How does a stock react when the demand for it is high? Like every other product or service, stocks of companies follow the usual economic rule where the demand and price are directly proportional, whereas the supply and price are inversely proportional.

So, imagine a company whose stock prices increase to a large extent. Though it is a positive sign of growth, companies generally see this as a matter of concern, as the shares may not be affordable to a substantial portion of investors. This will indeed impact the demand for the stock. To handle this scenario, companies resort to stock splits.

You may also like: What is equity share capital? [Explained]

What is a stock split?

A corporate action where a company reduces the price per share by splitting its stocks i.e., increasing the number of units of shares, is called a stock split.

The increase in the number of units and the price reduction is proportional, because of which the market capitalisation of companies remains unaffected.

The process of splitting stocks

Liquidity is one of the most essential features of a stock from the perspective of the investor and the owner company. It ascertains the demand for a stock and the degree of ease at which a stock can be sold in the market. Liquid stocks are usually prone to lesser risks as they can be converted into cash in a short span.

The stock splitting action allows companies to provide this feature to their investors by reducing stock prices, eventually increasing the demand.

Different companies use different ratios to split their stocks, while one of the most popularly used ratios is 2-for-1 stock split (2:1).

So, if a company splits its stocks in the ratio of 2:1, it means that every shareholder will get two shares per share held. This also means that the price per share will go down two times its current price. The market capitalisation will hence remain the same, but the number of outstanding shares in the market will increase by two times due to the stock split.

Also Read: A beginner’s guide to the stock market

Stock split example

To understand stock splits better, let us take an example:

Consider a company, ABC, with a market capitalisation of ₹ 1,20,00,000. Currently, the company has 10,000 shares outstanding with a value of ₹ 1,200 per share.

During a discussion between the board of directors, they noticed that the market price was getting unaffordable to people, affecting the stock’s liquidity. So, they announced a stock split in the ratio of 3:1.

Upon splitting, the number of shares outstanding is 30,000 (10,000 *3), and the value per share is ₹400.

The market capitalisation after the split is still ₹ 1,20,00,000 (10,000 * 1,200). But, the share price has reduced making it more affordable, and the liquidity has increased due to which the shares are readily available for trade.

A recent real-world example of a stock split is that of BCL Industries.

In May 2023, BCL Industries announced a stock split in the ratio of 10:1.

The board of directors decided to do so to boost the stock’s liquidity. With a market capitalisation of around ₹1,195 crores, BCL Industries will issue 10 shares for every share held by its investors on the record date.

The record date is the date at which companies check the list of eligible shareholders.

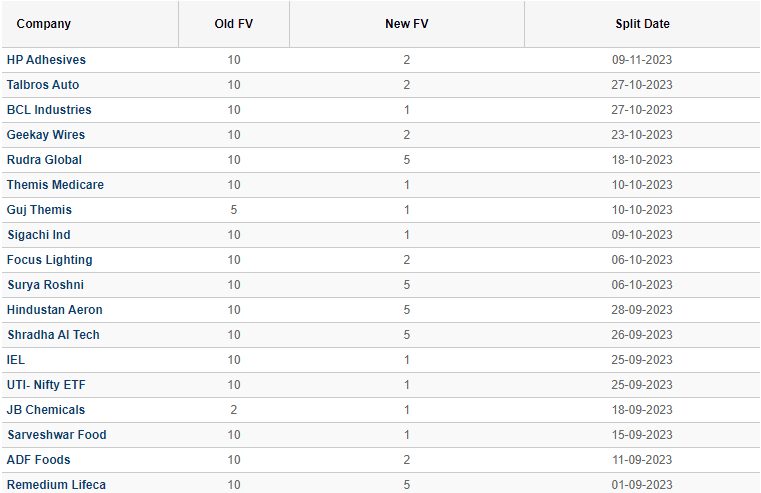

Below is the list of recent stock splits by companies in India:

Source: Moneycontrol

Impact of share split on investors

Stock splits do not have any significant impact on existing investors. Since there is no change in the net worth of shares held, existing investors do not gain or lose from stock splits. However, it has an impact on potential investors who are planning to invest in the stock.

The general psychology of regular investors is that buying 100 shares of ₹10 each is better than buying one share of ₹ 1,000.

Also Read: Decoding the significance of market capitalisation

Advantages and limitations

Benefits of stock split:

- The primary purpose of stock splits is to give the benefit of liquidity to companies, along with making it accessible to a wide range of investors.

- Stock splits increase the interest of investors in a company’s stock leading to an increase in demand. It will again lead to share prices going up, which increases the goodwill of the company.

- A stock split is usually seen as a positive corporate action as it indicates a company’s growth.

Cons of a stock split:

- A stock split is an expensive affair. It involves a lot of regulatory and legal aspects because of which this corporate action is costly.

- Stock splits are sometimes viewed as worthless actions as they do not add any real value to the company’s monetary worth.

- Stock splits can often mislead and create confusion in the minds of investors.

Reverse stock splits

Reverse stock split as the name suggests, is the reverse of stock splits. It is a corporate action where companies consolidate multiple units of stocks into one.

For example, assume company ABC announces a reverse stock split in the ratio of 5:1. So, this consolidates five shares into one and increases the price per stock by five times.

While stock splits have a positive impact on stocks, reverse stock splits have a negative influence on companies. Companies resort to reverse stock splits when they want to increase the value of their share prices to avoid getting delisted. This is an indication that the stocks are not performing well.

There are not many instances of reverse stock splits in India. Let’s consider the example of WeWork Inc., listed on the New York Stock Exchange (NYSE), the parent company of WeWork India, a co-working space provider.

As part of saving itself from bankruptcy, WeWork announced a reverse stock split in August 2023, in the ratio of 40:1 – meaning, the company planned to consolidate 40 shares into 1, to increase the share prices.

Bottomline

Stock split in financial management is a significant concept for investors and companies. Though it does not practically impact the value of investments from the investor’s perspective, stock splits have a large influence on investors who are tracking a particular stock and hoping for its prices to reduce.