premium for each Rupee of the company’s sales. It may indicate high growth expectations, but it could also suggest overvaluation, especially if not supported by strong revenue growth or profitability.

Evaluating whether a Price to Sales (P/S) ratio is good or bad for investment depends on various factors, including industry norms, company fundamentals, and growth prospects.

While the Price to Sales (P/S) ratio provides valuable insights into a company’s valuation, it has limitations. It does not consider profitability, debt levels, or other financial metrics, which can affect a company’s overall financial health. Additionally, industry dynamics and market conditions may influence the relevance of the P/S ratio for investment decisions.

While the P/S ratio provides valuable insights into a company’s valuation, it should be used in conjunction with other financial metrics and qualitative analysis for comprehensive investment decision-making.

Different industry sectors have different norms for P/S ratios but the factors that influence the norms could include profit margin, expected development, and the current market situation. Analysis of industry-specific facts can help assess the value here