Table of contents

Regardless of the size, every transaction involves two parties: the seller and the buyer. To complete these transactions and integrate value across the ecosystem, these parties are essential to the functioning of any economy.

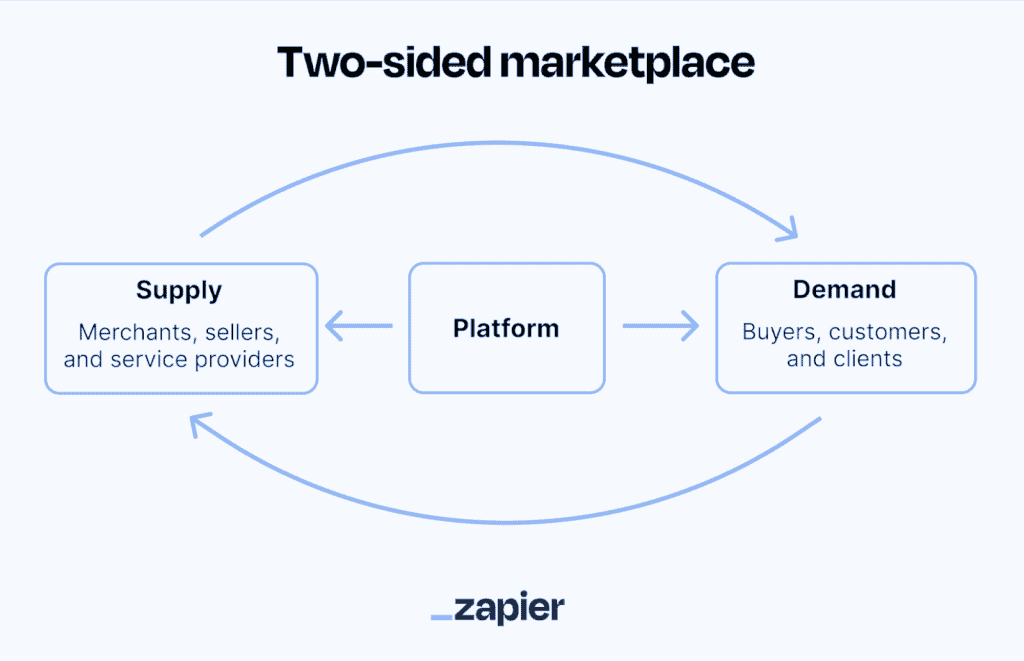

On the other hand, a middleman’s job is to facilitate transactions between buyers and sellers; in doing so, they gain customers from both parties and receive the benefits of mutual service. The term “two-sided market” describes an arrangement in which both buyers and sellers agree to use a shared platform for their transactions.

Let’s look at this concept in more detail.

What is a two-sided market?

When people looking to purchase or sell come together, it forms a two-sided market since there are bids to buy and offers to sell. When two groups of users work together via a platform or intermediary, it may be mutually beneficial for everyone involved.

A two-sided market may benefit all parties involved since it streamlines and speeds up transactions while reducing their costs. Typical one-sided marketplaces eventually reach an extent of decreasing returns when it comes to expanding their market share via client acquisition. In contrast, two-sided marketplaces offer an edge in this regard.

One characteristic of a two-sided market is the nature of the intermediary’s association with the third parties that use its platform. Platform managers are required to keep a balance between both parties of the network, at times offering subsidies to the side that is more price-sensitive and raising fees for the side that stands to benefit the most from the platform’s profitability.

Securities trading and two-sided market

Within the financial industry, the term two-sided market is mostly used to describe situations in which market makers provide a firm bid and ask for each security they can establish a market for.

Bond, derivative, and currency markets are only a few examples of other financial marketplaces that are two-sided. Broker-dealers, for instance, may create two-sided markets for more substantial, regularly traded bonds but rarely do so for bonds that are not actively traded. The idea behind this is that it improves the efficiency of markets and liquidity.

Apart from the share market, two-sided networks are present in several other industries as well. Retailers, manufacturers, and shoppers are just a few of the entities and individuals they serve.

For example, when it comes to credit card businesses, a larger credit limit means greater buying power and incentives. Meanwhile, service providers have seen a growing demand for credit card payments and have chosen to accept them.

In this way, consumers who pay with credit cards realise the value of such a payment method. Additionally, businesses that accept credit card payments often see an increase in sales.

Two-sided market example

One payment app that uses a two-sided market strategy is Google Pay. To begin with, it is a platform that acts as a go-between when transferring money from one account to another or from one person to another. To process payments, the app requires a sufficient number of users to register for its payment alternatives.

At grocery stores and kiosks, many customers have begun using Google Pay, and many more see it as their preferred alternative. When that happens, it will earn revenue even if it doesn’t charge the consumers anything. The company will instead use other revenue streams, such as ads, fees from service providers (such as telecom carriers), etc.

Strategies for two-sided markets

- Financial support:

Businesses may improve platform traffic or user registration using the subsidising strategy, which allows them to receive income from the group of users (suppliers and buyers). It is often believed that if one segment of the market draws in customers, the other segment will boost the company’s bottom line.

- Trialability:

Businesses may use it to provide products to customers at a discounted price for a short period. Trialability ensures product quality and people may spend more after trying a product.

- Pricing approach:

The company may use a pricing strategy to draw in consumers with low or no costs and then progressively raise charges to earn revenue.

One-sided market vs. two-sided market

A company using a one-sided market strategy targets just one segment of its target audience to maximise profits. The two-sided market strategy, on the other hand, is a way of doing business that allows the market to benefit from both segments of its user base.

The most prominent example of a one-sided market approach is an initial public offer (IPO) subscription. On the other hand, two-sided market strategies are shown by companies like Razorpay, Google, etc.

Conclusion

The primary goal of the two-sided market is to enable the exchange of products and services between providers and consumers in a way that is both efficient and affordable. Although a two-sided network may include marketplaces from many disciplines, they do exhibit common traits and qualities.

FAQs

Two-sided markets, also known as platforms, offer significant benefits by facilitating interactions between two distinct but interdependent groups, typically buyers and sellers. They provide a structure that reduces transaction costs and increases efficiency, allowing users to find each other more easily. These markets thrive on network effects; as more participants join, the value of the platform increases, often leading to a dominant position in the market.

A two-way market in trading refers to a situation where a security, commodity, or currency is quoted with both a bid and an ask price. In India, this is a common sight on stock exchanges like the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE), where market makers provide liquidity and depth to the market by being willing to buy and sell at the quoted prices.

When market makers are only able to quote one price rather than the asking and bid prices (a two-way market), we say that the market is one-sided or one-way. The maximum amount a buyer is willing to pay for the goods is known as the bid price. The minimum amount a seller is willing to take for a security is called the ask price.

Network effects in a two-sided market refer to the phenomenon where the value of the platform increases as more users join on both sides. For example, more buyers attract more sellers and vice versa, enhancing the platform’s overall value. This effect can lead to a virtuous cycle of growth, where increased usage improves the service, attracting even more users. However, it can also create barriers to entry for new platforms and lead to market concentration.

The two-sided model exposes you to the risk of marketplace leakage, which is a consequence of the model. The term “leakage” refers to the situation in which buyers and sellers use the marketplace to locate one another, but go outside of the platform in order to complete the transaction. And neglect to make the commission payment.