Table of contents

Investing can be a tricky business, especially when you’re planning for something as important as retirement. There are so many choices – stocks, bonds, and mutual funds. One option you may come across, particularly in retirement plans, is called a stable value fund.

But what exactly is it? For most people, retirement investing is a long game – you start putting money away in your 20s or 30s, keeping a keen eye on growth over decades. But once you hit your late 50s or 60s, that long-term perspective shifts to a shorter-term need to protect what you’ve accumulated.

You can’t afford to take huge risks mere years before you plan to start relying on your investments for income. This transition period is when stable value funds can make the most sense.

What is a stable value fund?

The goal of an insured bond portfolio with additional insurance, known as a stable value fund, is to safeguard investors against the possibility of a drop in yield or a complete loss of their investment. Money invested in a stable value fund will earn the agreed-upon interest rate regardless of what happens to the economy.

Some retirement plans, like 401(k) and stable value funds, go hand in hand as they allow shareholders, particularly those getting close to retirement, to make low-risk investments with stable returns. In both the short and medium term, stable value funds put the funds into bonds issued by reputable companies and the government.

The only difference between them and a regular bond fund is that they are insured. If the fund’s investors suffer a loss of principal or interest, the insurer or bank is legally obliged to compensate them.

In India, investors can take advantage of stable value funds by investing in mutual funds and insurance products.

How does a stable value fund work?

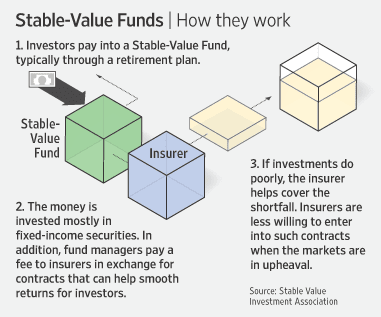

Stable value funds are based on the premise that market swings should not negatively impact investors and that they continue to receive the initial interest rate on their fixed-income investment. They use insurance policies or bank guarantees to support their investments in fixed-income products to accomplish this.

Wrap contracts are agreements backed by financial institutions like banks or insurance companies that provide a fixed return yield independent of the underlying asset’s value fluctuations. With the help of these wrap contracts, a stable value fund is guaranteed by financial institutions or insurers using their assets as collateral.

An investor in a stable value fund is assured that their principal will not decrease below their original investment. If the value of a fixed-income instrument drops due to anything beyond the issuer’s control, the issuer of the wrap contract must pay the difference.

Stable value funds guarantee their investors the same rate of return they were promised when they invested.

Benefits and drawbacks of stable value funds

| Benefits | Drawbacks |

| Investments in stable-value funds have a low degree of risk. Additionally, they make sure that the investment doesn’t drop below the initial capital. | The complexity of fixed-income returns derives from the fact that they are subject to a wide range of external and unpredictable factors. The entire process becomes more complicated and more challenging for investors when they use stable-value funds. |

| Insurers and banks provide wrap contracts that support stable value funds. Wrap contracts shield investments against any threats from external sources. The investor could additionally request compensation from financial institutions like banks or insurance companies for the value they lost. | Under the wrap agreements, banking institutions and insurance firms support stable value funds. However, investors can lose their legal claim to their assets if banks or insurance companies declare bankruptcy. |

| Stable value funds protect investors from the risk of losing money in volatile markets by relying on wrap contracts backed by financial institutions. Guaranteed stable value fund returns during market turbulence or recession are provided by funds with steady value. | Managing a stable value fund is more expensive because of the bank guarantee and insurance. |

Should you choose stable value funds as an investment?

Because the principal is guaranteed, these investments are conservative and offer a regular income with minimal risk. As their name suggests, stable value funds provide security for principal and stable interest payments.

Careful investors, along with individuals with a short-term horizon, such as employees approaching their retirement years, would do well to choose stable value funds. These investments may help investors stabilise their portfolios while still providing income with low risk.

Stable Value Fund Risks: What Investors Should Know

At first glance, stable value funds seem like a no-brainer—low risk, steady returns, and principal protection. But before parking your money, it’s important to understand what’s going on under the hood.

What is a Stable Value Fund?

A stable value fund is a low-volatility investment option commonly found in retirement plans like 401(k)s. It typically invests in high-quality short- to intermediate-term bonds and is backed by insurance contracts (called wrap contracts) that help maintain price stability.

What Are the Risks?

While these funds are considered safe, they’re not entirely risk-free. Here’s what you need to watch out for:

1. Interest Rate Risk

If interest rates rise, bond prices in the fund may drop—though the impact is often cushioned by the fund’s insurance wrapper.

2. Credit Risk

Stable value funds rely on insurance contracts. If the issuer of the wrap contract (typically a bank or insurance company) fails, your principal may be at risk.

3. Liquidity Restrictions

You can’t always pull your money out easily. Some funds require a 12-month waiting period for withdrawals or transfers to certain investment options.

4. Employer Plan Dependency

Many stable value funds are only available through employer-sponsored plans, limiting access and portability.

How to Choose the Best Stable Value Fund for Your Portfolio

All stable value funds aim for safety, but not all are created equal. Here’s how to evaluate them:

1. Look at Crediting Rate: This is the interest rate the fund credits to your account. Higher isn’t always better—make sure it’s consistent and sustainable.

2. Understand the Wrap Contracts: Who provides the insurance? Look for highly rated providers with a strong financial track record.

3. Know the Underlying Assets: Check whether the fund invests in government bonds, corporate bonds, or mortgage-backed securities. Quality matters.

4. Fees and Expenses: Stable value funds may come with hidden costs. Compare the expense ratio and any administrative fees.

5. Exit Restrictions : Some funds don’t allow quick withdrawals or transfers. Understand the rules before committing.

Are Stable Value Funds a Good Choice for Retirement Plans?

The Short Answer: Yes, but with a strategy.

Here’s when they work best:

- For conservative investors nearing retirement who want capital preservation.

- As a bond alternative for those worried about volatility in rising interest rate environments.

- For short-term saving goals within a retirement plan (e.g., parking funds before reallocating).

Conclusion

In essence, stable value funds provide a balance between growth and capital preservation as you approach retirement.

A portfolio that includes a combination of riskier but possibly profitable assets and safe but low-yielding investments is often advised by experienced financial advisers. As an investor gets closer to retirement age, the portfolio should gradually be reweighted towards safety.

FAQs

Stable value funds can be a worthwhile investment for those seeking capital preservation while earning steady returns. They are particularly appealing to conservative investors or those nearing retirement who prioritise safety over high returns. In India, while stable value funds are not as common as in the US, the concept is similar to fixed-income instruments that offer stability and protection against market volatility.

Stable value funds and Guaranteed Investment Contracts (GICs) both aim to protect the investor’s capital and provide steady returns. The key difference lies in their structure: stable value funds are typically diversified bond portfolios with insurance wrappers to protect against interest rate volatility, while GICs are insurance products that guarantee a fixed return over a specified period. In India, GICs are not as prevalent, and stable-value funds may take the form of conservative fixed-income funds.

Despite their conservative nature, stable value funds carry risks such as credit risk, interest rate risk, and manager risk. In the Indian context, these funds may also face risks related to currency fluctuations and changes in the regulatory environment. Investors should be aware that while stable value funds aim to minimise risk, they are not entirely risk-free and may underperform in rapidly rising markets.

Stable value funds are designed to be resilient during market downturns, offering protection against losses. They typically maintain their value and continue to pay interest even when markets crash, making them a safe haven for investors. However, it’s important to note that no investment is entirely without risk, and factors such as the financial health of the insurer backing the fund can affect its stability.

Investing in stable value funds is ideal for investors with a conservative risk profile or those looking for a low-volatility component in their portfolio. They are suitable for short-term goals or as a part of a diversified retirement portfolio. In India, investors might consider these funds during periods of market uncertainty or when a steady income stream is a priority.