Table of contents

Profit is a universally common topic when discussing company performance. Having said that, a company’s profits before and after taxes are quite different.

An approach to seeing how much profit a company is really making before taxes is to look at its Profit Before Tax, or PBT for short.

That said, let’s take a closer look at the concept of PBT, how it is calculated, and the difference between PBT and EBIT.

What is Profit Before Tax (PBT)?

Profit Before Tax is how much revenue a business makes before it pays corporate income tax. It is the total amount a business makes before taxes are taken out.

So, how exactly do you figure out a company’s Profit Before Taxes? One way is to look at the Operating Profit number on the Income Statement and subtract any interest expenses. A company’s Operating Profit is the total earnings generated from running the business, selling products/services, and paying all Operating Expenses.

But the Profit Before Tax figure goes a step further – it includes any extra income streams, such as investment earnings, earnings made from renting out property, etc. In the next part, we’ll talk about this in more depth.

In short, PBT represents the total earnings from operations and non-operating ones before taxes. It is sometimes also called Pre-Tax Income or Earnings Before Taxes (EBT).

Profit Before Tax Margin

Before paying taxes to the state and central government, a company keeps a certain amount of its income. This amount is called the Pre-Tax Profit Margin, or the EBT margin. To find a company’s Pre-Tax Margin, divide its Earnings Before Taxes (EBT) by its revenue.

How to calculate Profit Before Tax?

The PBT of a company may be determined by following a few steps. They are as follows:

- Gather all the financial information on revenue

The revenue might come from several sources, including total sales, rental revenue, and discounts received. Bonuses, interest on bank accounts, and service revenue are a few more uncommon sources of income.

- Consider deductible costs

The most usual expenses related to operating a company include rent, loans, and amenities, to name a few. In addition, some business owners keep track of their medical costs, earned and unpaid salaries, and charity donations.

- Subtract deductible costs from revenue earned

One may then calculate the earnings or Profit Before Taxes by deducting the deductible costs from the earned income.

To illustrate the Profit Before Tax formula, we need to look at:

Profit Before Tax = Revenue – Expenses (Not including the cost of taxes)

A hypothetical example to understand the idea of PBT for a company would be:

| Sales Revenue | ₹1,50,00,000 |

| Total Expenses | ₹1,20,00,000 |

| Profit Before Tax (Pbt) | ₹30,00,000 |

| Income Tax Expense | ₹6,00,000 |

| Net Income | ₹24,00,000 |

| Pre-Tax Margin | 20% |

In this case, PBT, according to the formula, will be (₹1,50,00,000 – ₹1,20,00,000) = ₹30,00,000. The Pre-Tax Margin will be (PBT/Revenue) * 100 = (₹30,00,000 / ₹1,50,00,000) * 100 = 20%.

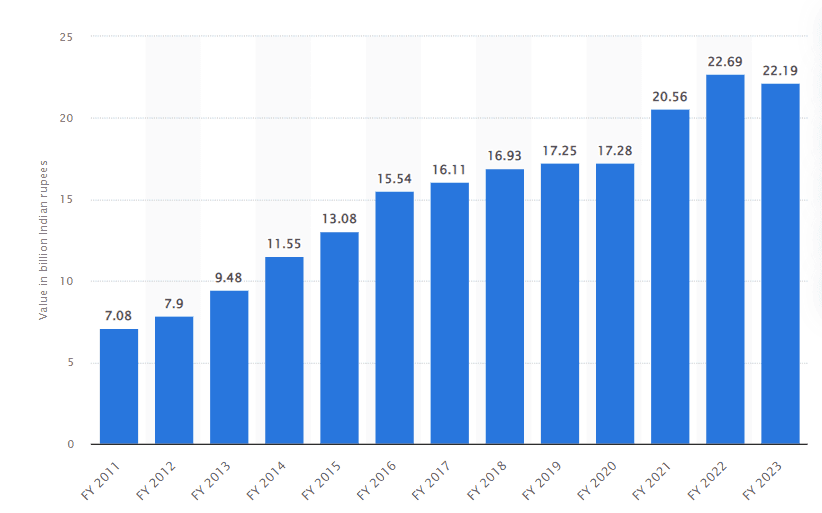

Now, if we consider a real-world example, we can see Dabur India Ltd.’s PBT growth from FY11 to FY23 (in ₹ billion). In Q3 FY24, Dabur’s PBT was ₹661 crore (₹6.61 billion).

Why is PBT important?

With PBT, we can determine the Pre-Tax Earnings of a business. First, it gives financial information on the performance of a company to internal and external management. PBT eliminates one variable—tax—which may have various implications affecting the collected financial data’s end results.

For instance, a company’s Net Income will go up if it operates in a sector of the economy that offers significant tax advantages. However, the Net Income of the corporation will decline if the sector has unfavourable tax rules.

Eliminating Income Taxes allows business owners to compare their operations regardless of the tax rules in place and determine the Net Profit Before Tax.

Difference between PBT and EBIT

Many use the words EBIT (Earnings/Profits Before Interest And Tax) and PBT (Profit Before Tax) the same way. The two metrics are still very different from one another. Although these metrics summarise the business’s profitability, they approach performance evaluation from different angles.

When comparing PBT to EBIT, interest expenses differentiate the two. PBT considers interest costs when determining profitability, while EBIT provides the Gross Profit without subtracting interest.

You may determine the EBIT by deducting operating expenses and the Cost of Goods Sold from the business’s total revenue. On the other hand, operational expenditures, interest, and Cost of Goods Sold are subtracted from the revenue to get the PBT. Therefore, in both situations, the value of profit is different.

Conclusion

The Profit Before Tax metric is critical for companies of all sizes to track. While knowing the final after-tax profits is also needed, PBT provides that initial big-picture profitability snapshot before taxes distort the numbers.

With PBT, businesses can budget appropriately for their tax obligations and see their true earnings potential.

FAQs

No, net profit is not equal to EBIT (Earnings Before Interest and Taxes). Net profit, also known as net income, is the amount of money that remains after all expenses, including interest and taxes, have been deducted from a company’s revenue. In contrast, EBIT represents the company’s earnings before any interest and tax expenses are accounted for. It’s a measure of a company’s operating performance without the influence of its capital structure or tax burden.

Net profit is neither EBIT nor EBT (Earnings Before Taxes). Net profit is the income after all expenses, including interest, taxes, depreciation, and amortisation, have been subtracted from revenue. EBIT is the profit before interest and taxes are deducted, while EBT is the profit before taxes are deducted but after interest expenses. Net profit provides the clearest picture of a company’s financial health after all financial obligations.

No, EBITDA (earnings before interest, taxes, depreciation, and amortisation) and gross profit are not the same. Gross profit is the revenue remaining after deducting the Cost Of Goods Sold (COGS), reflecting the core profitability of selling goods and services. EBITDA, on the other hand, is a measure of a company’s overall financial performance and includes more than just the costs of goods sold, such as operating expenses

In the context of a Profit and Loss (P&L) statement, EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortisation. It is a measure of a company’s operational efficiency and profitability. EBITDA is calculated by adding back interest, taxes, depreciation, and amortisation expenses to net income. This metric helps businesses and investors understand the company’s core profitability from its operations, before the impact of financial and accounting decisions.

COGS, or Cost of Goods Sold, refers to the direct costs attributable to the production of the goods sold by a company. In the Indian context, this includes the cost of materials and direct labour used in creating the product. It excludes indirect expenses such as distribution costs and sales force costs. COGS is a critical component in calculating gross profit, which is revenue minus COGS.